Basic Stats

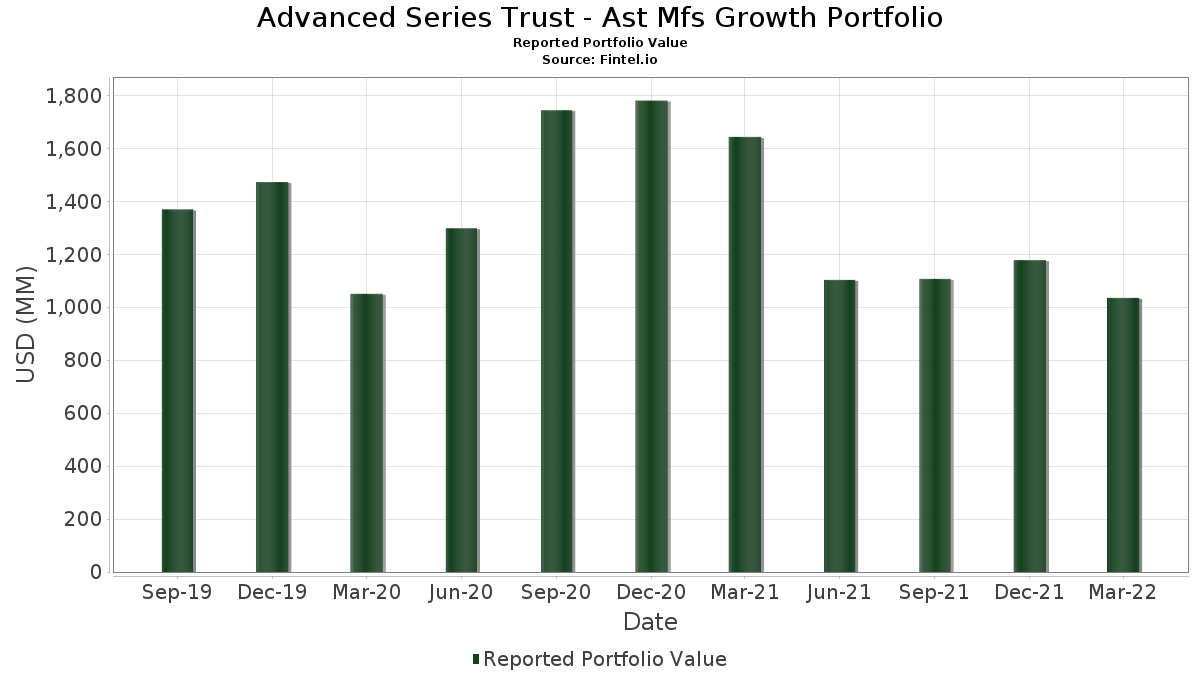

| Portfolio Value | $ 1,035,277,451 |

| Current Positions | 74 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Advanced Series Trust - Ast Mfs Growth Portfolio has disclosed 74 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,035,277,451 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Advanced Series Trust - Ast Mfs Growth Portfolio’s top holdings are Microsoft Corporation (US:MSFT) , Amazon.com, Inc. (US:AMZN) , Alphabet Inc. (US:GOOGL) , Apple Inc. (US:AAPL) , and Adobe Inc. (US:ADBE) . Advanced Series Trust - Ast Mfs Growth Portfolio’s new positions include Dreyfus Government Cash Management Funds - Dreyfus Government Cash Management Fund Institutional Shares (US:DGCXX) , American Express Company (US:AXP) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 45.01 | 44.97 | 4.5345 | 2.9009 | |

