Basic Stats

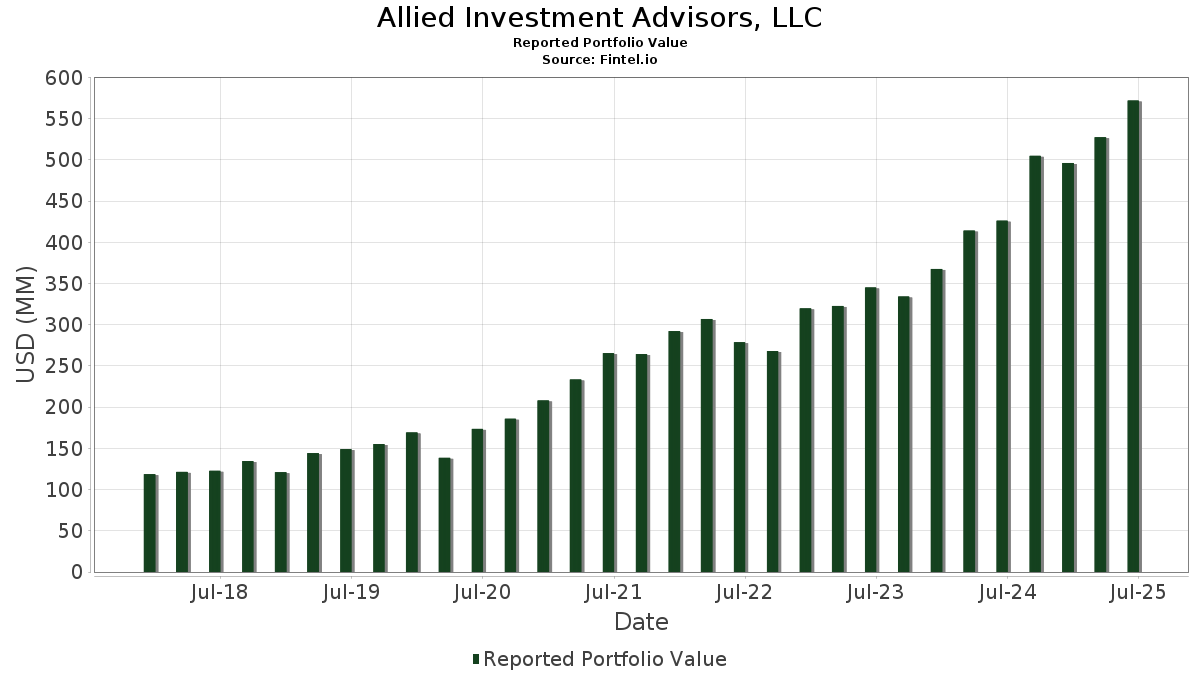

| Portfolio Value | $ 571,939,355 |

| Current Positions | 87 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Allied Investment Advisors, LLC has disclosed 87 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 571,939,355 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Allied Investment Advisors, LLC’s top holdings are Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF (US:SCHD) , Vanguard World Fund - Vanguard Health Care ETF (US:VHT) , Microsoft Corporation (US:MSFT) , Vanguard World Fund - Vanguard Utilities ETF (US:VPU) , and JPMorgan Chase & Co. (US:JPM) . Allied Investment Advisors, LLC’s new positions include Broadcom Inc. (US:AVGO) , Vanguard Malvern Funds - Vanguard Short-Term Inflation-Protected Securities ETF (US:VTIP) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.24 | 17.92 | 3.1332 | 1.4236 | |

| 0.06 | 30.98 | 5.4161 | 0.9742 | |

| 0.02 | 15.70 | 2.7442 | 0.4547 | |

| 0.02 | 6.51 | 1.1383 | 0.3643 | |

| 0.11 | 14.02 | 2.4516 | 0.2976 | |

| 0.04 | 16.98 | 2.9683 | 0.2806 | |

| 0.07 | 5.75 | 1.0059 | 0.2650 | |

| 0.12 | 13.23 | 2.3127 | 0.2566 | |

| 0.07 | 20.13 | 3.5187 | 0.2561 | |

| 0.07 | 2.55 | 0.4465 | 0.2259 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.15 | 38.47 | 6.7265 | -0.6279 | |

