Basic Stats

| Portfolio Value | $ 679,745,172 |

| Current Positions | 73 |

Latest Holdings, Performance, AUM (from 13F, 13D)

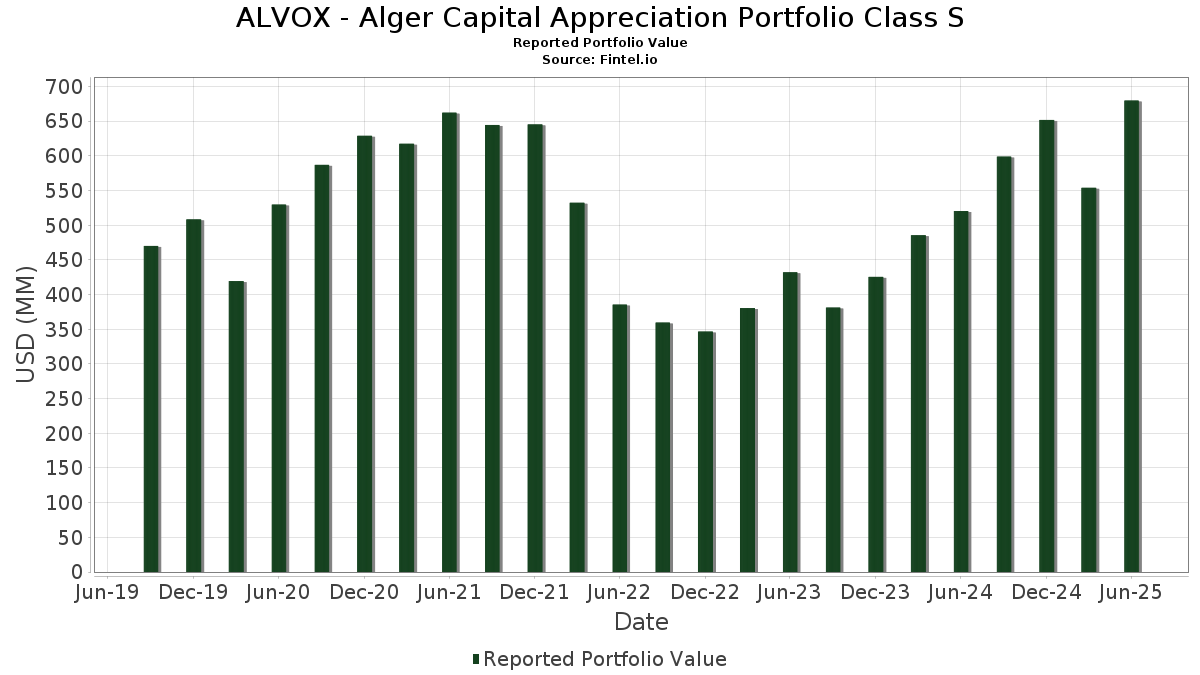

ALVOX - Alger Capital Appreciation Portfolio Class S has disclosed 73 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 679,745,172 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). ALVOX - Alger Capital Appreciation Portfolio Class S’s top holdings are NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Meta Platforms, Inc. (US:META) , Amazon.com, Inc. (US:AMZN) , and Apple Inc. (US:AAPL) . ALVOX - Alger Capital Appreciation Portfolio Class S’s new positions include Itron, Inc. (US:ITRI) , United Rentals, Inc. (US:URI) , Globant S.A. (US:GLOB) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.54 | 85.87 | 12.6208 | 1.5367 | |

| 0.08 | 16.46 | 2.4190 | 1.4405 | |

| 0.21 | 11.87 | 1.7446 | 1.4337 | |

| 0.07 | 8.11 | 1.1913 | 1.1913 | |

| 0.11 | 18.87 | 2.7740 | 1.1626 | |

| 0.02 | 7.25 | 1.0663 | 1.0153 | |

| 0.03 | 7.14 | 1.0495 | 0.8960 | |

| 0.06 | 6.46 | 0.9493 | 0.7351 | |

| 0.03 | 5.36 | 0.7882 | 0.7342 | |

| 0.05 | 15.12 | 2.2218 | 0.6732 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | 0.0000 | -2.0358 | |

| 0.15 | 29.88 | 4.3920 | -1.9293 | |

| 0.02 | 7.12 | 1.0465 | -1.1393 | |

| 0.08 | 27.16 | 3.9921 | -1.1337 | |

| 0.00 | 0.20 | 0.0301 | -0.8622 | |

| 0.22 | 47.36 | 6.9603 | -0.8207 | |

| 0.01 | 16.96 | 2.4924 | -0.8010 | |

| 0.25 | 12.41 | 1.8238 | -0.7874 | |

| 0.01 | 3.55 | 0.5224 | -0.5231 | |

| 0.01 | 4.30 | 0.6325 | -0.5205 |

13F and Fund Filings

This form was filed on 2025-08-28 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.54 | -4.68 | 85.87 | 38.95 | 12.6208 | 1.5367 | |||

