Basic Stats

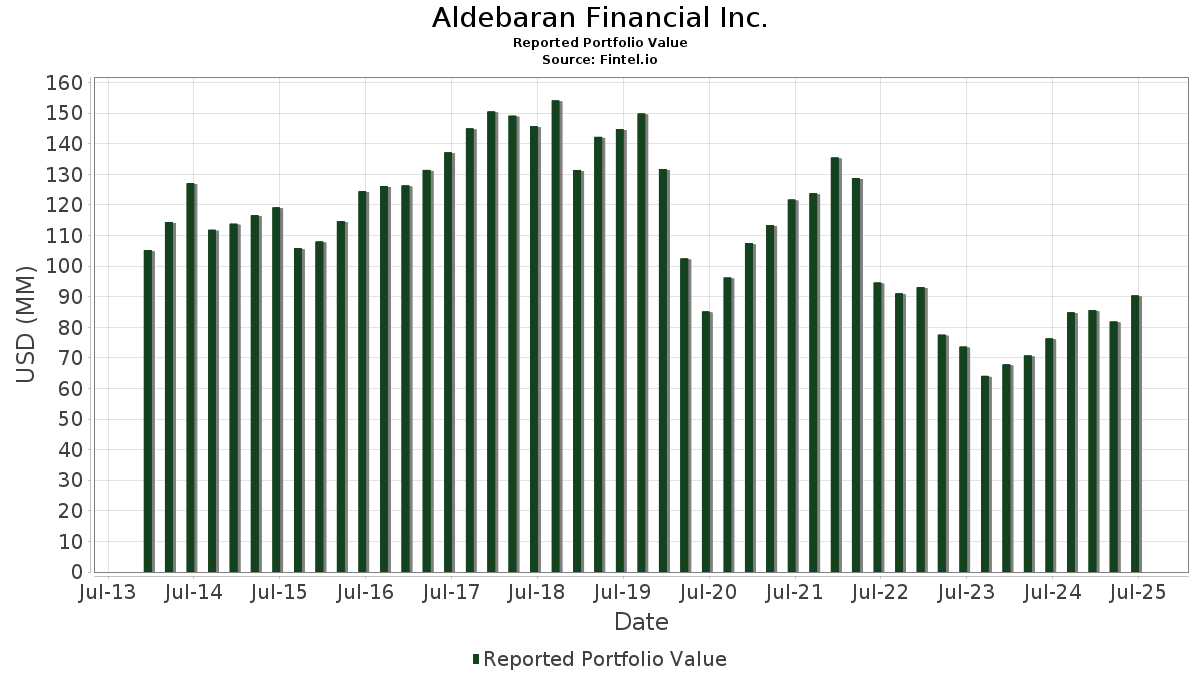

| Portfolio Value | $ 90,357,850 |

| Current Positions | 73 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Aldebaran Financial Inc. has disclosed 73 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 90,357,850 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Aldebaran Financial Inc.’s top holdings are Fortinet, Inc. (US:FTNT) , Berkshire Hathaway Inc. (US:BRK.B) , SPDR Series Trust - SPDR Portfolio S&P 1500 Composite Stock Market ETF (US:SPTM) , Apple Inc. (US:AAPL) , and SPDR S&P 500 ETF (US:SPY) . Aldebaran Financial Inc.’s new positions include Strategy Inc (US:MSTR) , Palantir Technologies Inc. (US:PLTR) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 3.56 | 3.9369 | 1.0728 | |

| 0.01 | 4.17 | 4.6192 | 0.8555 | |

| 0.00 | 1.92 | 2.1301 | 0.5100 | |

| 0.00 | 2.44 | 2.6957 | 0.4897 | |

| 0.07 | 5.47 | 6.0515 | 0.3484 | |

| 0.01 | 4.72 | 5.2227 | 0.3416 | |

| 0.00 | 0.31 | 0.3409 | 0.3409 | |

| 0.01 | 3.33 | 3.6888 | 0.3382 | |

| 0.00 | 0.29 | 0.3221 | 0.3221 | |

| 0.00 | 1.47 | 1.6245 | 0.3150 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 7.55 | 8.3594 | -1.7929 | |

| 0.02 | 5.07 | 5.6067 | -0.9630 | |

| 0.01 | 1.99 | 2.1977 | -0.3972 | |

| 0.00 | 0.31 | 0.3377 | -0.2883 | |

| 0.01 | 2.53 | 2.8018 | -0.2818 | |

| 0.01 | 0.87 | 0.9587 | -0.2361 | |

| 0.01 | 0.59 | 0.6517 | -0.1733 | |

| 0.00 | 0.84 | 0.9295 | -0.1637 | |

| 0.00 | 0.34 | 0.3805 | -0.1541 | |

| 0.00 | 0.57 | 0.6276 | -0.1521 |

13F and Fund Filings

This form was filed on 2025-08-14 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| FTNT / Fortinet, Inc. | 0.07 | 0.76 | 7.72 | 10.68 | 8.5460 | 0.0187 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.02 | -0.31 | 7.55 | -9.08 | 8.3594 | -1.7929 | |||

