Basic Stats

| Portfolio Value | $ 580,088,878 |

| Current Positions | 87 |

Latest Holdings, Performance, AUM (from 13F, 13D)

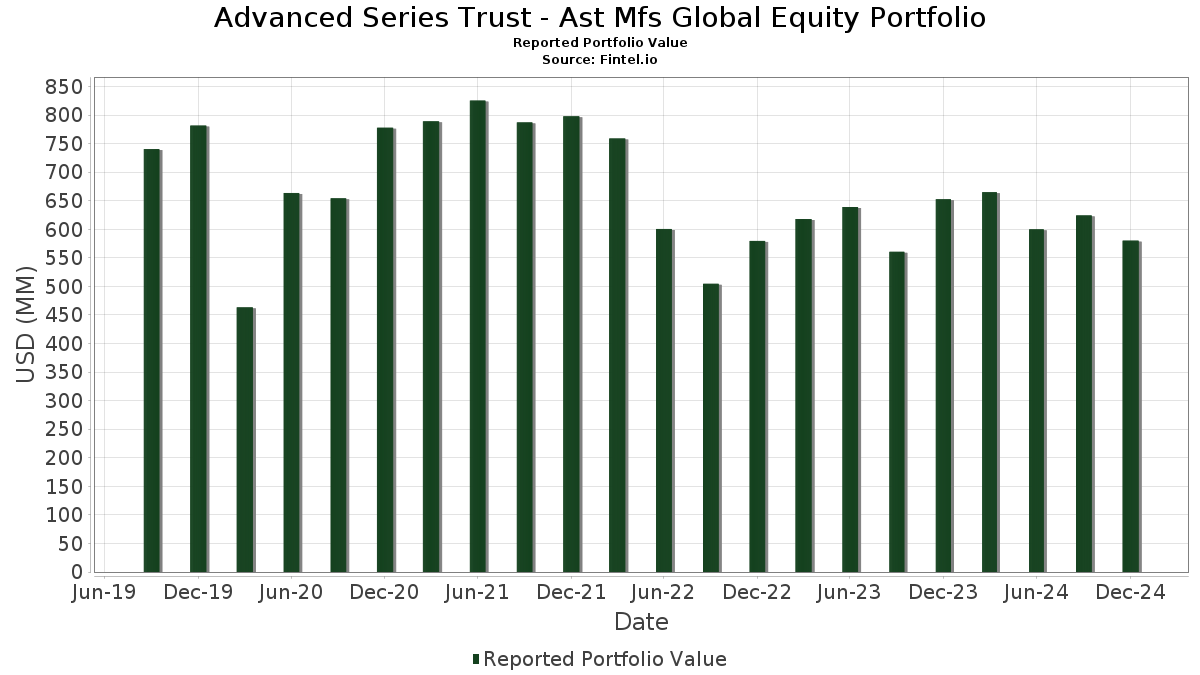

Advanced Series Trust - Ast Mfs Global Equity Portfolio has disclosed 87 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 580,088,878 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Advanced Series Trust - Ast Mfs Global Equity Portfolio’s top holdings are Visa Inc. (US:V) , Microsoft Corporation (US:MSFT) , Schneider Electric S.E. - Depositary Receipt (Common Stock) (US:SBGSY) , The Charles Schwab Corporation (US:SCHW) , and Alphabet Inc. (US:GOOGL) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 19.24 | 19.23 | 3.4196 | 3.4196 | |

| 0.04 | 14.94 | 2.6559 | 0.6873 | |

| 0.06 | 3.50 | 0.6227 | 0.6227 | |

| 3.45 | 0.6130 | 0.6130 | ||

| 0.06 | 18.76 | 3.3365 | 0.6068 | |

| 0.08 | 14.29 | 2.5411 | 0.4854 | |

| 0.19 | 14.34 | 2.5490 | 0.3182 | |

| 0.05 | 12.34 | 2.1943 | 0.3060 | |

| 0.82 | 5.66 | 1.0065 | 0.2822 | |

| 0.04 | 13.45 | 2.3912 | 0.2768 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.05 | 8.37 | 1.4886 | -0.4803 | |

