Basic Stats

| Portfolio Value | $ 9,884,000 |

| Current Positions | 35 |

Latest Holdings, Performance, AUM (from 13F, 13D)

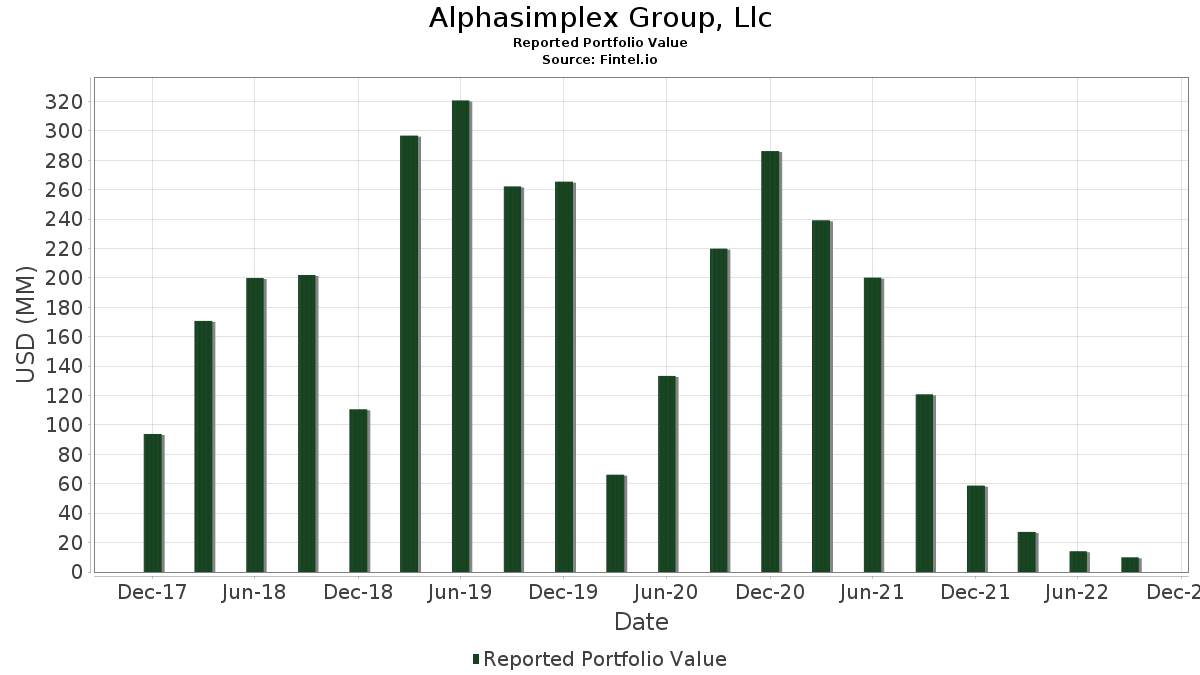

Alphasimplex Group, Llc has disclosed 35 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 9,884,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Alphasimplex Group, Llc’s top holdings are Duke Realty Corporation - Preferred Security (US:DRE) , Lakeland Bancorp, Inc. (US:LBAI) , Gilead Sciences, Inc. (US:GILD) , UnitedHealth Group Incorporated (US:UNH) , and Fastenal Company (US:FAST) . Alphasimplex Group, Llc’s new positions include Lakeland Bancorp, Inc. (US:LBAI) , United Parcel Service, Inc. (US:UPS) , Dynex Capital, Inc. (US:DX) , The Western Union Company (US:WU) , and .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 0.92 | 9.2776 | 9.2776 | |

| 0.05 | 0.81 | 8.1849 | 8.1849 | |

| 0.00 | 0.34 | 3.4804 | 3.4804 | |

| 0.00 | 0.28 | 2.8329 | 2.8329 | |

| 0.00 | 0.28 | 2.8227 | 2.8227 | |

| 0.00 | 0.26 | 2.5799 | 2.5799 | |

| 0.01 | 0.25 | 2.5597 | 2.5597 | |

| 0.01 | 0.42 | 4.2898 | 2.4518 | |

| 0.00 | 0.46 | 4.6236 | 1.7883 | |

| 0.00 | 0.29 | 2.9745 | 1.4500 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -7.2594 | ||

| 0.00 | 0.00 | -6.8391 | ||

| 0.00 | 0.00 | -5.6494 | ||

| 0.00 | 0.00 | -5.2860 | ||

| 0.00 | 0.00 | -2.2441 | ||

| 0.00 | 0.00 | -1.8807 | ||

| 0.00 | 0.00 | -1.8451 | ||

| 0.00 | 0.00 | -1.7739 | ||

| 0.00 | 0.00 | -1.7525 | ||

| 0.00 | 0.00 | -1.7454 |

13F and Fund Filings

This form was filed on 2022-11-08 for the reporting period 2022-09-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| DRE / Duke Realty Corporation - Preferred Security | 0.02 | 0.92 | 9.2776 | 9.2776 | |||||

| LBAI / Lakeland Bancorp, Inc. | 0.05 | 0.81 | 8.1849 | 8.1849 | |||||

| GILD / Gilead Sciences, Inc. | 0.01 | 0.00 | 0.46 | -0.22 | 4.6843 | 1.3788 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 16.93 | 0.46 | 14.82 | 4.6236 | 1.7883 | |||

| FAST / Fastenal Company | 0.01 | 78.32 | 0.42 | 64.34 | 4.2898 | 2.4518 | |||

| WMT / Walmart Inc. | 0.00 | 0.00 | 0.35 | 6.79 | 3.5006 | 1.1924 | |||

| UPS / United Parcel Service, Inc. | 0.00 | 0.34 | 3.4804 | 3.4804 | |||||

| TMUS / T-Mobile US, Inc. | 0.00 | -15.01 | 0.32 | -15.43 | 3.2173 | 0.5387 | |||