| SPTM / SPDR Series Trust - SPDR Portfolio S&P 1500 Composite Stock Market ETF | 0.07 | 6.41 | 5.47 | 17.19 | 6.0515 | 0.3484 | |||

| AAPL / Apple Inc. | 0.02 | 2.03 | 5.07 | -5.75 | 5.6067 | -0.9630 | |||

| SPY / SPDR S&P 500 ETF | 0.01 | 6.97 | 4.72 | 18.15 | 5.2227 | 0.3416 | |||

| MSFT / Microsoft Corporation | 0.01 | 2.28 | 4.17 | 35.53 | 4.6192 | 0.8555 | |||

| NVDA / NVIDIA Corporation | 0.02 | 4.13 | 3.56 | 51.81 | 3.9369 | 1.0728 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | 2.86 | 3.33 | 21.60 | 3.6888 | 0.3382 | |||

| SPLG / SPDR Series Trust - SPDR Portfolio S&P 500 ETF | 0.04 | 2.04 | 3.27 | 12.81 | 3.6169 | 0.0761 | |||

| WM / Waste Management, Inc. | 0.01 | 1.51 | 2.53 | 0.32 | 2.8018 | -0.2818 | |||

| META / Meta Platforms, Inc. | 0.00 | 5.36 | 2.44 | 34.90 | 2.6957 | 0.4897 | |||

| WMT / Walmart Inc. | 0.02 | 2.82 | 2.30 | 14.52 | 2.5493 | 0.0912 | |||

| PG / The Procter & Gamble Company | 0.01 | 0.04 | 1.99 | -6.50 | 2.1977 | -0.3972 | |||

| GOOG / Alphabet Inc. | 0.01 | 7.17 | 1.98 | 21.68 | 2.1931 | 0.2030 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 23.42 | 1.92 | 45.21 | 2.1301 | 0.5100 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.00 | -5.17 | 1.47 | 36.97 | 1.6245 | 0.3150 | |||

| LNG / Cheniere Energy, Inc. | 0.01 | -0.59 | 1.40 | 4.65 | 1.5453 | -0.0858 | |||

| DIS / The Walt Disney Company | 0.01 | -1.01 | 1.28 | 24.44 | 1.4204 | 0.1593 | |||

| CRM / Salesforce, Inc. | 0.00 | 0.02 | 1.14 | 1.61 | 1.2602 | -0.1092 | |||

| LLY / Eli Lilly and Company | 0.00 | 15.26 | 1.12 | 8.70 | 1.2449 | -0.0188 | |||

| NSC / Norfolk Southern Corporation | 0.00 | 0.00 | 1.07 | 8.00 | 1.1806 | -0.0257 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | 1.04 | 0.94 | 11.73 | 1.0437 | 0.0122 | |||

| QQQM / Invesco Exchange-Traded Fund Trust II - Invesco NASDAQ 100 ETF | 0.00 | 1.49 | 0.90 | 19.33 | 0.9913 | 0.0746 | |||

| JNJ / Johnson & Johnson | 0.01 | -3.80 | 0.87 | -11.36 | 0.9587 | -0.2361 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | -1.30 | 0.84 | -6.15 | 0.9295 | -0.1637 | |||

| KO / The Coca-Cola Company | 0.01 | 0.13 | 0.81 | -1.10 | 0.8942 | -0.1040 | |||

| HD / The Home Depot, Inc. | 0.00 | -0.24 | 0.77 | -0.26 | 0.8539 | -0.0908 | |||

| SPMD / SPDR Series Trust - SPDR Portfolio S&P 400 Mid Cap ETF | 0.01 | -0.36 | 0.75 | 5.81 | 0.8278 | -0.0356 | |||

| SPSM / SPDR Series Trust - SPDR Portfolio S&P 600 Small Cap ETF | 0.02 | -0.81 | 0.73 | 3.70 | 0.8069 | -0.0526 | |||

| XSMO / Invesco Exchange-Traded Fund Trust - Invesco S&P SmallCap Momentum ETF | 0.01 | -1.70 | 0.73 | 6.45 | 0.8044 | -0.0292 | |||

| BND / Vanguard Bond Index Funds - Vanguard Total Bond Market ETF | 0.01 | 29.53 | 0.67 | 29.90 | 0.7413 | 0.1109 | |||

| COHR / Coherent Corp. | 0.01 | -1.32 | 0.67 | 35.44 | 0.7366 | 0.1366 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.00 | 0.02 | 0.64 | 3.38 | 0.7126 | -0.0485 | |||

| MCD / McDonald's Corporation | 0.00 | 0.09 | 0.64 | -6.31 | 0.7067 | -0.1266 | |||

| UNP / Union Pacific Corporation | 0.00 | 0.00 | 0.63 | -2.63 | 0.6976 | -0.0934 | |||

| XOM / Exxon Mobil Corporation | 0.01 | 0.77 | 0.62 | -8.69 | 0.6864 | -0.1435 | |||

