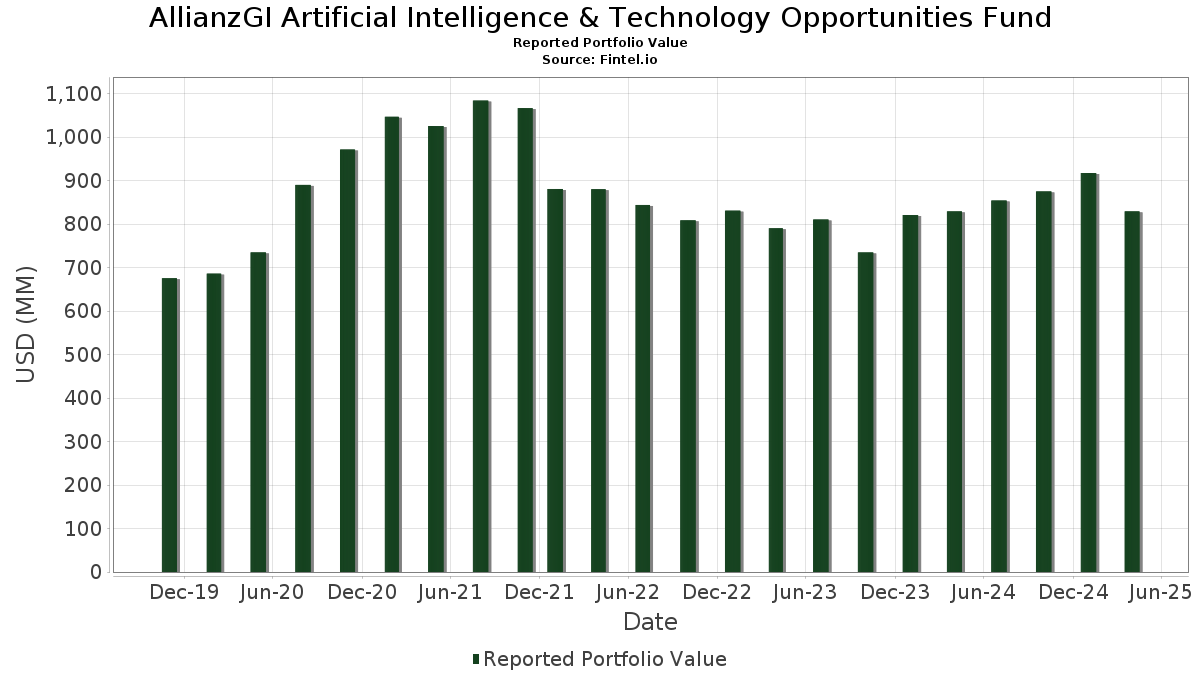

Basic Stats

| Portfolio Value | $ 829,275,382 |

| Current Positions | 93 |

Latest Holdings, Performance, AUM (from 13F, 13D)

AllianzGI Artificial Intelligence & Technology Opportunities Fund has disclosed 93 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 829,275,382 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). AllianzGI Artificial Intelligence & Technology Opportunities Fund’s top holdings are NVIDIA Corporation (US:NVDA) , Netflix, Inc. (US:NFLX) , Meta Platforms, Inc. (US:META) , Eli Lilly and Company (US:LLY) , and McKesson Corporation (US:MCK) . AllianzGI Artificial Intelligence & Technology Opportunities Fund’s new positions include CONVERTIBLE ZERO (US:US90353TAJ97) , Walmart Inc. (US:WMT) , Microchip Technology Incorporated - Preferred Stock (US:MROCL) , Iron Mountain, Inc. (US:US46284VAP67) , and CONV. NOTE (US:US62886HBK68) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 19.77 | 2.7705 | 2.3119 | |

| 0.13 | 12.51 | 1.7530 | 1.7530 | |

| 0.25 | 11.66 | 1.6335 | 1.6335 | |

| 0.03 | 18.54 | 2.5979 | 1.4057 | |

| 7.70 | 1.0796 | 1.0796 | ||

| 8.92 | 8.92 | 1.2495 | 1.0555 | |

| 7.09 | 7.09 | 0.9931 | 0.9931 | |

| 0.06 | 16.97 | 2.3786 | 0.8115 | |

| 0.03 | 5.70 | 0.7982 | 0.7982 | |

| 0.02 | 5.61 | 0.7863 | 0.7863 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.05 | 4.52 | 0.6338 | -1.7873 | |

