Basic Stats

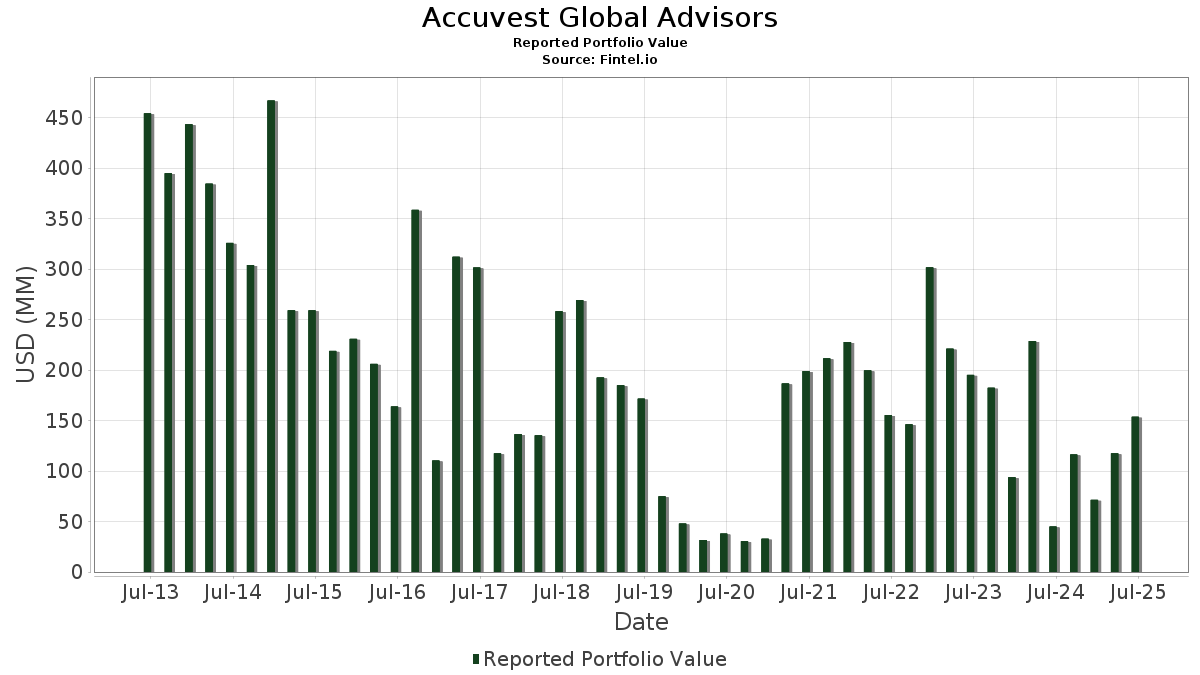

| Portfolio Value | $ 153,715,000 |

| Current Positions | 78 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Accuvest Global Advisors has disclosed 78 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 153,715,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Accuvest Global Advisors’s top holdings are Strategy Inc (US:MSTR) , Amazon.com, Inc. (US:AMZN) , Microsoft Corporation (US:MSFT) , Costco Wholesale Corporation (US:COST) , and Meta Platforms, Inc. (US:META) . Accuvest Global Advisors’s new positions include Brookfield Corporation (US:BN) , Semler Scientific, Inc. (US:SMLR) , SAP SE - Depositary Receipt (Common Stock) (US:SAP) , Colgate-Palmolive Company (US:CL) , and Novo Nordisk A/S - Depositary Receipt (Common Stock) (US:NVO) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 2.98 | 1.9419 | 1.9419 | |

| 0.00 | 2.96 | 1.9269 | 1.9269 | |

| 0.01 | 4.50 | 2.9255 | 1.7799 | |

| 0.01 | 2.64 | 1.7201 | 1.7201 | |

| 0.01 | 3.96 | 2.5775 | 1.3382 | |

| 0.03 | 1.96 | 1.2731 | 1.2731 | |

| 0.04 | 3.34 | 2.1722 | 1.1772 | |

| 0.06 | 4.05 | 2.6328 | 1.1577 | |

| 0.01 | 6.25 | 4.0679 | 1.0573 | |

| 0.00 | 1.62 | 1.0539 | 1.0539 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.03 | 7.08 | 4.6079 | -4.5755 | |

