Basic Stats

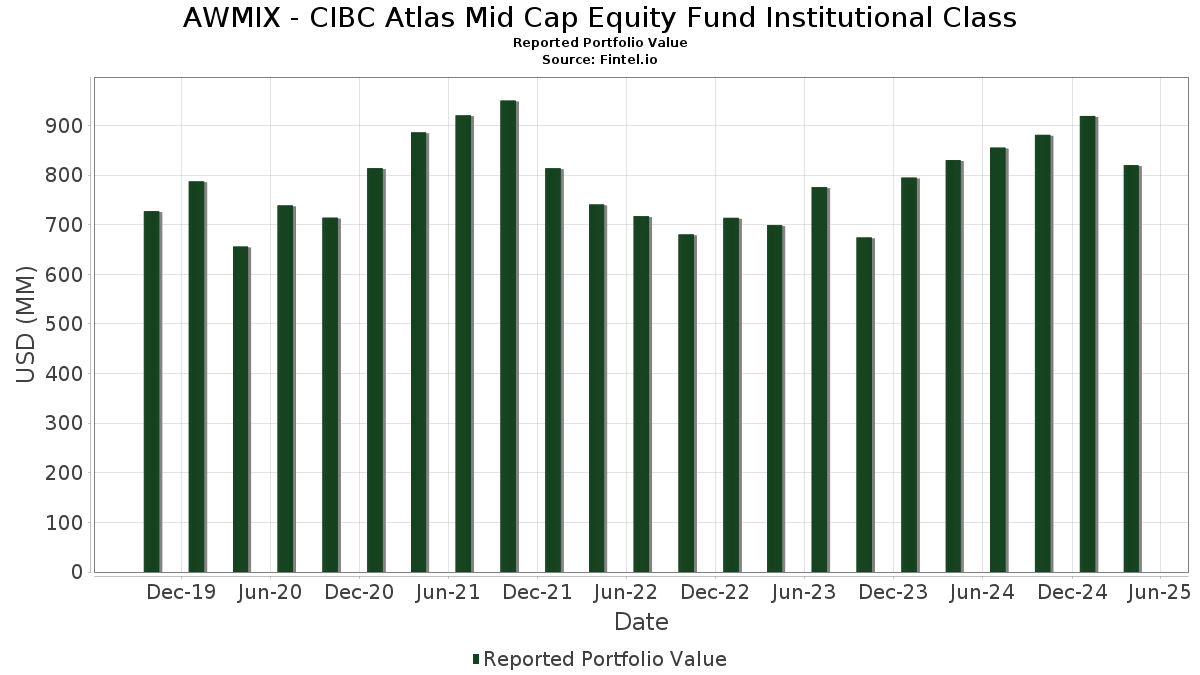

| Portfolio Value | $ 820,256,924 |

| Current Positions | 75 |

Latest Holdings, Performance, AUM (from 13F, 13D)

AWMIX - CIBC Atlas Mid Cap Equity Fund Institutional Class has disclosed 75 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 820,256,924 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). AWMIX - CIBC Atlas Mid Cap Equity Fund Institutional Class’s top holdings are Howmet Aerospace Inc. (US:HWM) , Ameriprise Financial, Inc. (US:AMP) , Cencora, Inc. (US:COR) , HubSpot, Inc. (US:HUBS) , and AutoZone, Inc. (US:AZO) . AWMIX - CIBC Atlas Mid Cap Equity Fund Institutional Class’s new positions include First American Funds Inc - First American Government Obligations Fund Class X (US:FGXXX) , Amcor plc (US:AMCR) , Cloudflare, Inc. (US:NET) , HealthEquity, Inc. (US:HQY) , and Skechers U.S.A., Inc. (US:SKX) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.82 | 7.57 | 0.9230 | 0.9230 | |