| 3.25 | 0.4551 | -1.1156 | ||

| 0.06 | 11.88 | 1.6647 | -1.0048 | |

| 0.22 | 8.66 | 1.2138 | -0.7965 | |

| 0.01 | 2.57 | 0.3604 | -0.6950 | |

| 0.01 | 4.98 | 0.6979 | -0.6696 | |

| 0.10 | 6.59 | 0.9235 | -0.6612 | |

| 0.04 | 6.39 | 0.8953 | -0.6437 | |

| 0.00 | 0.00 | -0.6109 | ||

| 0.00 | 0.00 | -0.6109 |

13F and Fund Filings

This form was filed on 2025-06-25 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.26 | 0.00 | 28.69 | -9.29 | 4.0205 | 0.1079 | |||

| NFLX / Netflix, Inc. | 0.02 | 360.34 | 19.77 | 433.49 | 2.7705 | 2.3119 | |||

| META / Meta Platforms, Inc. | 0.04 | 0.00 | 19.42 | -20.34 | 2.7206 | -0.2944 | |||

| LLY / Eli Lilly and Company | 0.02 | -23.34 | 19.31 | -15.04 | 2.7058 | -0.1056 | |||

| MCK / McKesson Corporation | 0.03 | 60.51 | 18.54 | 92.37 | 2.5979 | 1.4057 | |||

| BSX / Boston Scientific Corporation | 0.17 | 11.40 | 17.92 | 11.95 | 2.5109 | 0.5310 | |||

| PGR / The Progressive Corporation | 0.06 | 17.21 | 16.97 | 33.99 | 2.3786 | 0.8115 | |||

| JPM / JPMorgan Chase & Co. | 0.07 | 0.00 | 15.95 | -8.49 | 2.2346 | 0.0790 | |||

| US90353TAJ97 / CONVERTIBLE ZERO | 14.84 | 39.89 | 2.0792 | 0.7672 | |||||

| FLEX / Flex Ltd. | 0.41 | 5.96 | 14.18 | -12.64 | 1.9874 | -0.0209 | |||

| W1EL34 / Welltower Inc. - Depositary Receipt (Common Stock) | 13.81 | 27.06 | 1.9346 | 0.5904 | |||||

| WMT / Walmart Inc. | 0.13 | 12.51 | 1.7530 | 1.7530 | |||||

| MSFT / Microsoft Corporation | 0.03 | -14.38 | 12.37 | -18.46 | 1.7333 | -0.1433 | |||

| APH / Amphenol Corporation | 0.16 | 14.86 | 12.26 | 24.87 | 1.7180 | 0.5035 | |||

| ORCL / Oracle Corporation | 0.09 | -21.24 | 12.24 | -34.83 | 1.7146 | -0.6080 | |||

| AVGO / Broadcom Inc. | 0.06 | -36.71 | 11.88 | -44.95 | 1.6647 | -1.0048 | |||

| MROCL / Microchip Technology Incorporated - Preferred Stock | 0.25 | 11.66 | 1.6335 | 1.6335 | |||||

| BA.PRA / The Boeing Company - Preferred Security | 0.19 | -14.32 | 11.61 | -12.33 | 1.6262 | -0.0114 | |||

| US46284VAP67 / Iron Mountain, Inc. | 11.30 | -0.13 | 1.5839 | 0.1837 | |||||

| L1YV34 / Live Nation Entertainment, Inc. - Depositary Receipt (Common Stock) | 10.91 | -0.39 | 1.5293 | 0.1740 | |||||

| US62886HBK68 / CONV. NOTE | 10.79 | -11.92 | 1.5125 | -0.0033 | |||||

| US82452JAD19 / SHIFT4 PAYMENTS INC | 10.70 | -13.58 | 1.4996 | -0.0322 | |||||

| TCOM / Trip.com Group Limited - Depositary Receipt (Common Stock) | 10.53 | -9.87 | 1.4755 | 0.0303 | |||||

| US55024UAD19 / CONV. NOTE | 10.43 | -8.08 | 1.4609 | 0.0579 | |||||

| US362273BZ69 / GS Finance Corp | 10.34 | 22.53 | 1.4496 | 0.4052 | |||||

| D1LR34 / Digital Realty Trust, Inc. - Depositary Receipt (Common Stock) | 10.28 | 2.93 | 1.4400 | 0.2050 | |||||

| US95081QAP90 / WESCO DISTRIBUTION INC | 10.02 | -0.56 | 1.4036 | 0.1576 | |||||

| US43284MAA62 / Hilton Grand Vacations Borrower Escrow LLC / Hilton Grand Vacations Borrower Esc | 10.00 | -2.95 | 1.4012 | 0.1267 | |||||