| HD / The Home Depot, Inc. | 0.00 | 36.49 | 0.29 | 37.38 | 2.9745 | 1.4500 | |||

| MSFT / Microsoft Corporation | 0.00 | 0.00 | 0.28 | -9.35 | 2.8430 | 0.6345 | |||

| CL / Colgate-Palmolive Company | 0.00 | 0.28 | 2.8329 | 2.8329 | |||||

| HSY / The Hershey Company | 0.00 | 0.28 | 2.8227 | 2.8227 | |||||

| ITW / Illinois Tool Works Inc. | 0.00 | 14.22 | 0.27 | 13.14 | 2.7013 | 1.0201 | |||

| ABBV / AbbVie Inc. | 0.00 | 0.26 | 2.5799 | 2.5799 | |||||

| MDU / MDU Resources Group, Inc. | 0.01 | 0.25 | 2.5597 | 2.5597 | |||||

| TSLA / Tesla, Inc. | 0.00 | 155.65 | 0.25 | 0.40 | 2.5496 | 0.7614 | |||

| PAYX / Paychex, Inc. | 0.00 | 0.00 | 0.24 | -1.21 | 2.4686 | 0.7090 | |||

| TGT / Target Corporation | 0.00 | 0.00 | 0.24 | 5.33 | 2.3978 | 0.7949 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.00 | -13.94 | 0.23 | -17.38 | 2.3573 | 0.3484 | |||

| CHNG / Change Healthcare Inc | 0.01 | -19.49 | 0.23 | -4.12 | 2.3573 | 0.6262 | |||

| HTLD / Heartland Express, Inc. | 0.02 | 0.00 | 0.23 | 2.69 | 2.3169 | 0.7282 | |||

| FE / FirstEnergy Corp. | 0.01 | -31.16 | 0.23 | -33.53 | 2.2865 | -0.1356 | |||

| FCN / FTI Consulting, Inc. | 0.00 | 14.35 | 0.22 | 4.69 | 2.2562 | 0.7388 | |||

| ACM / AECOM | 0.00 | -13.00 | 0.22 | -8.64 | 2.2461 | 0.5149 | |||

| AME / AMETEK, Inc. | 0.00 | 0.00 | 0.21 | 2.90 | 2.1550 | 0.6803 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.00 | 0.21 | -10.30 | 2.1145 | 0.4546 | |||

| AAPL / Apple Inc. | 0.00 | -15.00 | 0.20 | -13.92 | 2.0639 | 0.3755 | |||

| ROP / Roper Technologies, Inc. | 0.00 | 0.00 | 0.20 | -8.64 | 2.0336 | 0.4663 | |||

| GBDC / Golub Capital BDC, Inc. | 0.02 | 0.00 | 0.19 | -4.43 | 1.9628 | 0.5166 | |||

| DX / Dynex Capital, Inc. | 0.01 | 0.14 | 1.4367 | 1.4367 | |||||

| WU / The Western Union Company | 0.01 | 0.14 | 1.3962 | 1.3962 | |||||

| PRMW / Primo Water Corporation | 0.01 | -19.13 | 0.14 | -24.02 | 1.3760 | 0.1008 | |||

| MTG / MGIC Investment Corporation | 0.01 | 0.00 | 0.13 | 2.36 | 1.3153 | 0.4105 | |||

| HBI / Hanesbrands Inc. | 0.02 | 45.14 | 0.12 | -1.61 | 1.2343 | 0.3509 | |||

| IRWD / Ironwood Pharmaceuticals, Inc. | 0.01 | 0.00 | 0.11 | -9.92 | 1.1028 | 0.2408 | |||

| GOOGL / Alphabet Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.6599 | ||||

| RPM / RPM International Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.7454 | ||||

| ZTS / Zoetis Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.8807 | ||||

| NP / Neenah Inc | 0.00 | -100.00 | 0.00 | -100.00 | -6.8391 | ||||

| MMM / 3M Company | 0.00 | -100.00 | 0.00 | -100.00 | -1.7026 | ||||

| AON / Aon plc | 0.00 | -100.00 | 0.00 | -100.00 | -1.7739 | ||||

| SSNC / SS&C Technologies Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.4248 | ||||

| ARR / ARMOUR Residential REIT, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6839 | ||||

| SHW / The Sherwin-Williams Company | 0.00 | -100.00 | 0.00 | -100.00 | -1.5815 | ||||

| NKE / NIKE, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.7525 | ||||

| TTMI / TTM Technologies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.5459 | ||||

| DOX / Amdocs Limited | 0.00 | -100.00 | 0.00 | -100.00 | -1.4604 | ||||

| SUN / Sunoco LP - Limited Partnership | 0.00 | -100.00 | 0.00 | -100.00 | -1.5602 | ||||

| RTLR / Rattler Midstream Lp - Unit | 0.00 | -100.00 | 0.00 | -100.00 | -5.2860 | ||||

| CTT / CatchMark Timber Trust Inc - Class A | 0.00 | -100.00 | 0.00 | -100.00 | -5.6494 | ||||

| CAG / Conagra Brands, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.8451 | ||||

| BDX / Becton, Dickinson and Company | 0.00 | -100.00 | 0.00 | -100.00 | -1.6813 | ||||

| CCMP / CMC Materials Inc | 0.00 | -100.00 | 0.00 | -100.00 | -7.2594 | ||||

| PG / The Procter & Gamble Company | 0.00 | -100.00 | 0.00 | -100.00 | -1.5673 | ||||

| EXPD / Expeditors International of Washington, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.5459 | ||||

| VRSK / Verisk Analytics, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.2441 | ||||

| AGNC / AGNC Investment Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0187 |