| 23.39 | 23.39 | 2.3581 | 2.3581 | |

| 0.05 | 11.30 | 1.1399 | 0.7797 | |

| 0.29 | 50.51 | 5.0933 | 0.7115 | |

| 0.04 | 13.25 | 1.3364 | 0.7059 | |

| 0.02 | 76.04 | 7.6675 | 0.6675 | |

| 0.02 | 59.08 | 5.9573 | 0.4190 | |

| 0.12 | 25.88 | 2.6098 | 0.4135 | |

| 0.09 | 7.40 | 0.7464 | 0.3752 | |

| 0.09 | 31.11 | 3.1367 | 0.3660 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.05 | 12.08 | 1.2176 | -1.6325 | |

| 0.06 | 7.43 | 0.7494 | -0.7788 | |

| 0.02 | 10.39 | 1.0474 | -0.5451 | |

| 0.05 | 23.31 | 2.3507 | -0.4560 | |

| 0.03 | 10.21 | 1.0294 | -0.4483 | |

| 0.07 | 33.97 | 3.4251 | -0.3798 | |

| 0.06 | 13.75 | 1.3866 | -0.3594 | |

| 0.00 | 0.83 | 0.0836 | -0.3577 | |

| 0.03 | 8.18 | 0.8251 | -0.3311 | |

| 0.04 | 8.34 | 0.8413 | -0.3201 |

13F and Fund Filings

This form was filed on 2022-05-25 for the reporting period 2022-03-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.37 | -3.98 | 113.99 | -11.97 | 11.4941 | 0.3027 | |||

| AMZN / Amazon.com, Inc. | 0.02 | -3.98 | 76.04 | -6.12 | 7.6675 | 0.6675 | |||

| GOOGL / Alphabet Inc. | 0.02 | -3.97 | 59.08 | -7.81 | 5.9573 | 0.4190 | |||

| AAPL / Apple Inc. | 0.29 | 1.31 | 50.51 | -0.37 | 5.0933 | 0.7115 | |||

| PGIM Institutional Money Market Fund - D / STIV (000000000) | 45.01 | 40,883.15 | 44.97 | 111.53 | 4.5345 | 2.9009 | |||

| ADBE / Adobe Inc. | 0.07 | -3.98 | 33.97 | -22.85 | 3.4251 | -0.3798 | |||

| NVDA / NVIDIA Corporation | 0.12 | -6.80 | 33.74 | -13.53 | 3.4017 | 0.0299 | |||

| MA / Mastercard Incorporated | 0.09 | -2.45 | 31.11 | -2.97 | 3.1367 | 0.3660 | |||

| V / Visa Inc. | 0.12 | -0.48 | 25.88 | 1.84 | 2.6098 | 0.4135 | |||

| DHR / Danaher Corporation | 0.08 | -3.98 | 23.56 | -14.39 | 2.3754 | -0.0027 | |||

| DGCXX / Dreyfus Government Cash Management Funds - Dreyfus Government Cash Management Fund Institutional Shares | 23.39 | 23.39 | 2.3581 | 2.3581 | |||||

| INTU / Intuit Inc. | 0.05 | -3.98 | 23.31 | -28.22 | 2.3507 | -0.4560 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.04 | 0.55 | 21.98 | -10.99 | 2.2166 | 0.0822 | |||

| GOOG / Alphabet Inc. | 0.01 | -3.96 | 18.21 | -7.30 | 1.8366 | 0.1385 | |||

| MSCI / MSCI Inc. | 0.03 | -3.98 | 16.83 | -21.19 | 1.6974 | -0.1485 | |||

| ABT / Abbott Laboratories | 0.14 | 1.81 | 16.12 | -14.38 | 1.6251 | -0.0017 | |||

| VRSK / Verisk Analytics, Inc. | 0.07 | -3.98 | 15.31 | -9.90 | 1.5439 | 0.0753 | |||

| VMC / Vulcan Materials Company | 0.08 | -3.98 | 14.59 | -15.03 | 1.4708 | -0.0127 | |||

| SCHW / The Charles Schwab Corporation | 0.17 | 6.23 | 14.43 | 6.49 | 1.4550 | 0.2840 | |||