| 0.01 | 1.19 | 0.7716 | -2.3242 | |

| 0.07 | 29.02 | 18.8804 | -1.9327 | |

| 0.00 | 0.21 | 0.1379 | -0.8520 | |

| 0.00 | 0.23 | 0.1490 | -0.7269 | |

| 0.02 | 4.41 | 2.8676 | -0.6869 | |

| 0.00 | 1.42 | 0.9264 | -0.6806 | |

| 0.00 | 0.76 | 0.4951 | -0.5374 | |

| 0.01 | 5.34 | 3.4759 | -0.4880 | |

| 0.03 | 4.30 | 2.7974 | -0.4431 |

13F and Fund Filings

This form was filed on 2025-08-05 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSTR / Strategy Inc | 0.07 | -15.36 | 29.02 | 18.69 | 18.8804 | -1.9327 | |||

| AMZN / Amazon.com, Inc. | 0.03 | -43.07 | 7.08 | -34.35 | 4.6079 | -4.5755 | |||

| MSFT / Microsoft Corporation | 0.01 | 33.43 | 6.25 | 76.79 | 4.0679 | 1.0573 | |||

| COST / Costco Wholesale Corporation | 0.01 | 9.61 | 5.34 | 14.73 | 3.4759 | -0.4880 | |||

| META / Meta Platforms, Inc. | 0.01 | 8.72 | 5.33 | 39.20 | 3.4675 | 0.2083 | |||

| WMT / Walmart Inc. | 0.05 | 15.26 | 5.21 | 28.39 | 3.3926 | -0.0648 | |||

| SPOT / Spotify Technology S.A. | 0.01 | -6.38 | 5.12 | 30.61 | 3.3282 | -0.0058 | |||

| NFLX / Netflix, Inc. | 0.00 | 0.35 | 5.03 | 44.11 | 3.2729 | 0.3015 | |||

| APO / Apollo Global Management, Inc. | 0.03 | 33.82 | 4.66 | 38.64 | 3.0342 | 0.1708 | |||

| V / Visa Inc. | 0.01 | 229.70 | 4.50 | 234.10 | 2.9255 | 1.7799 | |||

| AAPL / Apple Inc. | 0.02 | 14.29 | 4.41 | 5.56 | 2.8676 | -0.6869 | |||

| TJX / The TJX Companies, Inc. | 0.03 | 11.42 | 4.30 | 12.95 | 2.7974 | -0.4431 | |||

| KKR / KKR & Co. Inc. | 0.03 | 39.96 | 4.26 | 61.05 | 2.7733 | 0.5202 | |||

| LYV / Live Nation Entertainment, Inc. | 0.03 | 40.43 | 4.17 | 62.70 | 2.7128 | 0.5312 | |||

| KO / The Coca-Cola Company | 0.06 | 136.40 | 4.05 | 133.53 | 2.6328 | 1.1577 | |||

| MELI / MercadoLibre, Inc. | 0.00 | 31.31 | 3.97 | 75.92 | 2.5808 | 0.6613 | |||

| PGR / The Progressive Corporation | 0.01 | 188.66 | 3.96 | 172.12 | 2.5775 | 1.3382 | |||

| BX / Blackstone Inc. | 0.03 | 18.62 | 3.81 | 26.93 | 2.4806 | -0.0764 | |||

| UBER / Uber Technologies, Inc. | 0.04 | 123.02 | 3.34 | 185.63 | 2.1722 | 1.1772 | |||

