Basic Stats

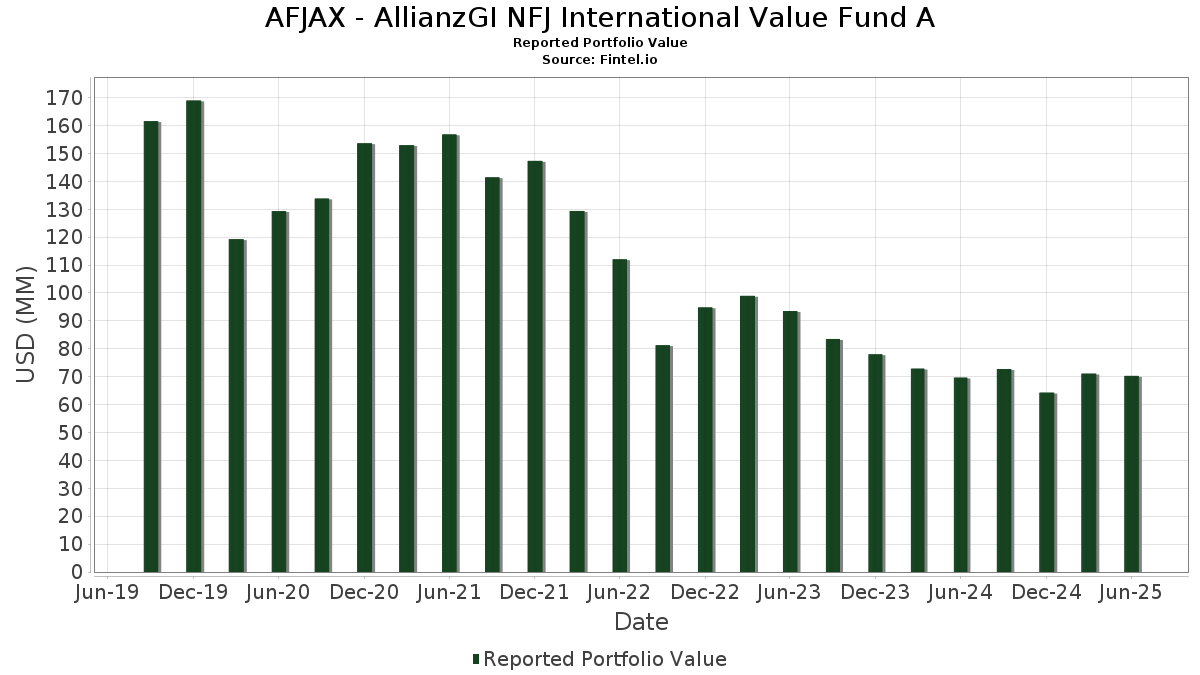

| Portfolio Value | $ 70,284,655 |

| Current Positions | 54 |

Latest Holdings, Performance, AUM (from 13F, 13D)

AFJAX - AllianzGI NFJ International Value Fund A has disclosed 54 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 70,284,655 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). AFJAX - AllianzGI NFJ International Value Fund A’s top holdings are Alibaba Group Holding Limited (DE:2RR) , Taiwan Semiconductor Manufacturing Company Limited (TW:2330) , Nippon Paint Holdings Co., Ltd. (DE:NI7) , Standard Chartered PLC - Depositary Receipt (Common Stock) (US:SCBFY) , and Daiichi Sankyo Company, Limited (DE:D4S) . AFJAX - AllianzGI NFJ International Value Fund A’s new positions include Alphabet Inc. (US:GOOGL) , The Saudi National Bank (SA:1180) , PT Bank Central Asia Tbk - Depositary Receipt (Common Stock) (US:PBCRY) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 2.18 | 3.1049 | 3.1049 | |

| 0.08 | 0.75 | 1.0639 | 1.0639 | |

| 0.37 | 2.96 | 4.2146 | 1.0562 | |

| 1.36 | 0.73 | 1.0323 | 1.0323 | |

| 0.10 | 3.47 | 4.9313 | 0.9389 | |

| 0.00 | 2.84 | 4.0442 | 0.5721 | |

| 0.01 | 1.98 | 2.8175 | 0.4678 | |

| 0.03 | 2.23 | 3.1664 | 0.2914 | |

| 0.18 | 2.93 | 4.1684 | 0.2299 | |

| 0.06 | 2.84 | 4.0351 | 0.2289 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.17 | 2.82 | 4.0070 | -1.0583 | |