| MSFT / Microsoft Corporation | 0.17 | -7.74 | 85.71 | 22.25 | 12.5973 | 0.0223 | |||

| META / Meta Platforms, Inc. | 0.07 | -8.70 | 49.04 | 16.92 | 7.2078 | -0.3153 | |||

| AMZN / Amazon.com, Inc. | 0.22 | -5.33 | 47.36 | 9.16 | 6.9603 | -0.8207 | |||

| AAPL / Apple Inc. | 0.15 | -8.20 | 29.88 | -15.21 | 4.3920 | -1.9293 | |||

| APP / AppLovin Corporation | 0.08 | -28.06 | 27.16 | -4.96 | 3.9921 | -1.1337 | |||

| AVGO / Broadcom Inc. | 0.08 | -16.25 | 21.55 | 37.88 | 3.1681 | 0.3642 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.09 | 0.76 | 20.62 | 37.47 | 3.0313 | 0.3404 | |||

| GOOG / Alphabet Inc. | 0.11 | 85.02 | 18.87 | 110.10 | 2.7740 | 1.1626 | |||

| TSLA / Tesla, Inc. | 0.06 | 21.79 | 18.54 | 49.28 | 2.7252 | 0.4974 | |||

| NFLX / Netflix, Inc. | 0.01 | -35.69 | 16.96 | -7.65 | 2.4924 | -0.8010 | |||

| VST / Vistra Corp. | 0.08 | 82.80 | 16.46 | 201.70 | 2.4190 | 1.4405 | |||

| TLN / Talen Energy Corporation | 0.05 | 20.23 | 15.12 | 75.08 | 2.2218 | 0.6732 | |||

| VRT / Vertiv Holdings Co | 0.11 | -6.62 | 14.24 | 66.09 | 2.0933 | 0.5551 | |||

| GFL / GFL Environmental Inc. | 0.25 | -18.40 | 12.41 | -14.76 | 1.8238 | -0.7874 | |||

| SE / Sea Limited - Depositary Receipt (Common Stock) | 0.08 | -14.78 | 12.23 | 4.46 | 1.7979 | -0.3026 | |||

| NBIS / Nebius Group N.V. | 0.21 | 161.30 | 11.87 | 584.88 | 1.7446 | 1.4337 | |||

| HOOD / Robinhood Markets, Inc. | 0.12 | -25.47 | 11.53 | 67.67 | 1.6946 | 0.4613 | |||

| NTRA / Natera, Inc. | 0.06 | -2.44 | 9.72 | 16.55 | 1.4284 | -0.0672 | |||

| SPF / Spotify Technology S.A. | 0.01 | 5.98 | 9.32 | 47.86 | 1.3706 | 0.2394 | |||

| Databricks, Inc. Series J / EC (000000000) | 0.07 | 8.11 | 1.1913 | 1.1913 | |||||

| HEIA / Heico Corp. - Class A | 0.03 | -3.85 | 7.57 | 17.94 | 1.1133 | -0.0388 | |||

| CEG / Constellation Energy Corporation | 0.02 | 1,494.11 | 7.25 | 2,454.23 | 1.0663 | 1.0153 | |||

| MELI / MercadoLibre, Inc. | 0.00 | -11.06 | 7.23 | 19.15 | 1.0630 | -0.0256 | |||

| SNOW / Snowflake Inc. | 0.03 | 444.99 | 7.14 | 735.09 | 1.0495 | 0.8960 | |||

| V / Visa Inc. | 0.02 | -42.33 | 7.12 | -41.57 | 1.0465 | -1.1393 | |||

| RBLX / Roblox Corporation | 0.06 | 199.71 | 6.46 | 440.87 | 0.9493 | 0.7351 | |||

| FWONK / Formula One Group | 0.06 | -3.85 | 6.19 | 11.62 | 0.9104 | -0.0849 | |||

| ISRG / Intuitive Surgical, Inc. | 0.01 | -30.81 | 5.61 | -24.09 | 0.8247 | -0.5010 | |||

| CAH / Cardinal Health, Inc. | 0.03 | 1,358.29 | 5.36 | 1,681.40 | 0.7882 | 0.7342 | |||

| BSX / Boston Scientific Corporation | 0.04 | -2.14 | 4.57 | 4.20 | 0.6716 | -0.1150 | |||

| LLY / Eli Lilly and Company | 0.01 | -29.08 | 4.30 | -33.06 | 0.6325 | -0.5205 | |||

| NET / Cloudflare, Inc. | 0.02 | -8.78 | 4.02 | 58.52 | 0.5910 | 0.1361 | |||

| ALAB / Astera Labs, Inc. | 0.04 | 5.69 | 3.97 | 60.17 | 0.5834 | 0.1389 | |||

| CCJ / Cameco Corporation | 0.05 | -20.84 | 3.73 | 42.75 | 0.5487 | 0.0797 | |||

| SPGI / S&P Global Inc. | 0.01 | -41.24 | 3.55 | -39.04 | 0.5224 | -0.5231 | |||

| FICO / Fair Isaac Corporation | 0.00 | 755.73 | 3.00 | 748.31 | 0.4414 | 0.3779 | |||

