Basic Stats

| Portfolio Value | $ 22,568,626 |

| Current Positions | 6 |

Latest Holdings, Performance, AUM (from 13F, 13D)

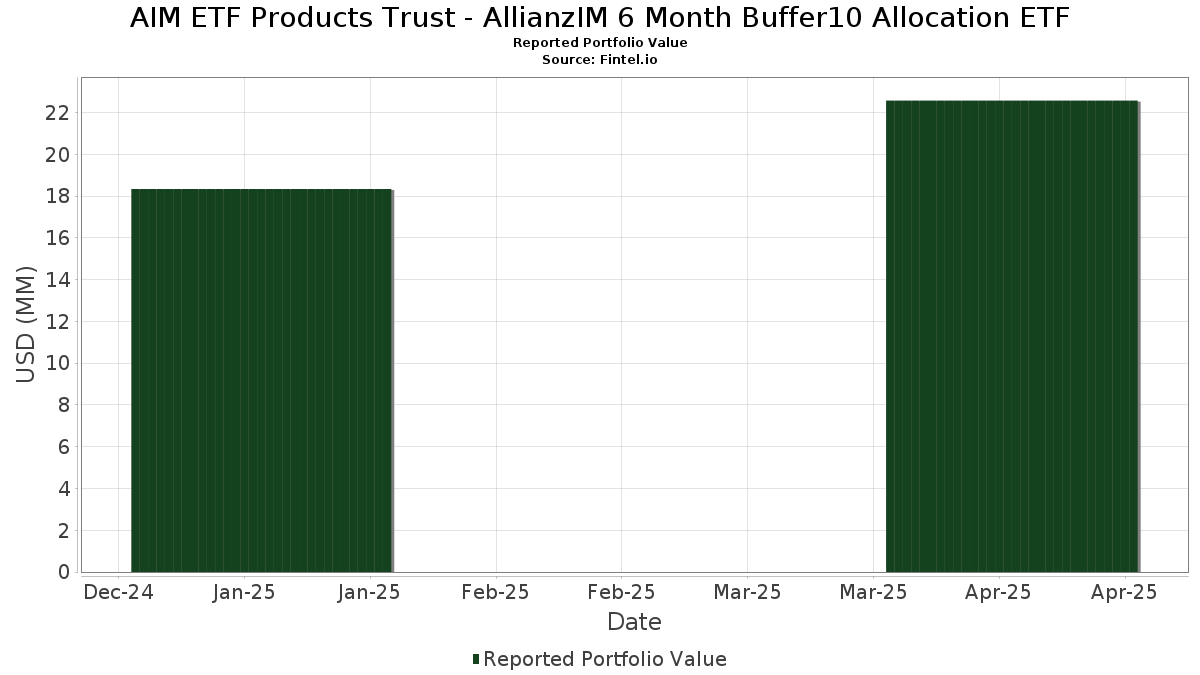

AIM ETF Products Trust - AllianzIM 6 Month Buffer10 Allocation ETF has disclosed 6 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 22,568,626 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). AIM ETF Products Trust - AllianzIM 6 Month Buffer10 Allocation ETF’s top holdings are AIM ETF Products Trust - AllianzIM U.S. Large Cap 6 Month Buffer10 Jun/Dec ETF (US:SIXD) , AIM ETF Products Trust - AllianzIM U.S. Large Cap 6 Month Buffer10 Feb/Aug ETF (US:SIXF) , AIM ETF Products Trust - AllianzIM U.S. Large Cap 6 Month Buffer10 Mar/Sep ETF (US:SIXP) , AIM ETF Products Trust - AllianzIM U.S. Large Cap 6 Month Buffer10 Jan/Jul ETF (US:SIXJ) , and AIM ETF Products Trust - AllianzIM U.S. Large Cap 6 Month Buffer10 May/Nov ETF (US:SIXZ) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.14 | 3.79 | 16.7958 | 0.1412 | |

| 0.14 | 3.77 | 16.7108 | 0.0609 | |

| 0.13 | 3.77 | 16.6741 | 0.0559 | |

| 0.14 | 3.78 | 16.7441 | 0.0195 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.12 | 3.72 | 16.4847 | -0.1382 | |

| 0.14 | 3.73 | 16.5317 | -0.1164 |

13F and Fund Filings

This form was filed on 2025-06-25 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SIXD / AIM ETF Products Trust - AllianzIM U.S. Large Cap 6 Month Buffer10 Jun/Dec ETF | 0.14 | 27.63 | 3.79 | 24.08 | 16.7958 | 0.1412 | |||

| SIXF / AIM ETF Products Trust - AllianzIM U.S. Large Cap 6 Month Buffer10 Feb/Aug ETF | 0.14 | 27.50 | 3.78 | 23.20 | 16.7441 | 0.0195 | |||

| SIXP / AIM ETF Products Trust - AllianzIM U.S. Large Cap 6 Month Buffer10 Mar/Sep ETF | 0.14 | 27.58 | 3.77 | 23.50 | 16.7108 | 0.0609 | |||

| SIXJ / AIM ETF Products Trust - AllianzIM U.S. Large Cap 6 Month Buffer10 Jan/Jul ETF | 0.13 | 27.66 | 3.77 | 23.48 | 16.6741 | 0.0559 | |||

| SIXZ / AIM ETF Products Trust - AllianzIM U.S. Large Cap 6 Month Buffer10 May/Nov ETF | 0.14 | 27.60 | 3.73 | 22.19 | 16.5317 | -0.1164 | |||

| SIXO / AIM ETF Products Trust - AllianzIM U.S. Large Cap 6 Month Buffer10 Apr/Oct ETF | 0.12 | 27.66 | 3.72 | 22.03 | 16.4847 | -0.1382 |