| TMUS / T-Mobile US, Inc. | 0.01 | 2.98 | 1.9419 | 1.9419 | |||||

| LLY / Eli Lilly and Company | 0.00 | 2.96 | 1.9269 | 1.9269 | |||||

| AMT / American Tower Corporation | 0.01 | 2.64 | 1.7201 | 1.7201 | |||||

| ORLY / O'Reilly Automotive, Inc. | 0.02 | 3,436.27 | 2.24 | 122.54 | 1.4579 | 0.6008 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | 14.04 | 2.04 | 34.74 | 1.3297 | 0.0385 | |||

| BN / Brookfield Corporation | 0.03 | 1.96 | 1.2731 | 1.2731 | |||||

| NOW / ServiceNow, Inc. | 0.00 | 1.62 | 1.0539 | 1.0539 | |||||

| SMLR / Semler Scientific, Inc. | 0.04 | 1.61 | 1.0493 | 1.0493 | |||||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -17.29 | 1.42 | -24.58 | 0.9264 | -0.6806 | |||

| PLTR / Palantir Technologies Inc. | 0.01 | 0.70 | 1.23 | 62.75 | 0.8015 | 0.1571 | |||

| GOOGL / Alphabet Inc. | 0.01 | -71.39 | 1.19 | -67.39 | 0.7716 | -2.3242 | |||

| NVDA / NVIDIA Corporation | 0.01 | 28.57 | 1.13 | 87.27 | 0.7371 | 0.2221 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 123.94 | 0.92 | 181.35 | 0.5985 | 0.3202 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.00 | 79.29 | 0.85 | 173.63 | 0.5536 | 0.2889 | |||

| ABBV / AbbVie Inc. | 0.00 | -29.19 | 0.76 | -37.26 | 0.4951 | -0.5374 | |||

| SAP / SAP SE - Depositary Receipt (Common Stock) | 0.00 | 0.71 | 0.4638 | 0.4638 | |||||

| HOOD / Robinhood Markets, Inc. | 0.01 | -19.60 | 0.70 | 80.78 | 0.4528 | 0.1251 | |||

| GSCE / GS Connect S&P GSCI Enhanced Commodity Total Return ETN | 0.00 | 0.66 | 0.4261 | 0.4261 | |||||

| SONY / Sony Group Corporation - Depositary Receipt (Common Stock) | 0.02 | 0.65 | 0.4229 | 0.4229 | |||||

| CL / Colgate-Palmolive Company | 0.01 | 0.51 | 0.3331 | 0.3331 | |||||

| SHOP / Shopify Inc. | 0.00 | -25.62 | 0.51 | -10.25 | 0.3305 | -0.1513 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | 54.70 | 0.48 | 110.53 | 0.3123 | 0.1182 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.01 | 0.47 | 0.3045 | 0.3045 | |||||

| APP / AppLovin Corporation | 0.00 | 0.42 | 0.2726 | 0.2726 | |||||

| HUBS / HubSpot, Inc. | 0.00 | 0.42 | 0.2713 | 0.2713 | |||||

| IRM / Iron Mountain Incorporated | 0.00 | -16.25 | 0.41 | -0.24 | 0.2667 | -0.0831 | |||

| SOFI / SoFi Technologies, Inc. | 0.02 | -14.37 | 0.38 | 33.81 | 0.2446 | 0.0054 | |||

| FLUT / Flutter Entertainment plc | 0.00 | 0.36 | 0.2362 | 0.2362 | |||||

| MO / Altria Group, Inc. | 0.01 | 0.00 | 0.36 | -2.18 | 0.2335 | -0.0788 | |||

| CBRE / CBRE Group, Inc. | 0.00 | -2.36 | 0.35 | 4.44 | 0.2296 | -0.0581 | |||

| NU / Nu Holdings Ltd. | 0.02 | -28.66 | 0.34 | -4.48 | 0.2218 | -0.0820 | |||

| VZ / Verizon Communications Inc. | 0.01 | -41.49 | 0.32 | -44.23 | 0.2108 | -0.2838 | |||