| MLM / Martin Marietta Materials, Inc. | 0.01 | 117.79 | 2.98 | 150.13 | 0.4386 | 0.2246 | |||

| PINS / Pinterest, Inc. | 0.08 | 188.95 | 2.92 | 234.25 | 0.4290 | 0.2724 | |||

| ITRI / Itron, Inc. | 0.02 | 2.89 | 0.4252 | 0.4252 | |||||

| ABT / Abbott Laboratories | 0.02 | 300.50 | 2.81 | 310.67 | 0.4130 | 0.2902 | |||

| SHOP / Shopify Inc. | 0.02 | -21.91 | 2.70 | 12.42 | 0.3964 | -0.0050 | |||

| COHR / Coherent Corp. | 0.03 | -17.56 | 2.57 | 13.25 | 0.3781 | -0.0293 | |||

| BURL / Burlington Stores, Inc. | 0.01 | 2.20 | 0.3228 | 0.3228 | |||||

| WFC / Wells Fargo & Company | 0.03 | -23.00 | 2.06 | -14.07 | 0.3034 | -0.1275 | |||

| CDNS / Cadence Design Systems, Inc. | 0.01 | -54.91 | 1.98 | -45.38 | 0.2905 | -0.3584 | |||

| ETN / Eaton Corporation plc | 0.01 | 1.92 | 0.2818 | 0.2818 | |||||

| TTWO / Take-Two Interactive Software, Inc. | 0.01 | -3.86 | 1.77 | 12.68 | 0.2599 | -0.0216 | |||

| SB Technology, Inc. Series E Preferred Stock / EP (000000000) | 0.10 | 1.77 | 0.2596 | 0.2596 | |||||

| NOW / ServiceNow, Inc. | 0.00 | 417.28 | 1.72 | 570.43 | 0.2533 | 0.2070 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.00 | -19.84 | 1.52 | -3.06 | 0.2237 | -0.0579 | |||

| URI / United Rentals, Inc. | 0.00 | 1.50 | 0.2211 | 0.2211 | |||||

| CVNA / Carvana Co. | 0.00 | -65.91 | 1.49 | -50.45 | 0.2188 | -0.2459 | |||

| UAL / United Airlines Holdings, Inc. | 0.02 | -44.09 | 1.46 | -35.56 | 0.2143 | -0.1913 | |||

| DASH / DoorDash, Inc. | 0.01 | 81.11 | 1.37 | 144.29 | 0.2011 | 0.1006 | |||

| THC / Tenet Healthcare Corporation | 0.01 | -33.70 | 1.34 | 35.80 | 0.1969 | 0.0122 | |||

| MU / Micron Technology, Inc. | 0.01 | -8.30 | 1.29 | 30.11 | 0.1899 | 0.0117 | |||

| DKNG / DraftKings Inc. | 0.03 | -76.14 | 1.15 | -72.48 | 0.1684 | -0.4712 | |||

| DAL / Delta Air Lines, Inc. | 0.02 | 31.65 | 1.14 | 48.50 | 0.1670 | 0.0298 | |||

| ORCL / Oracle Corporation | 0.00 | 1.00 | 0.1471 | 0.1471 | |||||

| EFX / Equifax Inc. | 0.00 | -42.11 | 0.86 | -38.36 | 0.1262 | -0.1236 | |||

| PLTR / Palantir Technologies Inc. | 0.01 | 61.03 | 0.79 | 159.93 | 0.1155 | 0.0613 | |||

| BLDR / Builders FirstSource, Inc. | 0.01 | -30.26 | 0.75 | -34.94 | 0.1110 | -0.0969 | |||

| GKOS / Glaukos Corporation | 0.01 | 61.62 | 0.73 | 69.77 | 0.1074 | 0.0301 | |||

| INDI / indie Semiconductor, Inc. | 0.19 | -3.85 | 0.68 | 68.33 | 0.0993 | 0.0273 | |||

| GLBE / Global-E Online Ltd. | 0.02 | -61.86 | 0.66 | -64.12 | 0.0973 | -0.2337 | |||

| GLOB / Globant S.A. | 0.01 | 0.56 | 0.0821 | 0.0821 | |||||

| CROSSLINK VENTURES C LLC CALSS A SHARES / EC (000000000) | 0.00 | 0.40 | 0.0588 | 0.0588 | |||||

| TKO / TKO Group Holdings, Inc. | 0.00 | -54.67 | 0.34 | -46.15 | 0.0495 | -0.0625 | |||

| COIN / Coinbase Global, Inc. | 0.00 | 0.34 | 0.0495 | 0.0495 | |||||

| CHIME FINANCIAL INC /PFD/ / EP (000000000) | 0.01 | 0.23 | 0.0339 | 0.0339 | |||||

| NRG / NRG Energy, Inc. | 0.00 | -97.55 | 0.20 | -95.90 | 0.0301 | -0.8622 | |||

| US2619081076 / DREYFUS TREASURY PRIME CASH MANAGEMENT/ CLASS A | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | -2.0358 |