| 0.02 | 12.10 | 2.1516 | -0.2542 | |

| 0.07 | 8.09 | 1.4386 | -0.2111 | |

| 0.40 | 5.93 | 1.0548 | -0.2081 | |

| 0.08 | 6.88 | 1.2233 | -0.2043 | |

| 0.17 | 5.51 | 0.9802 | -0.2030 | |

| 0.12 | 9.01 | 1.6018 | -0.1786 | |

| 0.06 | 9.12 | 1.6217 | -0.1742 | |

| 0.10 | 3.74 | 0.6642 | -0.1539 | |

| 0.13 | 5.57 | 0.9912 | -0.1510 |

13F and Fund Filings

This form was filed on 2025-02-27 for the reporting period 2024-12-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| PGIM Institutional Money Market Fund - D / STIV (000000000) | 19.24 | 19.23 | 3.4196 | 3.4196 | |||||

| V / Visa Inc. | 0.06 | -2.75 | 18.76 | 11.78 | 3.3365 | 0.6068 | |||

| MSFT / Microsoft Corporation | 0.04 | 25.96 | 14.94 | 23.39 | 2.6559 | 0.6873 | |||

| SBGSY / Schneider Electric S.E. - Depositary Receipt (Common Stock) | 0.06 | -2.75 | 14.55 | -8.15 | 2.5866 | 0.0110 | |||

| SCHW / The Charles Schwab Corporation | 0.19 | -8.49 | 14.34 | 4.51 | 2.5490 | 0.3182 | |||

| GOOGL / Alphabet Inc. | 0.08 | -0.95 | 14.29 | 13.05 | 2.5411 | 0.4854 | |||

| WTW / Willis Towers Watson Public Limited Company | 0.04 | -2.75 | 13.45 | 3.43 | 2.3912 | 0.2768 | |||

| MDT / Medtronic plc | 0.16 | -2.75 | 12.58 | -13.71 | 2.2368 | -0.1339 | |||

| HON / Honeywell International Inc. | 0.05 | -2.75 | 12.34 | 6.28 | 2.1943 | 0.3060 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.02 | -2.75 | 12.10 | -18.20 | 2.1516 | -0.2542 | |||

| MC / LVMH Moët Hennessy - Louis Vuitton, Société Européenne | 0.02 | 4.28 | 10.75 | -10.55 | 1.9111 | -0.0429 | |||

| BDX / Becton, Dickinson and Company | 0.05 | 5.84 | 10.67 | -0.40 | 1.8980 | 0.1550 | |||

| RHHBY / Roche Holding AG - Depositary Receipt (Common Stock) | 0.04 | -2.75 | 10.66 | -15.03 | 1.8953 | -0.1446 | |||

| CMCSA / Comcast Corporation | 0.28 | -2.75 | 10.64 | -12.62 | 1.8922 | -0.0882 | |||

| UBSG / UBS Group AG | 0.34 | -2.75 | 10.38 | -3.77 | 1.8453 | 0.0914 | |||

| LIN / Linde plc | 0.02 | -2.75 | 10.21 | -14.61 | 1.8161 | -0.1291 | |||

| AXP / American Express Company | 0.03 | -2.75 | 10.19 | 6.44 | 1.8114 | 0.2549 | |||

| CFRUY / Compagnie Financière Richemont SA - Depositary Receipt (Common Stock) | 0.07 | -2.64 | 9.88 | -7.26 | 1.7568 | 0.0245 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.30 | -2.75 | 9.55 | -11.52 | 1.6979 | -0.0572 | |||

| GS / The Goldman Sachs Group, Inc. | 0.02 | -14.24 | 9.17 | -0.81 | 1.6314 | 0.1272 | |||

| CAP / Capgemini SE | 0.06 | 9.17 | 9.12 | -17.41 | 1.6217 | -0.1742 | |||

| CP / Canadian Pacific Kansas City Limited | 0.12 | -2.75 | 9.01 | -17.72 | 1.6018 | -0.1786 | |||

| APD / Air Products and Chemicals, Inc. | 0.03 | -11.92 | 8.62 | -14.20 | 1.5329 | -0.1010 | |||

| AON / Aon plc | 0.02 | -2.75 | 8.40 | 0.96 | 1.4937 | 0.1405 | |||

| ORCL / Oracle Corporation | 0.05 | -29.29 | 8.37 | -30.85 | 1.4886 | -0.4803 | |||

| NSRGY / Nestlé S.A. - Depositary Receipt (Common Stock) | 0.10 | 2.91 | 8.29 | -15.99 | 1.4734 | -0.1305 | |||

| MRK / Marks Electrical Group PLC | 0.06 | 0.59 | 8.09 | -17.09 | 1.4387 | -0.1481 | |||

| PRNDY / Pernod Ricard SA - Depositary Receipt (Common Stock) | 0.07 | 6.79 | 8.09 | -20.24 | 1.4386 | -0.2111 | |||