| 1.63 | 43.26 | 7.5644 | -0.5531 | |

| 0.08 | 11.90 | 2.0808 | -0.4369 | |

| 0.12 | 12.73 | 2.2259 | -0.3745 | |

| 0.05 | 10.36 | 1.8107 | -0.3443 | |

| 0.07 | 10.72 | 1.8744 | -0.2922 | |

| 0.08 | 9.80 | 1.7139 | -0.2862 | |

| 0.07 | 10.61 | 1.8558 | -0.2733 | |

| 0.19 | 13.04 | 2.2798 | -0.2436 | |

| 0.07 | 9.00 | 1.5738 | -0.2418 |

13F and Fund Filings

This form was filed on 2025-07-31 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SCHD / Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF | 1.63 | 6.61 | 43.26 | 1.05 | 7.5644 | -0.5531 | |||

| VHT / Vanguard World Fund - Vanguard Health Care ETF | 0.15 | 5.72 | 38.47 | -0.82 | 6.7265 | -0.6279 | |||

| MSFT / Microsoft Corporation | 0.06 | -0.22 | 30.98 | 32.21 | 5.4161 | 0.9742 | |||

| VPU / Vanguard World Fund - Vanguard Utilities ETF | 0.14 | 1.22 | 24.49 | 4.59 | 4.2825 | -0.1572 | |||

| JPM / JPMorgan Chase & Co. | 0.07 | -1.05 | 20.13 | 16.95 | 3.5187 | 0.2561 | |||

| AAON / AAON, Inc. | 0.24 | 110.54 | 17.92 | 98.74 | 3.1332 | 1.4236 | |||

| CAT / Caterpillar Inc. | 0.04 | 1.74 | 16.98 | 19.75 | 2.9683 | 0.2806 | |||

| WFC / Wells Fargo & Company | 0.20 | -0.49 | 15.74 | 11.06 | 2.7519 | 0.0648 | |||

| GS / The Goldman Sachs Group, Inc. | 0.02 | 0.32 | 15.70 | 29.98 | 2.7442 | 0.4547 | |||

| RTX / RTX Corporation | 0.10 | -1.24 | 15.24 | 8.88 | 2.6641 | 0.0108 | |||

| BAC / Bank of America Corporation | 0.31 | 0.96 | 14.69 | 14.48 | 2.5684 | 0.1356 | |||

| EMR / Emerson Electric Co. | 0.11 | 1.49 | 14.02 | 23.41 | 2.4516 | 0.2976 | |||

| DE / Deere & Company | 0.03 | 1.84 | 13.92 | 10.33 | 2.4333 | 0.0418 | |||

| STT / State Street Corporation | 0.12 | 2.69 | 13.23 | 21.98 | 2.3127 | 0.2566 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.19 | 1.96 | 13.04 | -2.04 | 2.2798 | -0.2436 | |||

| XOM / Exxon Mobil Corporation | 0.12 | 2.40 | 12.73 | -7.18 | 2.2259 | -0.3745 | |||

| LOW / Lowe's Companies, Inc. | 0.06 | 3.37 | 12.67 | -1.66 | 2.2146 | -0.2275 | |||

| MMM / 3M Company | 0.08 | -0.38 | 12.28 | 3.26 | 2.1463 | -0.1075 | |||

| ABT / Abbott Laboratories | 0.09 | -0.47 | 12.19 | 2.06 | 2.1319 | -0.1333 | |||

| CVX / Chevron Corporation | 0.08 | 4.70 | 11.90 | -10.38 | 2.0808 | -0.4369 | |||

| USB / U.S. Bancorp | 0.25 | 6.09 | 11.28 | 13.70 | 1.9721 | 0.0913 | |||

| OTIS / Otis Worldwide Corporation | 0.11 | 2.43 | 11.09 | -1.71 | 1.9389 | -0.2002 | |||

| SYY / Sysco Corporation | 0.14 | 3.39 | 10.80 | 4.36 | 1.8877 | -0.0737 | |||

| JNJ / Johnson & Johnson | 0.07 | 1.85 | 10.72 | -6.19 | 1.8744 | -0.2922 | |||

| PG / The Procter & Gamble Company | 0.07 | 1.10 | 10.61 | -5.49 | 1.8558 | -0.2733 | |||

| TTE / TotalEnergies SE - Depositary Receipt (Common Stock) | 0.17 | 4.38 | 10.51 | -0.94 | 1.8380 | -0.1740 | |||

