Basic Stats

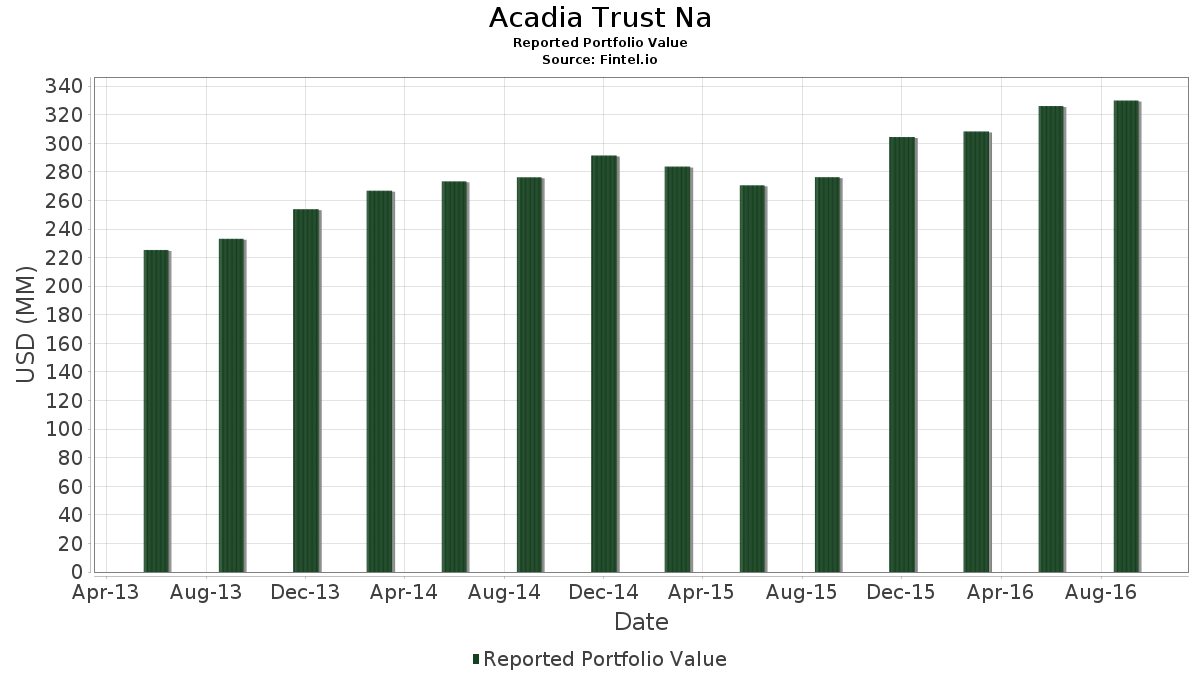

| Portfolio Value | $ 329,893,000 |

| Current Positions | 74 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Acadia Trust Na has disclosed 74 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 329,893,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Acadia Trust Na’s top holdings are Johnson & Johnson (US:JNJ) , Accenture plc (US:ACN) , The Procter & Gamble Company (US:PG) , Microsoft Corporation (US:MSFT) , and Ventas, Inc. (US:VTR) . Acadia Trust Na’s new positions include Check Point Software Technologies Ltd. (US:CHKP) , Rockwell Collins, Inc. (US:COL) , CVS Health Corporation (US:CVS) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.06 | 7.27 | 2.2028 | 2.2028 | |

| 0.23 | 6.66 | 2.0194 | 2.0194 | |

| 0.05 | 4.13 | 1.2513 | 1.2513 | |

| 0.05 | 4.12 | 1.2501 | 1.2501 | |

| 0.09 | 4.07 | 1.2322 | 1.2322 | |

| 0.06 | 3.89 | 1.1786 | 1.1786 | |

| 0.04 | 3.48 | 1.0543 | 1.0543 | |

| 0.18 | 9.40 | 2.8491 | 0.3393 | |

| 0.18 | 6.64 | 2.0122 | 0.2774 | |

| 0.18 | 10.40 | 3.1528 | 0.2469 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -2.4055 | ||

| 0.12 | 7.83 | 2.3732 | -0.3436 | |

| 0.14 | 8.49 | 2.5730 | -0.2901 | |

| 0.04 | 9.72 | 2.9473 | -0.2877 | |

| 0.24 | 9.65 | 2.9240 | -0.2620 | |

| 0.12 | 8.79 | 2.6654 | -0.2442 | |

| 0.10 | 11.88 | 3.6018 | -0.2190 | |

| 0.09 | 7.60 | 2.3035 | -0.2158 | |

| 0.17 | 8.32 | 2.5235 | -0.1944 | |

| 0.06 | 7.20 | 2.1837 | -0.1800 |

13F and Fund Filings

This form was filed on 2016-11-15 for the reporting period 2016-09-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| JNJ / Johnson & Johnson | 0.10 | -2.07 | 11.88 | -4.63 | 3.6018 | -0.2190 | |||

| ACN / Accenture plc | 0.09 | -0.48 | 11.46 | 7.32 | 3.4729 | 0.1990 | |||

| PG / The Procter & Gamble Company | 0.12 | -0.97 | 10.80 | 4.97 | 3.2744 | 0.1185 | |||