| DASH / DoorDash, Inc. | 0.00 | 0.30 | 0.1965 | 0.1965 | |||||

| NIO / NIO Inc. - Depositary Receipt (Common Stock) | 0.09 | -0.23 | 0.30 | -9.97 | 0.1939 | -0.0879 | |||

| RACE / Ferrari N.V. | 0.00 | 0.29 | 0.1874 | 0.1874 | |||||

| AXP / American Express Company | 0.00 | 0.28 | 0.1841 | 0.1841 | |||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.00 | 0.28 | 0.1802 | 0.1802 | |||||

| LNG / Cheniere Energy, Inc. | 0.00 | -37.22 | 0.27 | -33.90 | 0.1776 | -0.1739 | |||

| UPS / United Parcel Service, Inc. | 0.00 | -41.38 | 0.26 | -46.22 | 0.1711 | -0.2451 | |||

| SPG / Simon Property Group, Inc. | 0.00 | -48.10 | 0.25 | -49.80 | 0.1626 | -0.2612 | |||

| TGT / Target Corporation | 0.00 | 0.25 | 0.1600 | 0.1600 | |||||

| PDD / PDD Holdings Inc. - Depositary Receipt (Common Stock) | 0.00 | -36.96 | 0.23 | -44.18 | 0.1529 | -0.2055 | |||

| DRI / Darden Restaurants, Inc. | 0.00 | 0.23 | 0.1529 | 0.1529 | |||||

| XOM / Exxon Mobil Corporation | 0.00 | -54.95 | 0.23 | -59.23 | 0.1522 | -0.3363 | |||

| HSY / The Hershey Company | 0.00 | 0.23 | 0.1503 | 0.1503 | |||||

| JNJ / Johnson & Johnson | 0.00 | -75.83 | 0.23 | -77.75 | 0.1490 | -0.7269 | |||

| CVX / Chevron Corporation | 0.00 | -54.75 | 0.23 | -61.36 | 0.1483 | -0.3539 | |||

| CB / Chubb Limited | 0.00 | 0.23 | 0.1470 | 0.1470 | |||||

| IBN / ICICI Bank Limited - Depositary Receipt (Common Stock) | 0.01 | 0.22 | 0.1457 | 0.1457 | |||||

| DKNG / DraftKings Inc. | 0.01 | 0.22 | 0.1451 | 0.1451 | |||||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.00 | 0.22 | 0.1425 | 0.1425 | |||||

| MRK / Merck & Co., Inc. | 0.00 | 0.22 | 0.1418 | 0.1418 | |||||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.00 | 0.21 | 0.1379 | 0.1379 | |||||

| AZO / AutoZone, Inc. | 0.00 | -81.31 | 0.21 | -81.77 | 0.1379 | -0.8520 | |||

| COIN / Coinbase Global, Inc. | 0.00 | -66.08 | 0.21 | -31.05 | 0.1373 | -0.1232 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.00 | 0.21 | 0.1340 | 0.1340 | |||||

| MUFG / Mitsubishi UFJ Financial Group, Inc. - Depositary Receipt (Common Stock) | 0.01 | 30.09 | 0.19 | 31.03 | 0.1236 | 0.0002 | |||

| USA / Liberty All-Star Equity Fund | 0.02 | 0.15 | 0.0995 | 0.0995 | |||||

| ARI / Apollo Commercial Real Estate Finance, Inc. | 0.01 | 0.01 | 0.11 | 1.87 | 0.0709 | -0.0202 | |||

| MCD / McDonald's Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ISRG / Intuitive Surgical, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GIS / General Mills, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TSLA / Tesla, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1966 | ||||

| WRBY / Warby Parker Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| T / AT&T Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AFRM / Affirm Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CELH / Celsius Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CMG / Chipotle Mexican Grill, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NKE / NIKE, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MTN / Vail Resorts, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AMD / Advanced Micro Devices, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NEE / NextEra Energy, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RDDT / Reddit, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GE / General Electric Company | 0.00 | -100.00 | 0.00 | 0.0000 |