| AMADY / Amadeus IT Group, S.A. - Depositary Receipt (Common Stock) | 0.11 | -2.75 | 7.74 | -5.21 | 1.3763 | 0.0483 | |||

| CHKP / Check Point Software Technologies Ltd. | 0.04 | -7.68 | 7.71 | -10.61 | 1.3710 | -0.0316 | |||

| ACN / Accenture plc | 0.02 | -2.75 | 7.55 | -3.22 | 1.3420 | 0.0739 | |||

| FI / Fiserv, Inc. | 0.04 | -7.58 | 7.46 | 5.68 | 1.3270 | 0.1786 | |||

| HEINY / Heineken N.V. - Depositary Receipt (Common Stock) | 0.10 | 2.86 | 7.41 | -17.43 | 1.3177 | -0.1417 | |||

| CNI / Canadian National Railway Company | 0.07 | 1.06 | 7.28 | -12.42 | 1.2947 | -0.0575 | |||

| LGRDY / Legrand SA - Depositary Receipt (Common Stock) | 0.07 | 4.56 | 7.15 | -11.72 | 1.2721 | -0.0457 | |||

| IFF / International Flavors & Fragrances Inc. | 0.08 | -2.75 | 6.88 | -21.63 | 1.2233 | -0.2043 | |||

| DIS / The Walt Disney Company | 0.06 | -2.75 | 6.65 | 12.58 | 1.1822 | 0.2218 | |||

| UNP / Union Pacific Corporation | 0.03 | -2.75 | 6.51 | -10.01 | 1.1571 | -0.0190 | |||

| TRU / TransUnion | 0.07 | -2.75 | 6.18 | -13.88 | 1.0986 | -0.0681 | |||

| WAT / Waters Corporation | 0.02 | -19.33 | 6.15 | -16.84 | 1.0933 | -0.1091 | |||

| BSX / Boston Scientific Corporation | 0.07 | -9.21 | 5.98 | -3.24 | 1.0636 | 0.0584 | |||

| OLY1 / Olympus Corporation | 0.40 | -2.74 | 5.93 | -23.62 | 1.0548 | -0.2081 | |||

| ABT / Abbott Laboratories | 0.05 | -2.75 | 5.67 | -3.51 | 1.0085 | 0.0526 | |||

| FIS / Fidelity National Information Services, Inc. | 0.07 | -2.75 | 5.66 | -6.21 | 1.0069 | 0.0251 | |||

| LSEG / London Stock Exchange Group plc | 0.04 | -2.74 | 5.66 | 0.27 | 1.0067 | 0.0885 | |||

| MLSPF / Melrose Industries PLC | 0.82 | 12.41 | 5.66 | 27.11 | 1.0065 | 0.2822 | |||

| CRM / Salesforce, Inc. | 0.02 | -8.33 | 5.66 | 11.97 | 1.0063 | 0.1844 | |||

| EXPGY / Experian plc - Depositary Receipt (Common Stock) | 0.13 | -2.75 | 5.57 | -20.63 | 0.9912 | -0.1510 | |||

| CLNX / Cellnex Telecom, S.A. | 0.17 | -2.75 | 5.51 | -24.23 | 0.9802 | -0.2030 | |||

| RKT / Reckitt Benckiser Group plc | 0.09 | -2.75 | 5.33 | -3.79 | 0.9475 | 0.0469 | |||

| RYCEY / Rolls-Royce Holdings plc - Depositary Receipt (Common Stock) | 0.73 | -9.02 | 5.17 | -8.84 | 0.9186 | -0.0030 | |||

| AENA / Aena S.M.E., S.A. | 0.03 | -2.75 | 5.10 | -9.65 | 0.9073 | -0.0110 | |||

| AIQUY / L'Air Liquide S.A. - Depositary Receipt (Common Stock) | 0.03 | -2.75 | 5.07 | -18.13 | 0.9007 | -0.1055 | |||

| MAR / Marriott International, Inc. | 0.02 | -2.75 | 4.81 | 9.10 | 0.8548 | 0.1384 | |||

| COO / The Cooper Companies, Inc. | 0.05 | -2.75 | 4.73 | -18.98 | 0.8412 | -0.1083 | |||

| PPG / PPG Industries, Inc. | 0.04 | -2.75 | 4.36 | -12.30 | 0.7759 | -0.0332 | |||

| EBKDY / Erste Group Bank AG - Depositary Receipt (Common Stock) | 0.07 | -2.75 | 4.21 | 9.87 | 0.7483 | 0.1253 | |||