| 0.23 | 13.62 | 1.6619 | 0.7033 | |

| 0.09 | 25.25 | 3.0796 | 0.6948 | |

| 0.20 | 27.98 | 3.4125 | 0.6336 | |

| 0.04 | 5.02 | 0.6127 | 0.6127 | |

| 0.01 | 21.94 | 2.6762 | 0.5520 | |

| 0.04 | 12.90 | 1.5735 | 0.5431 | |

| 0.14 | 20.02 | 2.4426 | 0.4852 | |

| 0.02 | 10.20 | 1.2447 | 0.4704 | |

| 0.04 | 3.81 | 0.4651 | 0.4651 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.13 | 6.85 | 0.8355 | -1.5622 | |

| 0.09 | 14.46 | 1.7644 | -0.9858 | |

| 0.14 | 8.04 | 0.9813 | -0.7103 | |

| 0.17 | 16.96 | 2.0688 | -0.5076 | |

| 0.22 | 5.55 | 0.6767 | -0.5022 | |

| 0.02 | 4.93 | 0.6018 | -0.4541 | |

| 0.00 | 0.00 | -0.4512 | ||

| 0.04 | 22.41 | 2.7340 | -0.3732 | |

| 0.04 | 4.23 | 0.5164 | -0.3701 | |

| 0.08 | 4.86 | 0.5924 | -0.3610 |

13F and Fund Filings

This form was filed on 2025-06-26 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| HWM / Howmet Aerospace Inc. | 0.20 | -0.22 | 27.98 | 9.24 | 3.4125 | 0.6336 | |||

| AMP / Ameriprise Financial, Inc. | 0.06 | -0.21 | 25.92 | -13.50 | 3.1613 | -0.0899 | |||

| COR / Cencora, Inc. | 0.09 | -0.22 | 25.25 | 14.88 | 3.0796 | 0.6948 | |||

| HUBS / HubSpot, Inc. | 0.04 | -0.22 | 22.41 | -21.73 | 2.7340 | -0.3732 | |||

| AZO / AutoZone, Inc. | 0.01 | -0.21 | 21.94 | 12.08 | 2.6762 | 0.5520 | |||

| SFM / Sprouts Farmers Market, Inc. | 0.12 | -15.82 | 21.33 | -9.09 | 2.6023 | 0.0559 | |||

| LNG / Cheniere Energy, Inc. | 0.09 | -0.22 | 20.75 | 3.11 | 2.5313 | 0.3474 | |||

| APH / Amphenol Corporation | 0.26 | -0.22 | 20.15 | 8.48 | 2.4581 | 0.4423 | |||

| ROST / Ross Stores, Inc. | 0.14 | 20.25 | 20.02 | 11.02 | 2.4426 | 0.4852 | |||

| TW / Tradeweb Markets Inc. | 0.14 | -0.22 | 19.79 | 8.74 | 2.4139 | 0.4392 | |||

| VEEV / Veeva Systems Inc. | 0.08 | -0.22 | 18.80 | -0.04 | 2.2932 | 0.2525 | |||

| CDNS / Cadence Design Systems, Inc. | 0.06 | -13.62 | 17.47 | -13.59 | 2.1305 | -0.0628 | |||

| FLT / Corpay, Inc. | 0.05 | -0.22 | 17.09 | -14.67 | 2.0844 | -0.0887 | |||

| DDOG / Datadog, Inc. | 0.17 | -0.22 | 16.96 | -28.57 | 2.0688 | -0.5076 | |||

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 16.54 | -20.66 | 2.0172 | -0.2444 | |||||

| ALNY / Alnylam Pharmaceuticals, Inc. | 0.06 | -0.22 | 16.16 | -3.19 | 1.9717 | 0.1599 | |||

| MNDY / monday.com Ltd. | 0.06 | 0.67 | 16.10 | 10.73 | 1.9635 | 0.3861 | |||

| WCN / Waste Connections, Inc. | 0.08 | -0.22 | 15.77 | 7.31 | 1.9239 | 0.3289 | |||

| TSCO / Tractor Supply Company | 0.29 | -1.70 | 14.67 | -8.46 | 1.7896 | 0.0504 | |||