| US29365BAB99 / Entegris Escrow Corp | 9.83 | 0.11 | 1.3774 | 0.1628 | |||||

| US88033GDK31 / Tenet Healthcare Corp | 9.82 | -0.29 | 1.3763 | 0.1577 | |||||

| Seagate HDD Cayman / DBT (US81180WBP59) | 9.81 | -0.07 | 1.3753 | 0.1603 | |||||

| Rivian Automotive Inc / DBT (US76954AAB98) | 9.80 | 3.18 | 1.3737 | 0.1983 | |||||

| US98379KAB89 / XPO INC | 9.78 | -0.92 | 1.3701 | 0.1493 | |||||

| TEAM / Atlassian Corporation | 0.04 | 38.89 | 9.59 | 3.36 | 1.3432 | 0.1960 | |||

| US668771AL22 / NortonLifeLock Inc | 9.52 | 0.08 | 1.3346 | 0.1573 | |||||

| US18915MAC10 / CONVERTIBLE ZERO | 9.49 | 8.76 | 1.3297 | 0.2503 | |||||

| US682189AS48 / CONVERTIBLE ZERO | 9.37 | 51.06 | 1.3125 | 0.4061 | |||||

| US16115QAG55 / Chart Industries Inc | 9.27 | -1.16 | 1.2991 | 0.1388 | |||||

| D1DG34 / Datadog, Inc. - Depositary Receipt (Common Stock) | 9.20 | 21.67 | 1.2893 | 0.3538 | |||||

| WFC / Wells Fargo & Company | 0.13 | -13.40 | 9.04 | -21.97 | 1.2674 | -0.1664 | |||

| TFDXX / Blackrock Liquidity Funds - BlackRock Liquidity Funds FedFund Portfolio Institutional Class | 8.92 | 468.43 | 8.92 | 468.69 | 1.2495 | 1.0555 | |||

| CLS / Celestica Inc. | 0.10 | 146.76 | 8.90 | 70.60 | 1.2472 | 0.6017 | |||

| MACOM Technology Solutions Holdings Inc / DBT (US55405YAC49) | 8.83 | -10.00 | 1.2373 | 0.0236 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 8.81 | 0.77 | 1.2340 | 0.1529 | |||||

| Performance Food Group Inc / DBT (US71376LAF76) | 8.80 | -0.18 | 1.2335 | 0.1426 | |||||

| US531229AQ58 / CONV. NOTE | 8.78 | -3.40 | 1.2303 | 0.1060 | |||||

| HLT / Hilton Worldwide Holdings Inc. | 0.04 | -21.42 | 8.77 | -30.81 | 1.2296 | -0.3392 | |||

| BAC / Bank of America Corporation | 0.22 | -38.12 | 8.66 | -46.70 | 1.2138 | -0.7965 | |||

| CB / Chubb Limited | 0.03 | 44.74 | 8.65 | 69.00 | 1.2126 | 0.4891 | |||

| US74736KAH41 / Qorvo Inc | 8.60 | 140.95 | 1.2047 | 0.7633 | |||||

| W1DC34 / Western Digital Corporation - Depositary Receipt (Common Stock) | 8.57 | -3.58 | 1.2008 | 0.1014 | |||||

| HPE.PRC / Hewlett Packard Enterprise Company - Preferred Security | 0.17 | -11.06 | 8.48 | -26.96 | 1.1881 | -0.2479 | |||

| MSI / Motorola Solutions, Inc. | 0.02 | -7.28 | 8.41 | -12.98 | 1.1790 | -0.0171 | |||

| AAPL / Apple Inc. | 0.04 | 79.97 | 8.25 | 62.06 | 1.1559 | 0.5262 | |||

| SHOP / Shopify Inc. | 8.19 | 36.74 | 1.1479 | 0.4068 | |||||

| S2YN34 / Synaptics Incorporated - Depositary Receipt (Common Stock) | 7.70 | 1.0796 | 1.0796 | ||||||

| G2WR34 / Guidewire Software, Inc. - Depositary Receipt (Common Stock) | 7.70 | 1.57 | 1.0785 | 0.1411 | |||||

| US902104AC24 / II-VI Inc | 7.66 | -0.51 | 1.0732 | 0.1209 | |||||

| US031652BK50 / Amkor Technology Inc 6.625% 09/15/2027 144A | 7.54 | -0.30 | 1.0569 | 0.1211 | |||||

| Caesars Entertainment Inc / DBT (US12769GAD25) | 7.54 | -3.07 | 1.0568 | 0.0944 | |||||