| STE / STERIS plc | 0.02 | -2.75 | 4.14 | -17.57 | 0.7366 | -0.0807 | |||

| CBGB / Carlsberg A/S | 0.04 | 5.58 | 4.06 | -14.85 | 0.7228 | -0.0534 | |||

| KUBTF / Kubota Corporation | 0.34 | -2.74 | 3.98 | -21.10 | 0.7082 | -0.1126 | |||

| APH / Amphenol Corporation | 0.06 | -2.75 | 3.94 | 3.65 | 0.7014 | 0.0826 | |||

| CPG N / Compass Group PLC | 0.12 | -2.75 | 3.87 | 0.91 | 0.6876 | 0.0646 | |||

| EBAY / eBay Inc. | 0.06 | -2.75 | 3.86 | -7.46 | 0.6861 | 0.0080 | |||

| MTUAY / MTU Aero Engines AG - Depositary Receipt (Common Stock) | 0.01 | -2.74 | 3.85 | 3.94 | 0.6847 | 0.0822 | |||

| IKTSF / Intertek Group plc | 0.06 | 3.97 | 3.81 | -11.16 | 0.6781 | -0.0199 | |||

| 005930 / Samsung Electronics Co., Ltd. | 0.10 | -2.75 | 3.74 | -25.75 | 0.6642 | -0.1539 | |||

| DB1 / Deutsche Börse AG | 0.02 | -2.75 | 3.72 | -4.59 | 0.6623 | 0.0275 | |||

| AKZOY / Akzo Nobel N.V. - Depositary Receipt (Common Stock) | 0.06 | -1.88 | 3.51 | -16.64 | 0.6246 | -0.0606 | |||

| Aptiv PLC / EC (JE00BTDN8H13) | 0.06 | 3.50 | 0.6227 | 0.6227 | |||||

| UPS / United Parcel Service, Inc. | 0.03 | -2.74 | 3.48 | -10.05 | 0.6191 | -0.0104 | |||

| US3130AK6H44 / Federal Home Loan Banks | 3.45 | 0.6130 | 0.6130 | ||||||

| OTIS / Otis Worldwide Corporation | 0.04 | -2.75 | 3.28 | -13.36 | 0.5824 | -0.0323 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.04 | -2.75 | 3.17 | -3.09 | 0.5637 | 0.0317 | |||

| 0WP / WPP plc | 0.30 | -2.75 | 3.10 | -2.12 | 0.5505 | 0.0361 | |||

| EFX / Equifax Inc. | 0.01 | -2.75 | 3.01 | -15.66 | 0.5345 | -0.0451 | |||

| ESLOY / EssilorLuxottica Société anonyme - Depositary Receipt (Common Stock) | 0.01 | -2.74 | 2.78 | 0.14 | 0.4935 | 0.0428 | |||

| HESAY / Hermès International Société en commandite par actions - Depositary Receipt (Common Stock) | 0.00 | -2.65 | 2.73 | -5.14 | 0.4860 | 0.0174 | |||

| HOCPY / HOYA Corporation - Depositary Receipt (Common Stock) | 0.02 | -2.68 | 2.71 | -12.80 | 0.4811 | -0.0235 | |||

| BB2 / Burberry Group plc | 0.20 | -2.75 | 2.44 | 26.85 | 0.4336 | 0.1209 | |||

| BAER / Julius Bär Gruppe AG | 0.03 | -2.75 | 2.21 | 4.64 | 0.3934 | 0.0495 | |||

| WTBCF / Whitbread plc | 0.06 | -2.75 | 2.07 | -14.73 | 0.3675 | -0.0266 | |||

| MCHP / Microchip Technology Incorporated | 0.04 | -2.75 | 2.04 | -30.52 | 0.3631 | -0.1150 | |||

| CARR / Carrier Global Corporation | 0.03 | -2.75 | 1.95 | -17.51 | 0.3461 | -0.0377 | |||

| BNR / Burning Rock Biotech Limited - Depositary Receipt (Common Stock) | 0.03 | -2.75 | 1.83 | -21.65 | 0.3256 | -0.0544 | |||

| OMC / Omnicom Group Inc. | 0.02 | -2.74 | 1.46 | -19.03 | 0.2587 | -0.0336 | |||

| 4FN / Grupo Financiero Banorte, S.A.B. de C.V. | 0.15 | -2.75 | 0.96 | -11.97 | 0.1713 | -0.0066 | |||

| (PIPA070) PGIM Core Government Money Market Fund / STIV (000000000) | 0.03 | 0.03 | 0.0060 | 0.0060 |