| ARES / Ares Management Corporation | 0.09 | -25.83 | 14.46 | -42.93 | 1.7644 | -0.9858 | |||

| CPRT / Copart, Inc. | 0.23 | -0.22 | 14.15 | 5.12 | 1.7258 | 0.2653 | |||

| CYBR / CyberArk Software Ltd. | 0.04 | 0.25 | 13.67 | -4.84 | 1.6678 | 0.1087 | |||

| MNST / Monster Beverage Corporation | 0.23 | 24.96 | 13.62 | 54.22 | 1.6619 | 0.7033 | |||

| USFD / US Foods Holding Corp. | 0.20 | -0.22 | 13.33 | -7.63 | 1.6263 | 0.0600 | |||

| ZS / Zscaler, Inc. | 0.06 | -0.23 | 13.25 | 11.39 | 1.6167 | 0.3255 | |||

| AJG / Arthur J. Gallagher & Co. | 0.04 | 27.85 | 12.90 | 35.85 | 1.5735 | 0.5431 | |||

| MAR / Marriott International, Inc. | 0.05 | -0.22 | 12.81 | -18.07 | 1.5619 | -0.1342 | |||

| ROP / Roper Technologies, Inc. | 0.02 | -0.22 | 12.27 | -2.92 | 1.4971 | 0.1252 | |||

| AME / AMETEK, Inc. | 0.07 | -0.22 | 11.88 | -8.32 | 1.4494 | 0.0430 | |||

| HUBB / Hubbell Incorporated | 0.03 | -0.22 | 11.65 | -14.33 | 1.4210 | -0.0547 | |||

| DXCM / DexCom, Inc. | 0.16 | 29.14 | 11.30 | 6.16 | 1.3783 | 0.2233 | |||

| MPWR / Monolithic Power Systems, Inc. | 0.02 | -0.23 | 11.12 | -7.16 | 1.3559 | 0.0567 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.21 | -0.22 | 10.45 | -13.61 | 1.2741 | -0.0379 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.02 | 39.50 | 10.20 | 43.01 | 1.2447 | 0.4704 | |||

| DKNG / DraftKings Inc. | 0.30 | -0.22 | 10.00 | -20.82 | 1.2198 | -0.1507 | |||

| CTAS / Cintas Corporation | 0.05 | -24.05 | 9.79 | -19.84 | 1.1946 | -0.1311 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.02 | -0.23 | 9.67 | 7.50 | 1.1789 | 0.2032 | |||

| TRU / TransUnion | 0.11 | -0.23 | 9.33 | -16.61 | 1.1375 | -0.0759 | |||

| MSCI / MSCI Inc. | 0.02 | -0.23 | 8.89 | -8.86 | 1.0838 | 0.0259 | |||

| KEYS / Keysight Technologies, Inc. | 0.06 | -0.23 | 8.83 | -18.66 | 1.0776 | -0.1010 | |||

| ENTG / Entegris, Inc. | 0.11 | -0.22 | 8.75 | -22.25 | 1.0675 | -0.1540 | |||

| LYV / Live Nation Entertainment, Inc. | 0.06 | 42.92 | 8.30 | 30.83 | 1.0120 | 0.3239 | |||

| DPZ / Domino's Pizza, Inc. | 0.02 | -0.23 | 8.19 | 8.93 | 0.9995 | 0.1832 | |||

| PKI / Revvity Inc. | 0.09 | -0.23 | 8.16 | -26.10 | 0.9953 | -0.2027 | |||

| MRVL / Marvell Technology, Inc. | 0.14 | -0.22 | 8.04 | -48.40 | 0.9813 | -0.7103 | |||

| ALGN / Align Technology, Inc. | 0.05 | -0.22 | 8.03 | -21.08 | 0.9791 | -0.1246 | |||

| VVV / Valvoline Inc. | 0.23 | 47.69 | 7.78 | 36.35 | 0.9496 | 0.3300 | |||

| IEX / IDEX Corporation | 0.04 | -0.23 | 7.71 | -22.62 | 0.9406 | -0.1407 | |||

| CW / Curtiss-Wright Corporation | 0.02 | 63.90 | 7.70 | 62.94 | 0.9398 | 0.4267 | |||

