Basic Stats

| Portfolio Value | $ 1,521,174,547 |

| Current Positions | 46 |

Latest Holdings, Performance, AUM (from 13F, 13D)

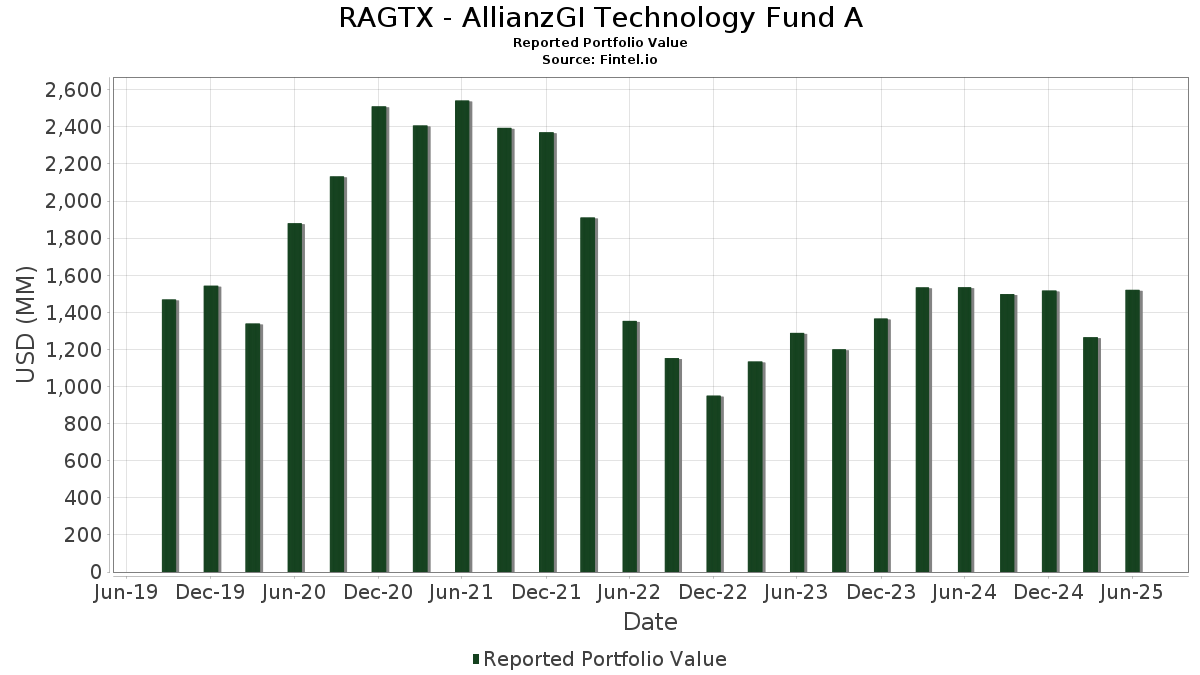

RAGTX - AllianzGI Technology Fund A has disclosed 46 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,521,174,547 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). RAGTX - AllianzGI Technology Fund A’s top holdings are Meta Platforms, Inc. (US:META) , NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Alphabet Inc. (US:GOOG) , and Apple Inc. (US:AAPL) . RAGTX - AllianzGI Technology Fund A’s new positions include Samsara Inc. (US:IOT) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.93 | 146.45 | 9.2159 | 0.8414 | |

| 0.31 | 85.09 | 5.3547 | 0.5013 | |

| 0.07 | 54.06 | 3.4022 | 0.4942 | |

| 0.15 | 32.79 | 2.0637 | 0.4072 | |

| 0.10 | 3.87 | 0.2433 | 0.2433 | |

| 0.12 | 20.22 | 1.2722 | 0.2179 | |

| 0.09 | 11.56 | 0.7272 | 0.2140 | |

| 0.29 | 36.00 | 2.2655 | 0.2065 | |

| 0.14 | 13.82 | 0.8700 | 0.1447 | |

| 0.28 | 138.73 | 8.7298 | 0.1311 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.43 | 88.63 | 5.5775 | -2.2055 | |

| 0.63 | 111.42 | 7.0113 | -0.9480 | |

| 0.12 | 24.19 | 1.5221 | -0.7072 | |

| 0.26 | 37.25 | 2.3440 | -0.6586 | |

| 0.27 | 58.23 | 3.6640 | -0.5813 | |

| 0.08 | 12.80 | 0.8058 | -0.3711 | |

| 0.54 | 62.06 | 3.9052 | -0.3573 | |

| 0.17 | 52.51 | 3.3043 | -0.2984 | |

| 0.10 | 12.57 | 0.7908 | -0.2892 | |

| 0.20 | 147.11 | 9.2572 | -0.2214 |

13F and Fund Filings

This form was filed on 2025-08-26 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| META / Meta Platforms, Inc. | 0.20 | -4.27 | 147.11 | 22.59 | 9.2572 | -0.2214 | |||

| NVDA / NVIDIA Corporation | 0.93 | -5.24 | 146.45 | 38.13 | 9.2159 | 0.8414 | |||

| MSFT / Microsoft Corporation | 0.28 | -3.83 | 138.73 | 27.43 | 8.7298 | 0.1311 | |||

| GOOG / Alphabet Inc. | 0.63 | -2.62 | 111.42 | 10.57 | 7.0113 | -0.9480 | |||

| AAPL / Apple Inc. | 0.43 | -2.61 | 88.63 | -10.05 | 5.5775 | -2.2055 | |||

| AVGO / Broadcom Inc. | 0.31 | -15.89 | 85.09 | 38.48 | 5.3547 | 0.5013 | |||

| SHOP / Shopify Inc. | 0.54 | -4.81 | 62.06 | 15.00 | 3.9052 | -0.3573 | |||

| AMZN / Amazon.com, Inc. | 0.27 | -6.05 | 58.23 | 8.33 | 3.6640 | -0.5813 | |||

| AXON / Axon Enterprise, Inc. | 0.07 | -6.71 | 54.06 | 46.85 | 3.4022 | 0.4942 | |||