| 0.28 | 3.87 | 5.5062 | -1.0151 | |

| 0.02 | 1.58 | 2.2536 | -0.4893 | |

| 0.00 | 0.67 | 0.9569 | -0.3389 | |

| 0.13 | 2.63 | 3.7445 | -0.3298 | |

| 0.01 | 1.40 | 1.9887 | -0.2904 | |

| 0.12 | 2.90 | 4.1283 | -0.2773 | |

| 0.01 | 0.63 | 0.9021 | -0.2667 | |

| 0.18 | 1.76 | 2.5029 | -0.2402 | |

| 0.15 | 0.89 | 1.2681 | -0.2325 |

13F and Fund Filings

This form was filed on 2025-08-26 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| 2RR / Alibaba Group Holding Limited | 0.28 | 0.00 | 3.87 | -15.48 | 5.5062 | -1.0151 | |||

| 2330 / Taiwan Semiconductor Manufacturing Company Limited | 0.10 | -4.02 | 3.47 | 23.65 | 4.9313 | 0.9389 | |||

| NI7 / Nippon Paint Holdings Co., Ltd. | 0.37 | 24.55 | 2.96 | 33.60 | 4.2146 | 1.0562 | |||

| SCBFY / Standard Chartered PLC - Depositary Receipt (Common Stock) | 0.18 | -5.09 | 2.93 | 5.97 | 4.1684 | 0.2299 | |||

| D4S / Daiichi Sankyo Company, Limited | 0.12 | -4.39 | 2.90 | -6.18 | 4.1283 | -0.2773 | |||

| ASML / ASML Holding N.V. | 0.00 | -3.31 | 2.84 | 16.66 | 4.0442 | 0.5721 | |||

| 005930 / Samsung Electronics Co., Ltd. | 0.06 | -5.03 | 2.84 | 6.14 | 4.0351 | 0.2289 | |||

| 9618 / JD.com, Inc. | 0.17 | 0.00 | 2.82 | -20.81 | 4.0070 | -1.0583 | |||

| NNND / Tencent Holdings Limited | 0.04 | -1.13 | 2.81 | -0.85 | 4.0005 | -0.0390 | |||

| 3064 / MonotaRO Co., Ltd. | 0.13 | -12.99 | 2.63 | -7.97 | 3.7445 | -0.3298 | |||

| 6758 / Sony Group Corporation | 0.09 | -6.89 | 2.41 | -4.66 | 3.4339 | -0.1733 | |||

| HDB / HDFC Bank Limited - Depositary Receipt (Common Stock) | 0.03 | -4.45 | 2.23 | 10.31 | 3.1664 | 0.2914 | |||

| GOOGL / Alphabet Inc. | 0.01 | 2.18 | 3.1049 | 3.1049 | |||||

| NNW0 / Naspers Limited | 0.01 | -4.43 | 1.98 | 20.07 | 2.8175 | 0.4678 | |||

| XVALO / Vale S.A. | 0.18 | -6.06 | 1.76 | -8.67 | 2.5029 | -0.2402 | |||

| NEE / NextEra Energy, Inc. | 0.02 | -16.00 | 1.58 | -17.71 | 2.2536 | -0.4893 | |||

| E3G1 / Evolution AB (publ) | 0.02 | -4.44 | 1.46 | 1.89 | 2.0719 | 0.0359 | |||

| AEM / Agnico Eagle Mines Limited | 0.01 | -15.74 | 1.41 | -7.31 | 2.0016 | -0.1613 | |||

| MKTX / MarketAxess Holdings Inc. | 0.01 | -15.37 | 1.40 | -12.62 | 1.9887 | -0.2904 | |||

| DIS / The Walt Disney Company | 0.05 | -4.45 | 1.14 | -1.73 | 1.6167 | -0.0302 | |||

| SGRO / SEGRO Plc | 0.10 | -4.45 | 0.91 | -0.33 | 1.2999 | -0.0060 | |||

| PJXB / Petróleo Brasileiro S.A. - Petrobras - Preferred Stock | 0.15 | -4.40 | 0.89 | -15.38 | 1.2681 | -0.2325 | |||

| 4507 / Shionogi & Co., Ltd. | 0.04 | -4.20 | 0.78 | 14.22 | 1.1095 | 0.1378 | |||