| MSFT / Microsoft Corporation | 0.18 | -2.48 | 10.40 | 9.76 | 3.1528 | 0.2469 | |||

| VTR / Ventas, Inc. | 0.14 | -1.38 | 10.07 | -4.34 | 3.0540 | -0.1758 | |||

| BCR / C. R. Bard, Inc. - Corporate Bond/Note | 0.04 | -3.36 | 9.72 | -7.83 | 2.9473 | -0.2877 | |||

| MRK / Merck & Co., Inc. | 0.16 | -2.38 | 9.72 | 5.76 | 2.9467 | 0.1278 | |||

| T / AT&T Inc. | 0.24 | -1.19 | 9.65 | -7.15 | 2.9240 | -0.2620 | |||

| OMC / Omnicom Group Inc. | 0.11 | 0.07 | 9.45 | 4.37 | 2.8658 | 0.0880 | |||

| BDX / Becton, Dickinson and Company | 0.05 | -2.83 | 9.40 | 2.99 | 2.8503 | 0.0505 | |||

| XYL / Xylem Inc. | 0.18 | -2.23 | 9.40 | 14.85 | 2.8491 | 0.3393 | |||

| RSG / Republic Services, Inc. | 0.18 | -2.73 | 8.83 | -4.36 | 2.6766 | -0.1548 | |||

| SCU / Sculptor Capital Management Inc - Class A | 0.12 | -3.11 | 8.79 | -7.33 | 2.6654 | -0.2442 | |||

| 872307903 / TCF Financial Corporation | 0.14 | -1.95 | 8.49 | -9.08 | 2.5730 | -0.2901 | |||

| PEP / PepsiCo, Inc. | 0.08 | -1.72 | 8.41 | 0.90 | 2.5505 | -0.0068 | |||

| SYY / Sysco Corporation | 0.17 | -2.75 | 8.32 | -6.07 | 2.5235 | -0.1944 | |||

| SO / The Southern Company | 0.16 | -0.90 | 8.30 | -5.19 | 2.5148 | -0.1686 | |||

| WY / Weyerhaeuser Company | 0.26 | -1.84 | 8.25 | 5.33 | 2.4996 | 0.0987 | |||

| BCE / BCE Inc. | 0.18 | -0.71 | 8.12 | -3.08 | 2.4629 | -0.1079 | |||

| GIS / General Mills, Inc. | 0.12 | -1.34 | 7.83 | -11.63 | 2.3732 | -0.3436 | |||

| MCD / McDonald's Corporation | 0.07 | 0.39 | 7.83 | -3.76 | 2.3726 | -0.1215 | |||

| IBM / International Business Machines Corporation | 0.05 | -0.63 | 7.74 | 3.99 | 2.3453 | 0.0637 | |||

| DUK / Duke Energy Corporation | 0.09 | -0.86 | 7.60 | -7.50 | 2.3035 | -0.2158 | |||

| USB / U.S. Bancorp | 0.17 | 1.81 | 7.42 | 8.28 | 2.2507 | 0.1479 | |||

| 74005P104 / Praxair, Inc. | 0.06 | 0.25 | 7.27 | 7.79 | 2.2028 | 2.2028 | |||

| KMB / Kimberly-Clark Corporation | 0.06 | 1.86 | 7.20 | -6.54 | 2.1837 | -0.1800 | |||

| US3024451011 / FLIR Systems, Inc. | 0.23 | 2.01 | 7.08 | 3.55 | 2.1477 | 0.0495 | |||

| CAG / Conagra Brands, Inc. | 0.15 | 0.59 | 6.92 | -0.89 | 2.0964 | -0.0435 | |||

| HMC / Honda Motor Co., Ltd. - Depositary Receipt (Common Stock) | 0.23 | -0.83 | 6.66 | 13.22 | 2.0194 | 2.0194 | |||

| INTC / Intel Corporation | 0.18 | 1.95 | 6.64 | 17.34 | 2.0122 | 0.2774 | |||

| RTX / RTX Corporation | 0.06 | 2.68 | 6.22 | 1.72 | 1.8867 | 0.0102 | |||

| GE / General Electric Company | 0.21 | 3.28 | 6.21 | -2.82 | 1.8812 | -0.0772 | |||

| CB / Chubb Limited | 0.05 | 3.29 | 6.20 | -0.72 | 1.8806 | -0.0357 | |||

| FLR / Fluor Corporation | 0.11 | -0.86 | 5.46 | 3.25 | 1.6545 | 0.0334 | |||

| CHKP / Check Point Software Technologies Ltd. | 0.05 | 4.13 | 1.2513 | 1.2513 | |||||

| COL / Rockwell Collins, Inc. | 0.05 | 4.12 | 1.2501 | 1.2501 | |||||

| TRP / TC Energy Corporation | 0.09 | 0.38 | 4.07 | 5.56 | 1.2322 | 1.2322 | |||