| BSX / Boston Scientific Corporation | 0.32 | 3.39 | 14.04 | 7.79 | 1.4156 | 0.2900 | |||

| SHW / The Sherwin-Williams Company | 0.06 | -3.98 | 13.75 | -31.94 | 1.3866 | -0.3594 | |||

| EL / The Estée Lauder Companies Inc. | 0.05 | -3.98 | 13.34 | -29.37 | 1.3452 | -0.2871 | |||

| AON / Aon plc | 0.04 | 67.67 | 13.25 | 81.67 | 1.3364 | 0.7059 | |||

| ZTS / Zoetis Inc. | 0.07 | -3.98 | 12.49 | -25.80 | 1.2592 | -0.1951 | |||

| META / Meta Platforms, Inc. | 0.05 | -44.61 | 12.08 | -63.38 | 1.2176 | -1.6325 | |||

| CRM / Salesforce, Inc. | 0.06 | -3.98 | 11.83 | -19.78 | 1.1929 | -0.0815 | |||

| NOW / ServiceNow, Inc. | 0.02 | -3.98 | 11.72 | -17.62 | 1.1821 | -0.0477 | |||

| CME / CME Group Inc. | 0.05 | 160.52 | 11.30 | 171.27 | 1.1399 | 0.7797 | |||

| LBRDA / Liberty Broadband Corporation | 0.02 | 2.66 | 10.68 | -14.11 | 1.0765 | 0.0024 | |||

| LRCX / Lam Research Corporation | 0.02 | -24.59 | 10.39 | -43.63 | 1.0474 | -0.5451 | |||

| NFLX / Netflix, Inc. | 0.03 | -3.98 | 10.21 | -40.29 | 1.0294 | -0.4483 | |||

| ASMLF / ASML Holding N.V. | 0.01 | -3.98 | 9.92 | -19.44 | 1.0007 | -0.0640 | |||

| TRU / TransUnion | 0.09 | -3.98 | 9.24 | -16.32 | 0.9321 | -0.0226 | |||

| AME / AMETEK, Inc. | 0.07 | -3.98 | 9.04 | -13.03 | 0.9118 | 0.0133 | |||

| EW / Edwards Lifesciences Corporation | 0.08 | -3.98 | 9.03 | -12.75 | 0.9106 | 0.0161 | |||

| CL / Colgate-Palmolive Company | 0.12 | -3.98 | 8.83 | -14.67 | 0.8906 | -0.0040 | |||

| ADSK / Autodesk, Inc. | 0.04 | -18.56 | 8.34 | -37.91 | 0.8413 | -0.3201 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0.05 | 38.12 | 8.22 | 34.36 | 0.8285 | 0.3000 | |||

| ICLR / ICON Public Limited Company | 0.03 | -22.12 | 8.18 | -38.84 | 0.8251 | -0.3311 | |||

| CDNS / Cadence Design Systems, Inc. | 0.05 | -3.98 | 7.88 | -15.26 | 0.7942 | -0.0090 | |||

| EFX / Equifax Inc. | 0.03 | -3.98 | 7.86 | -22.25 | 0.7931 | -0.0811 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.03 | 12.83 | 7.76 | 34.09 | 0.7826 | 0.2824 | |||

| MTCH / Match Group, Inc. | 0.07 | -3.98 | 7.58 | -21.05 | 0.7648 | -0.0654 | |||

| PYPL / PayPal Holdings, Inc. | 0.06 | -31.47 | 7.43 | -57.97 | 0.7494 | -0.7788 | |||

| CP / Canadian Pacific Kansas City Limited | 0.09 | 50.22 | 7.40 | 72.36 | 0.7464 | 0.3752 | |||

| EA / Electronic Arts Inc. | 0.06 | -3.98 | 7.23 | -7.90 | 0.7286 | 0.0506 | |||