| FHN / First Horizon Corporation | 0.03 | 0.08 | 0.60 | 9.11 | 0.6640 | -0.0071 | |||

| EMN / Eastman Chemical Company | 0.01 | 2.95 | 0.59 | -12.89 | 0.6517 | -0.1733 | |||

| VZ / Verizon Communications Inc. | 0.01 | 0.00 | 0.59 | -4.71 | 0.6504 | -0.1025 | |||

| SCHD / Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF | 0.02 | 0.00 | 0.57 | -5.16 | 0.6313 | -0.1042 | |||

| ABBV / AbbVie Inc. | 0.00 | 0.33 | 0.57 | -10.99 | 0.6276 | -0.1521 | |||

| MPC / Marathon Petroleum Corporation | 0.00 | 0.00 | 0.52 | 14.07 | 0.5750 | 0.0181 | |||

| DLR / Digital Realty Trust, Inc. | 0.00 | -1.65 | 0.52 | 19.63 | 0.5738 | 0.0442 | |||

| NOC / Northrop Grumman Corporation | 0.00 | 20.78 | 0.51 | 17.87 | 0.5627 | 0.0359 | |||

| PHM / PulteGroup, Inc. | 0.00 | -4.08 | 0.50 | -1.59 | 0.5486 | -0.0670 | |||

| SOFI / SoFi Technologies, Inc. | 0.03 | -20.24 | 0.46 | 25.07 | 0.5084 | 0.0589 | |||

| DUK / Duke Energy Corporation | 0.00 | 0.00 | 0.42 | -3.25 | 0.4616 | -0.0653 | |||

| ECL / Ecolab Inc. | 0.00 | 0.00 | 0.39 | 6.54 | 0.4328 | -0.0168 | |||

| ET / Energy Transfer LP - Limited Partnership | 0.02 | 0.00 | 0.39 | -2.51 | 0.4299 | -0.0569 | |||

| TSLA / Tesla, Inc. | 0.00 | 4.92 | 0.37 | 28.28 | 0.4127 | 0.0583 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.00 | 0.37 | 14.15 | 0.4111 | 0.0128 | |||

| VYMI / Vanguard Whitehall Funds - Vanguard International High Dividend Yield ETF | 0.00 | 0.00 | 0.37 | 8.53 | 0.4091 | -0.0064 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.00 | 0.35 | 0.36 | 23.13 | 0.4010 | 0.0412 | |||

| TFC / Truist Financial Corporation | 0.01 | 6.48 | 0.35 | 11.04 | 0.3907 | 0.0029 | |||

| SBUX / Starbucks Corporation | 0.00 | -15.87 | 0.34 | -21.51 | 0.3805 | -0.1541 | |||

| RF / Regions Financial Corporation | 0.01 | 0.11 | 0.34 | 8.28 | 0.3766 | -0.0072 | |||

| USHY / iShares Trust - iShares Broad USD High Yield Corporate Bond ETF | 0.01 | 0.00 | 0.32 | 1.92 | 0.3529 | -0.0295 | |||

| DIA / SPDR Dow Jones Industrial Average ETF Trust | 0.00 | 2.18 | 0.31 | 7.29 | 0.3428 | -0.0102 | |||

| MSTR / Strategy Inc | 0.00 | 0.31 | 0.3409 | 0.3409 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | 0.00 | 0.31 | -40.43 | 0.3377 | -0.2883 | |||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.00 | 0.00 | 0.29 | 17.60 | 0.3261 | 0.0199 | |||

| PLTR / Palantir Technologies Inc. | 0.00 | 0.29 | 0.3221 | 0.3221 | |||||

| CNC / Centene Corporation | 0.01 | 0.00 | 0.28 | -10.58 | 0.3088 | -0.0726 | |||

| KR / The Kroger Co. | 0.00 | -1.03 | 0.28 | 4.96 | 0.3052 | -0.0161 | |||

| ELV / Elevance Health, Inc. | 0.00 | 0.15 | 0.27 | -10.44 | 0.2949 | -0.0688 | |||

| TJX / The TJX Companies, Inc. | 0.00 | 0.28 | 0.26 | 1.95 | 0.2903 | -0.0250 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.00 | 0.25 | 17.59 | 0.2818 | 0.0174 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.00 | 0.25 | 4.56 | 0.2794 | -0.0154 | |||

| FDX / FedEx Corporation | 0.00 | 0.00 | 0.25 | -6.72 | 0.2767 | -0.0510 | |||

| SLV / iShares Silver Trust | 0.01 | -0.35 | 0.23 | 5.45 | 0.2578 | -0.0120 | |||

| SO / The Southern Company | 0.00 | 0.00 | 0.22 | -0.44 | 0.2490 | -0.0263 | |||

| TOWN / TowneBank | 0.01 | 0.00 | 0.21 | 0.00 | 0.2270 | -0.0237 | |||

| T / AT&T Inc. | 0.01 | 0.20 | 0.2240 | 0.2240 |