| TGT / Target Corporation | 0.06 | 3.20 | 3.89 | 1.49 | 1.1786 | 1.1786 | |||

| XOM / Exxon Mobil Corporation | 0.04 | 0.46 | 3.68 | -6.48 | 1.1164 | -0.0912 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.04 | 4.98 | 3.51 | 0.46 | 1.0631 | -0.0075 | |||

| CVS / CVS Health Corporation | 0.04 | 3.48 | 1.0543 | 1.0543 | |||||

| CAC / Camden National Corporation | 0.07 | -1.07 | 3.19 | 12.46 | 0.9658 | 0.0970 | |||

| HD / The Home Depot, Inc. | 0.01 | -0.81 | 1.18 | 0.00 | 0.3565 | -0.0042 | |||

| SLB / Schlumberger Limited | 0.01 | -0.81 | 0.82 | -1.33 | 0.2480 | -0.0063 | |||

| MMM / 3M Company | 0.00 | -5.68 | 0.79 | -5.04 | 0.2398 | -0.0157 | |||

| CAT / Caterpillar Inc. | 0.01 | 0.00 | 0.74 | 17.01 | 0.2231 | 0.0302 | |||

| WMT / Walmart Inc. | 0.01 | 1.01 | 0.72 | -0.14 | 0.2186 | -0.0029 | |||

| HON / Honeywell International Inc. | 0.01 | -0.48 | 0.70 | -0.43 | 0.2128 | -0.0034 | |||

| CVX / Chevron Corporation | 0.01 | -0.74 | 0.69 | -2.55 | 0.2089 | -0.0080 | |||

| DHR / Danaher Corporation | 0.01 | 0.00 | 0.57 | -22.37 | 0.1725 | -0.0523 | |||

| CL / Colgate-Palmolive Company | 0.01 | -1.12 | 0.56 | 0.18 | 0.1685 | -0.0017 | |||

| ABBV / AbbVie Inc. | 0.01 | -2.55 | 0.54 | -0.73 | 0.1640 | -0.0031 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -4.09 | 0.53 | -4.50 | 0.1610 | -0.0095 | |||

| CSCO / Cisco Systems, Inc. | 0.02 | 0.00 | 0.48 | 10.50 | 0.1467 | 0.0124 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | -0.26 | 0.48 | -4.00 | 0.1455 | -0.0078 | |||

| DIS / The Walt Disney Company | 0.01 | -0.96 | 0.48 | -5.92 | 0.1446 | -0.0109 | |||

| PFE / Pfizer Inc. | 0.01 | -0.36 | 0.47 | -4.05 | 0.1437 | -0.0078 | |||

| CMCSA / Comcast Corporation | 0.01 | -0.64 | 0.47 | 1.07 | 0.1434 | -0.0001 | |||

| ABT / Abbott Laboratories | 0.01 | -7.60 | 0.46 | -0.65 | 0.1400 | -0.0026 | |||

| KO / The Coca-Cola Company | 0.01 | -2.87 | 0.46 | -9.31 | 0.1388 | -0.0160 | |||

| AAPL / Apple Inc. | 0.00 | -8.53 | 0.45 | 8.43 | 0.1364 | 0.0091 | |||

| UGI / UGI Corporation | 0.01 | -4.76 | 0.45 | -4.68 | 0.1358 | -0.0083 | |||

| NEE / NextEra Energy, Inc. | 0.00 | -0.80 | 0.44 | -6.99 | 0.1331 | -0.0117 | |||

| TRV / The Travelers Companies, Inc. | 0.00 | 4.28 | 0.42 | 0.24 | 0.1270 | -0.0012 | |||

| GPC / Genuine Parts Company | 0.00 | 0.00 | 0.39 | -0.76 | 0.1185 | -0.0023 | |||

| PNY / Piedmont Natural Gas Co., Inc. | 0.01 | 0.00 | 0.38 | -0.26 | 0.1152 | -0.0017 | |||

| JWN / Nordstrom, Inc. | 0.01 | 0.00 | 0.37 | 36.30 | 0.1116 | 0.0288 | |||

| LLY / Eli Lilly and Company | 0.00 | -0.88 | 0.36 | 1.12 | 0.1094 | -0.0001 | |||

| VZ / Verizon Communications Inc. | 0.01 | -0.50 | 0.34 | -7.32 | 0.1037 | -0.0095 | |||

| HUBB / Hubbell Incorporated | 0.00 | 0.00 | 0.34 | 2.11 | 0.1028 | 0.0009 | |||

| D / Dominion Energy, Inc. | 0.00 | -1.47 | 0.29 | -6.17 | 0.0876 | -0.0068 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -1.32 | 0.26 | -2.25 | 0.0791 | -0.0028 | |||

| CPB / The Campbell's Company | 0.00 | 0.00 | 0.23 | -17.82 | 0.0685 | -0.0158 | |||

| WFC / Wells Fargo & Company | 0.01 | 16.22 | 0.22 | 8.82 | 0.0673 | 0.0047 | |||

| ESRX / Express Scripts Holding Co. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0767 | ||||

| HSY / The Hershey Company | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| EMC / Global X Funds - Global X Emerging Markets Great Consumer ETF | 0.00 | -100.00 | 0.00 | -100.00 | -2.4055 |