| NKE / NIKE, Inc. | 0.05 | -14.87 | 7.20 | -31.27 | 0.7261 | -0.1794 | |||

| CSGP / CoStar Group, Inc. | 0.10 | 3.30 | 6.79 | -12.92 | 0.6850 | 0.0107 | |||

| SNPS / Synopsys, Inc. | 0.02 | -3.98 | 6.22 | -13.15 | 0.6273 | 0.0082 | |||

| AMT / American Tower Corporation | 0.02 | -3.98 | 6.02 | -17.52 | 0.6074 | -0.0238 | |||

| ROP / Roper Technologies, Inc. | 0.01 | -3.98 | 5.86 | -7.81 | 0.5905 | 0.0415 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.00 | -3.96 | 5.56 | -13.09 | 0.5609 | 0.0077 | |||

| AMAT / Applied Materials, Inc. | 0.04 | -27.56 | 5.54 | -39.33 | 0.5586 | -0.2305 | |||

| JCI / Johnson Controls International plc | 0.08 | -3.98 | 5.29 | -22.57 | 0.5339 | -0.0570 | |||

| BDX / Becton, Dickinson and Company | 0.02 | 43.50 | 4.65 | 51.81 | 0.4692 | 0.2043 | |||

| TEAM / Atlassian Corporation | 0.02 | -3.98 | 4.60 | -26.01 | 0.4635 | -0.0734 | |||

| STE / STERIS plc | 0.02 | 8.95 | 4.57 | 8.22 | 0.4607 | 0.0958 | |||

| CLVT / Clarivate Plc | 0.24 | -3.98 | 4.08 | -31.58 | 0.4110 | -0.1038 | |||

| LULU / lululemon athletica inc. | 0.01 | -3.97 | 4.00 | -10.40 | 0.4033 | 0.0175 | |||

| UBER / Uber Technologies, Inc. | 0.11 | -3.98 | 3.88 | -18.29 | 0.3916 | -0.0192 | |||

| SQ / Block, Inc. | 0.03 | -41.70 | 3.73 | -51.06 | 0.3762 | -0.2826 | |||

| ATVI / Activision Blizzard Inc | 0.04 | -19.03 | 3.60 | -2.52 | 0.3635 | 0.0440 | |||

| AXP / American Express Company | 0.02 | 3.44 | 0.3466 | 0.3466 | |||||

| SBUX / Starbucks Corporation | 0.03 | 10.89 | 3.12 | -13.77 | 0.3151 | 0.0019 | |||

| MGM / MGM Resorts International | 0.07 | 14.79 | 2.94 | 7.27 | 0.2960 | 0.0595 | |||

| ROST / Ross Stores, Inc. | 0.03 | -3.98 | 2.87 | -23.99 | 0.2895 | -0.0369 | |||

| EQIX / Equinix, Inc. | 0.00 | -45.47 | 2.71 | -52.19 | 0.2735 | -0.2168 | |||

| DLTR / Dollar Tree, Inc. | 0.02 | 2.65 | 0.2675 | 0.2675 | |||||

| APD / Air Products and Chemicals, Inc. | 0.01 | 43.00 | 2.63 | 17.43 | 0.2651 | 0.0716 | |||

| BKI / Black Knight Inc - Class A | 0.03 | -3.97 | 1.85 | -32.80 | 0.1870 | -0.0516 | |||

| RBLX / Roblox Corporation | 0.04 | -3.98 | 1.82 | -56.97 | 0.1833 | -0.1817 | |||

| TTWO / Take-Two Interactive Software, Inc. | 0.01 | -25.78 | 1.75 | -35.82 | 0.1768 | -0.0592 | |||

| BMBL / Bumble Inc. | 0.04 | -3.98 | 1.03 | -17.84 | 0.1036 | -0.0044 | |||

| SHOP / Shopify Inc. | 0.00 | -66.93 | 0.83 | -83.78 | 0.0836 | -0.3577 | |||

| ABNB / Airbnb, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0227 |