| AMCR / Amcor plc | 0.82 | 7.57 | 0.9230 | 0.9230 | |||||

| FANG / Diamondback Energy, Inc. | 0.06 | -0.23 | 7.39 | -19.87 | 0.9019 | -0.0993 | |||

| ULTA / Ulta Beauty, Inc. | 0.02 | -0.24 | 6.97 | -4.23 | 0.8503 | 0.0604 | |||

| TTD / The Trade Desk, Inc. | 0.13 | -31.40 | 6.85 | -69.00 | 0.8355 | -1.5622 | |||

| IR / Ingersoll Rand Inc. | 0.08 | -23.88 | 5.92 | -38.79 | 0.7221 | -0.3274 | |||

| CSGP / CoStar Group, Inc. | 0.08 | -0.24 | 5.81 | -3.39 | 0.7082 | 0.0560 | |||

| VRT / Vertiv Holdings Co | 0.07 | -19.40 | 5.59 | -41.19 | 0.6818 | -0.3496 | |||

| PINS / Pinterest, Inc. | 0.22 | -33.53 | 5.55 | -48.94 | 0.6767 | -0.5022 | |||

| WCC / WESCO International, Inc. | 0.03 | -0.24 | 5.52 | -12.12 | 0.6733 | -0.0083 | |||

| PCOR / Procore Technologies, Inc. | 0.08 | 1.06 | 5.36 | -18.59 | 0.6538 | -0.0606 | |||

| MDB / MongoDB, Inc. | 0.03 | 1.08 | 5.23 | -36.33 | 0.6384 | -0.2535 | |||

| US7587501039 / Regal-Beloit Corp. | 0.05 | -0.23 | 5.22 | -33.47 | 0.6362 | -0.2146 | |||

| ZWS / Zurn Elkay Water Solutions Corporation | 0.15 | -0.24 | 5.21 | -14.11 | 0.6357 | -0.0226 | |||

| NET / Cloudflare, Inc. | 0.04 | 5.02 | 0.6127 | 0.6127 | |||||

| PNR / Pentair plc | 0.05 | -0.24 | 4.98 | -12.70 | 0.6070 | -0.0115 | |||

| SAIA / Saia, Inc. | 0.02 | -0.23 | 4.93 | -49.30 | 0.6018 | -0.4541 | |||

| MAS / Masco Corporation | 0.08 | -27.70 | 4.86 | -44.72 | 0.5924 | -0.3610 | |||

| OSK / Oshkosh Corporation | 0.05 | -0.25 | 4.24 | -28.21 | 0.5177 | -0.1239 | |||

| PLNT / Planet Fitness, Inc. | 0.04 | -56.04 | 4.23 | -38.44 | 0.5164 | -0.3701 | |||

| FND / Floor & Decor Holdings, Inc. | 0.06 | -0.24 | 4.19 | -28.80 | 0.5109 | -0.1274 | |||

| HQY / HealthEquity, Inc. | 0.04 | 3.81 | 0.4651 | 0.4651 | |||||

| GEHC / GE HealthCare Technologies Inc. | 0.05 | -0.25 | 3.40 | -20.55 | 0.4147 | -0.0497 | |||

| BIO / Bio-Rad Laboratories, Inc. | 0.01 | -0.25 | 2.98 | -32.53 | 0.3630 | -0.1156 | |||

| GMED / Globus Medical, Inc. | 0.04 | -0.26 | 2.96 | -22.80 | 0.3606 | -0.0549 | |||

| SKX / Skechers U.S.A., Inc. | 0.06 | 2.78 | 0.3393 | 0.3393 | |||||

| GTLB / GitLab Inc. | 0.05 | 2.34 | 0.2854 | 0.2854 | |||||

| FMC / FMC Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.4512 | ||||

| ICLR / ICON Public Limited Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.3056 |