| 1180 / The Saudi National Bank | 0.08 | 0.75 | 1.0639 | 1.0639 | |||||

| 000660 / SK hynix Inc. | 0.00 | -36.58 | 0.74 | 2.91 | 1.0559 | 0.0288 | |||

| KBC / KBC Group NV | 0.01 | -8.89 | 0.73 | 3.27 | 1.0329 | 0.0310 | |||

| PBCRY / PT Bank Central Asia Tbk - Depositary Receipt (Common Stock) | 1.36 | 0.73 | 1.0323 | 1.0323 | |||||

| BARC / Barclays PLC | 0.16 | -15.76 | 0.73 | 3.72 | 1.0319 | 0.0358 | |||

| ENX / Euronext N.V. | 0.00 | -24.65 | 0.71 | -11.28 | 1.0080 | -0.1292 | |||

| ARC / Aker BP ASA | 0.03 | -4.45 | 0.71 | 3.06 | 1.0069 | 0.0289 | |||

| 600036 / China Merchants Bank Co., Ltd. | 0.11 | -8.24 | 0.70 | -1.55 | 0.9952 | -0.0162 | |||

| 4FN / Grupo Financiero Banorte, S.A.B. de C.V. | 0.08 | -11.66 | 0.70 | 16.81 | 0.9894 | 0.1411 | |||

| ITUB20 / Itau Unibanco Holding SA | 0.10 | -29.68 | 0.69 | -13.36 | 0.9878 | -0.1534 | |||

| AMT / American Tower Corporation | 0.00 | -9.51 | 0.69 | -8.11 | 0.9840 | -0.0879 | |||

| BBVA / Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) | 0.04 | -14.51 | 0.69 | -3.65 | 0.9762 | -0.0384 | |||

| FLN / Admiral Group plc | 0.02 | -20.18 | 0.68 | -2.84 | 0.9730 | -0.0309 | |||

| RYSD / NatWest Group plc | 0.10 | -21.22 | 0.68 | -6.45 | 0.9713 | -0.0670 | |||

| DEVL / DBS Group Holdings Ltd | 0.02 | -3.98 | 0.68 | -1.16 | 0.9707 | -0.0134 | |||

| EMIRATESNBD / Emirates NBD Bank PJSC | 0.11 | -12.36 | 0.68 | -0.88 | 0.9602 | -0.0099 | |||

| CPALL.F / FOREIGN SH. THB1.0 A | 0.50 | -1.15 | 0.67 | -8.67 | 0.9601 | -0.0909 | |||

| RBA / RB Global, Inc. | 0.01 | -10.87 | 0.67 | -5.60 | 0.9593 | -0.0587 | |||

| FNV / Franco-Nevada Corporation | 0.00 | -28.94 | 0.67 | -26.07 | 0.9569 | -0.3389 | |||

| BN / Brookfield Corporation | 0.01 | -4.44 | 0.66 | 12.91 | 0.9342 | 0.1066 | |||

| FANUY / Fanuc Corporation - Depositary Receipt (Common Stock) | 0.02 | -3.72 | 0.64 | -3.34 | 0.9068 | -0.0322 | |||

| AU / AngloGold Ashanti plc | 0.01 | -35.88 | 0.63 | -22.68 | 0.9021 | -0.2667 | |||

| AZN / Astrazeneca plc | 0.00 | -4.43 | 0.62 | -9.62 | 0.8825 | -0.0948 | |||

| REP / Repsol, S.A. | 0.04 | -4.45 | 0.62 | 5.30 | 0.8774 | 0.0441 | |||

| 2618 / JD Logistics, Inc. | 0.36 | -1.14 | 0.61 | 2.35 | 0.8686 | 0.0194 | |||

| EQNR / Equinor ASA - Depositary Receipt (Common Stock) | 0.02 | -4.45 | 0.60 | -8.46 | 0.8473 | -0.0791 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.01 | -4.44 | 0.56 | -2.96 | 0.7946 | -0.0256 | |||

| 2020 / ANTA Sports Products Limited | 0.05 | -3.84 | 0.54 | 5.24 | 0.7720 | 0.0379 | |||

| ARAMCO / Saudi Arabian Oil Co | 0.08 | -4.45 | 0.54 | -13.02 | 0.7707 | -0.1165 | |||

| NBAD / First Abu Dhabi Bank PJSC | 0.12 | -15.35 | 0.52 | 1.96 | 0.7401 | 0.0124 | |||

| MC / LVMH Moët Hennessy - Louis Vuitton, Société Européenne | 0.00 | -4.29 | 0.25 | -18.87 | 0.3486 | -0.0826 |