| FDX / FedEx Corporation | 0.05 | 6.39 | 10.51 | -0.79 | 1.8370 | -0.1709 | |||

| AAPL / Apple Inc. | 0.05 | -1.36 | 10.36 | -8.89 | 1.8107 | -0.3443 | |||

| MDT / Medtronic plc | 0.12 | 2.41 | 10.30 | -0.66 | 1.8014 | -0.1649 | |||

| KMB / Kimberly-Clark Corporation | 0.08 | 2.50 | 9.80 | -7.08 | 1.7139 | -0.2862 | |||

| LMT / Lockheed Martin Corporation | 0.02 | 3.00 | 9.80 | 6.79 | 1.7135 | -0.0265 | |||

| GPC / Genuine Parts Company | 0.07 | 11.57 | 9.04 | 13.59 | 1.5809 | 0.0719 | |||

| PEP / PepsiCo, Inc. | 0.07 | 6.74 | 9.00 | -6.01 | 1.5738 | -0.2418 | |||

| TGT / Target Corporation | 0.08 | 20.66 | 8.28 | 14.05 | 1.4477 | 0.0713 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.08 | 6.28 | 8.02 | 2.27 | 1.4021 | -0.0845 | |||

| PFE / Pfizer Inc. | 0.33 | 8.83 | 8.02 | 4.10 | 1.4017 | -0.0583 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.02 | 44.20 | 6.51 | 59.48 | 1.1383 | 0.3643 | |||

| VGK / Vanguard International Equity Index Funds - Vanguard FTSE Europe ETF | 0.07 | 33.37 | 5.75 | 47.25 | 1.0059 | 0.2650 | |||

| PICK / iShares, Inc. - iShares MSCI Global Metals & Mining Producers ETF | 0.07 | 109.44 | 2.55 | 119.52 | 0.4465 | 0.2259 | |||

| GLD / SPDR Gold Trust | 0.01 | 7.28 | 2.02 | 13.47 | 0.3536 | 0.0157 | |||

| WMT / Walmart Inc. | 0.02 | 6.85 | 2.00 | 19.02 | 0.3501 | 0.0311 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | -2.03 | 1.81 | -10.63 | 0.3160 | -0.0675 | |||

| NOBL / ProShares Trust - ProShares S&P 500 Dividend Aristocrats ETF | 0.02 | 0.10 | 1.64 | -1.32 | 0.2867 | -0.0284 | |||

| COST / Costco Wholesale Corporation | 0.00 | 2.94 | 1.56 | 7.80 | 0.2730 | -0.0018 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 1.46 | -8.71 | 0.2549 | -0.0479 | |||

| IBM / International Business Machines Corporation | 0.00 | -4.91 | 1.44 | 12.71 | 0.2513 | 0.0096 | |||

| VGT / Vanguard World Fund - Vanguard Information Technology ETF | 0.00 | -10.11 | 1.30 | 9.95 | 0.2280 | 0.0031 | |||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.01 | 30.47 | 0.93 | 33.57 | 0.1621 | 0.0304 | |||

| SPLV / Invesco Exchange-Traded Fund Trust II - Invesco S&P 500 Low Volatility ETF | 0.01 | 0.00 | 0.89 | -2.52 | 0.1553 | -0.0175 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.01 | 10.20 | 0.89 | 60.80 | 0.1549 | 0.0504 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.00 | 0.71 | 10.40 | 0.1244 | 0.0023 | |||

| HD / The Home Depot, Inc. | 0.00 | -0.11 | 0.69 | 0.00 | 0.1214 | -0.0103 | |||

| SBUX / Starbucks Corporation | 0.01 | 0.00 | 0.64 | -6.57 | 0.1120 | -0.0180 | |||

| GOOGL / Alphabet Inc. | 0.00 | -1.95 | 0.64 | 11.71 | 0.1118 | 0.0033 | |||

| GBCI / Glacier Bancorp, Inc. | 0.01 | 0.00 | 0.64 | -2.60 | 0.1117 | -0.0126 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 3.82 | 0.55 | 19.65 | 0.0969 | 0.0091 | |||

| MRK / Merck & Co., Inc. | 0.01 | -2.31 | 0.55 | -13.88 | 0.0956 | -0.0247 | |||

| EBMT / Eagle Bancorp Montana, Inc. | 0.03 | 0.53 | 0.0926 | 0.0926 | |||||

| DFUS / Dimensional ETF Trust - Dimensional U.S. Equity Market ETF | 0.01 | 0.00 | 0.52 | 10.90 | 0.0908 | 0.0019 | |||