| CRM / Salesforce, Inc. | 0.03 | 0.00 | 7.10 | -21.36 | 0.9948 | -0.1220 | |||

| DREYFUS GOVERNMENT CASH MANAGE / STIV (000000000) | 7.09 | 7.09 | 0.9931 | 0.9931 | |||||

| SYK / Stryker Corporation | 0.02 | -8.60 | 6.61 | -12.66 | 0.9269 | -0.0100 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.03 | 68.21 | 6.61 | 35.59 | 0.9257 | 0.3230 | |||

| C / Citigroup Inc. | 0.10 | -38.74 | 6.59 | -48.55 | 0.9235 | -0.6612 | |||

| MS / Morgan Stanley | 0.06 | -25.71 | 6.44 | -38.05 | 0.9022 | -0.3835 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.04 | -35.51 | 6.39 | -48.64 | 0.8953 | -0.6437 | |||

| DE / Deere & Company | 0.01 | 472.75 | 6.30 | 614.53 | 0.8821 | 0.7628 | |||

| PH / Parker-Hannifin Corporation | 0.01 | 31.19 | 6.16 | 12.27 | 0.8631 | 0.1844 | |||

| SNOWD / Snowflake Inc. - Depositary Receipt (Common Stock) | 5.85 | -6.49 | 0.8196 | 0.0459 | |||||

| DGX / Quest Diagnostics Incorporated | 0.03 | 5.70 | 0.7982 | 0.7982 | |||||

| FFIV / F5, Inc. | 0.02 | 5.61 | 0.7863 | 0.7863 | |||||

| IRTC / iRhythm Technologies, Inc. | 5.44 | 0.7627 | 0.7627 | ||||||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.07 | 98.36 | 5.33 | 101.25 | 0.7474 | 0.4195 | |||

| US902252AB17 / Tyler Technologies Inc | 5.22 | -28.44 | 0.7320 | -0.1710 | |||||

| CDNS / Cadence Design Systems, Inc. | 0.02 | -0.23 | 5.15 | -0.19 | 0.7212 | 0.0833 | |||

| NOW / ServiceNow, Inc. | 0.01 | -51.96 | 4.98 | -54.95 | 0.6979 | -0.6696 | |||

| NXPI / NXP Semiconductors N.V. | 0.03 | 48.71 | 4.93 | 31.43 | 0.6904 | 0.2266 | |||

| ANET / Arista Networks Inc | 0.05 | -67.63 | 4.52 | -76.89 | 0.6338 | -1.7873 | |||

| SE / Sea Limited - Depositary Receipt (Common Stock) | 4.50 | -44.61 | 0.6312 | -0.3748 | |||||

| RHHBY / Roche Holding AG - Depositary Receipt (Common Stock) | 0.11 | 135.29 | 4.49 | 132.02 | 0.6285 | 0.3367 | |||

| HD / The Home Depot, Inc. | 0.01 | 0.00 | 4.43 | -12.50 | 0.6201 | -0.0055 | |||

| DIS / The Walt Disney Company | 0.04 | -41.12 | 4.01 | -52.64 | 0.5613 | -0.4848 | |||

| Affirm Holdings Inc / DBT (US00827BAC00) | 3.87 | -28.72 | 0.5419 | -0.1292 | |||||

| G1PI34 / Global Payments Inc. - Depositary Receipt (Common Stock) | 3.80 | 0.5320 | 0.5320 | ||||||

| Galaxy Digital Holdings LP / DBT (US36317GAB23) | 3.37 | -40.20 | 0.4720 | -0.2248 | |||||

| CMG / Chipotle Mexican Grill, Inc. | 0.06 | -55.79 | 3.26 | -61.72 | 0.4564 | -0.5963 | |||

| US816850AF86 / Semtech Corp | 3.25 | -74.43 | 0.4551 | -1.1156 | |||||

| CEG / Constellation Energy Corporation | 0.01 | -59.53 | 2.57 | -69.86 | 0.3604 | -0.6950 | |||

| EMR / Emerson Electric Co. | 0.02 | 0.00 | 2.36 | -19.13 | 0.3312 | -0.0303 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | -41.39 | 2.32 | -55.56 | 0.3257 | -0.3212 | |||

| NTRA / Natera, Inc. | 0.01 | 0.00 | 2.19 | -14.70 | 0.3075 | -0.0107 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | -69.70 | 1.33 | -72.68 | 0.1865 | -0.4159 | |||

| DGCXX / Dreyfus Government Cash Management Funds - Dreyfus Government Cash Management Fund Institutional Shares | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | -0.2823 | |||

| URI / United Rentals, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6109 | ||||

| PEG / Public Service Enterprise Group Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.3806 | ||||

| URI / United Rentals, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6109 |