| TSLA / Tesla, Inc. | 0.17 | -6.08 | 52.51 | 15.12 | 3.3043 | -0.2984 | |||

| NOW / ServiceNow, Inc. | 0.05 | -8.60 | 46.98 | 18.03 | 2.9565 | -0.1877 | |||

| MELI / MercadoLibre, Inc. | 0.01 | -9.24 | 39.14 | 21.59 | 2.4629 | -0.0796 | |||

| AMD / Advanced Micro Devices, Inc. | 0.26 | -29.05 | 37.25 | -2.01 | 2.3440 | -0.6586 | |||

| MU / Micron Technology, Inc. | 0.29 | -2.63 | 36.00 | 38.11 | 2.2655 | 0.2065 | |||

| ORCL / Oracle Corporation | 0.15 | 0.00 | 32.79 | 56.38 | 2.0637 | 0.4072 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.06 | -18.22 | 32.24 | 18.14 | 2.0287 | -0.1268 | |||

| ANET / Arista Networks Inc | 0.25 | -2.62 | 25.11 | 28.59 | 1.5799 | 0.0377 | |||

| TTD / The Trade Desk, Inc. | 0.34 | -2.62 | 24.65 | 28.12 | 1.5511 | 0.0315 | |||

| PANW / Palo Alto Networks, Inc. | 0.12 | -28.54 | 24.19 | -14.30 | 1.5221 | -0.7072 | |||

| MPWR / Monolithic Power Systems, Inc. | 0.03 | 0.00 | 22.67 | 26.10 | 1.4267 | 0.0066 | |||

| ARM / Arm Holdings plc - Depositary Receipt (Common Stock) | 0.12 | 0.00 | 20.22 | 51.46 | 1.2722 | 0.2179 | |||

| TOST / Toast, Inc. | 0.45 | 0.00 | 19.71 | 33.53 | 1.2402 | 0.0744 | |||

| DDOG / Datadog, Inc. | 0.12 | 0.00 | 16.79 | 35.40 | 1.0566 | 0.0771 | |||

| INTU / Intuit Inc. | 0.02 | 0.00 | 15.52 | 28.28 | 0.9764 | 0.0210 | |||

| SPF / Spotify Technology S.A. | 0.02 | 0.00 | 15.35 | 39.51 | 0.9657 | 0.0968 | |||

| APH / Amphenol Corporation | 0.14 | 0.00 | 13.82 | 50.57 | 0.8700 | 0.1447 | |||

| KLAC / KLA Corporation | 0.01 | 0.00 | 13.44 | 31.76 | 0.8455 | 0.0401 | |||

| AMAT / Applied Materials, Inc. | 0.07 | 0.00 | 12.81 | 26.15 | 0.8064 | 0.0040 | |||

| QCOM / QUALCOMM Incorporated | 0.08 | -17.11 | 12.80 | -14.07 | 0.8058 | -0.3711 | |||

| DELL / Dell Technologies Inc. | 0.10 | -31.67 | 12.57 | -8.09 | 0.7908 | -0.2892 | |||

| CDNS / Cadence Design Systems, Inc. | 0.04 | -5.99 | 12.33 | 13.91 | 0.7756 | -0.0791 | |||

| VRT / Vertiv Holdings Co | 0.09 | 0.00 | 11.56 | 77.84 | 0.7272 | 0.2140 | |||

| UBER / Uber Technologies, Inc. | 0.11 | 0.00 | 10.58 | 28.06 | 0.6658 | 0.0132 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 10.42 | 20.94 | 0.6556 | -0.0248 | |||

| ADBE / Adobe Inc. | 0.02 | 0.00 | 9.63 | 0.88 | 0.6062 | -0.1481 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 0.00 | 6.95 | 25.67 | 0.4372 | 0.0005 | |||

| SRAD / Sportradar Group AG | 0.23 | 0.00 | 6.42 | 29.89 | 0.4039 | 0.0136 | |||

| MDB / MongoDB, Inc. | 0.03 | -15.73 | 6.30 | 0.88 | 0.3964 | -0.0968 | |||

| BR / Broadridge Financial Solutions, Inc. | 0.02 | -16.13 | 5.06 | -15.93 | 0.3181 | -0.1568 | |||

| PINS / Pinterest, Inc. | 0.14 | 0.00 | 4.86 | 15.69 | 0.3058 | -0.0260 | |||

| CRM / Salesforce, Inc. | 0.02 | -24.68 | 4.74 | -23.47 | 0.2986 | -0.1911 | |||

| APPF / AppFolio, Inc. | 0.02 | 0.00 | 4.61 | 4.71 | 0.2898 | -0.0576 | |||

| IOT / Samsara Inc. | 0.10 | 3.87 | 0.2433 | 0.2433 | |||||

| HUBS / HubSpot, Inc. | 0.01 | 0.00 | 2.78 | -2.56 | 0.1751 | -0.0505 | |||

| NXPI / NXP Semiconductors N.V. | 0.01 | 0.00 | 2.38 | 14.97 | 0.1499 | -0.0138 | |||

| V / Visa Inc. | 0.00 | 0.00 | 0.36 | 1.43 | 0.0223 | -0.0053 | |||

| SEMR / Semrush Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1795 |