| VFH / Vanguard World Fund - Vanguard Financials ETF | 0.00 | 0.00 | 0.49 | 6.56 | 0.0852 | -0.0015 | |||

| ORCL / Oracle Corporation | 0.00 | 0.00 | 0.45 | 56.64 | 0.0784 | 0.0240 | |||

| META / Meta Platforms, Inc. | 0.00 | 9.41 | 0.39 | 40.21 | 0.0690 | 0.0156 | |||

| BA / The Boeing Company | 0.00 | 0.00 | 0.39 | 22.74 | 0.0690 | 0.0081 | |||

| MCD / McDonald's Corporation | 0.00 | 4.31 | 0.39 | -2.26 | 0.0680 | -0.0076 | |||

| KNF / Knife River Corporation | 0.00 | 0.00 | 0.37 | -9.58 | 0.0645 | -0.0128 | |||

| MDU / MDU Resources Group, Inc. | 0.02 | 0.00 | 0.37 | -1.61 | 0.0643 | -0.0064 | |||

| FIBK / First Interstate BancSystem, Inc. | 0.01 | 0.18 | 0.37 | 0.83 | 0.0641 | -0.0049 | |||

| ECG / Everus Construction Group, Inc. | 0.01 | 0.00 | 0.35 | 71.71 | 0.0616 | 0.0226 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | -10.21 | 0.35 | -0.85 | 0.0611 | -0.0057 | |||

| ABBV / AbbVie Inc. | 0.00 | 0.00 | 0.34 | -11.43 | 0.0597 | -0.0134 | |||

| SCHV / Schwab Strategic Trust - Schwab U.S. Large-Cap Value ETF | 0.01 | 0.00 | 0.34 | 4.33 | 0.0589 | -0.0025 | |||

| AXP / American Express Company | 0.00 | 0.00 | 0.32 | 18.42 | 0.0552 | 0.0047 | |||

| C / Citigroup Inc. | 0.00 | 2.82 | 0.31 | 23.02 | 0.0544 | 0.0065 | |||

| CSL / Carlisle Companies Incorporated | 0.00 | 0.00 | 0.31 | 9.68 | 0.0535 | 0.0006 | |||

| VIS / Vanguard World Fund - Vanguard Industrials ETF | 0.00 | 0.00 | 0.30 | 12.93 | 0.0521 | 0.0022 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 0.00 | 0.25 | 0.82 | 0.0431 | -0.0032 | |||

| COP / ConocoPhillips | 0.00 | -13.00 | 0.25 | -25.76 | 0.0429 | -0.0197 | |||

| AVGO / Broadcom Inc. | 0.00 | 0.24 | 0.0426 | 0.0426 | |||||

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0.00 | 0.00 | 0.23 | 0.45 | 0.0394 | -0.0032 | |||

| IJJ / iShares Trust - iShares S&P Mid-Cap 400 Value ETF | 0.00 | -6.55 | 0.22 | -3.51 | 0.0385 | -0.0048 | |||

| GOOG / Alphabet Inc. | 0.00 | 0.21 | 0.0376 | 0.0376 | |||||

| LLY / Eli Lilly and Company | 0.00 | -1.11 | 0.21 | -6.76 | 0.0363 | -0.0059 | |||

| AMD / Advanced Micro Devices, Inc. | 0.00 | 0.20 | 0.0358 | 0.0358 | |||||

| VTIP / Vanguard Malvern Funds - Vanguard Short-Term Inflation-Protected Securities ETF | 0.00 | 0.20 | 0.0353 | 0.0353 | |||||

| F / Ford Motor Company | 0.01 | 0.00 | 0.13 | 8.13 | 0.0234 | -0.0001 | |||

| GERN / Geron Corporation | 0.02 | 0.00 | 0.03 | -12.12 | 0.0052 | -0.0012 | |||

| RVYL / Ryvyl Inc. | 0.01 | 0.00 | 0.01 | -14.29 | 0.0022 | -0.0006 | |||

| SPMD / SPDR Series Trust - SPDR Portfolio S&P 400 Mid Cap ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SPLG / SPDR Series Trust - SPDR Portfolio S&P 500 ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ECL / Ecolab Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SPDW / SPDR Index Shares Funds - SPDR Portfolio Developed World ex-US ETF | 0.00 | -100.00 | 0.00 | 0.0000 |