Basic Stats

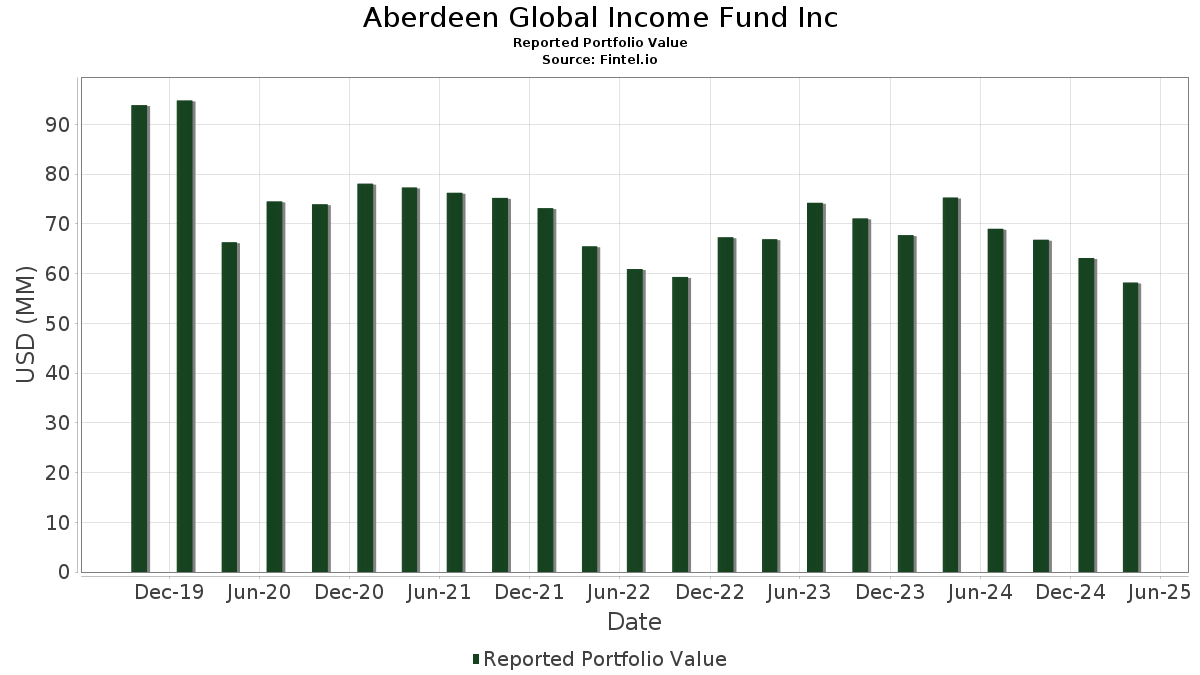

| Portfolio Value | $ 58,162,552 |

| Current Positions | 291 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Aberdeen Global Income Fund Inc has disclosed 291 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 58,162,552 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Aberdeen Global Income Fund Inc’s top holdings are State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls (US:GVMXX) , Oman Government International Bond (OM:US68205LAT08) , Mineral Resources Limited - Depositary Receipt (Common Stock) (US:MALRY) , Peruvian Government International Bond (PE:USP87324BE10) , and Dominican Republic International Bond (DO:USP3579ECG00) . Aberdeen Global Income Fund Inc’s new positions include Oman Government International Bond (OM:US68205LAT08) , Mineral Resources Limited - Depositary Receipt (Common Stock) (US:MALRY) , Peruvian Government International Bond (PE:USP87324BE10) , Dominican Republic International Bond (DO:USP3579ECG00) , and Brazil Notas do Tesouro Nacional Serie F (BR:BRSTNCNTF1Q6) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.90 | 1.90 | 4.5425 | 4.3210 | |

| 0.55 | 1.3126 | 1.3126 | ||

| 0.74 | 1.7716 | 0.8974 | ||

| 0.34 | 0.8197 | 0.8197 | ||

| 0.20 | 0.4726 | 0.4726 | ||

| 0.19 | 0.4631 | 0.4631 | ||

| 0.19 | 0.4497 | 0.4497 | ||

| 0.13 | 0.3060 | 0.3060 | ||

| 0.11 | 0.2736 | 0.2736 | ||

| 1.46 | 3.4834 | 0.2645 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.19 | 0.4640 | -0.8471 | ||

| 1.14 | 2.7259 | -0.6889 | ||

| 0.32 | 0.7535 | -0.5571 | ||

| 0.83 | 1.9887 | -0.4350 | ||

| 0.20 | 0.4828 | -0.3652 | ||

| 0.04 | 0.0884 | -0.3566 | ||

| 0.06 | 0.1453 | -0.2963 | ||

| 0.68 | 1.6364 | -0.2663 | ||

| -0.10 | -0.2372 | -0.2372 | ||

| 0.06 | 0.1342 | -0.1603 |

13F and Fund Filings

This form was filed on 2025-06-13 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 1.90 | 1,779.88 | 1.90 | 1,780.20 | 4.5425 | 4.3210 | |||

| US68205LAT08 / Oman Government International Bond | 1.46 | -0.82 | 3.4834 | 0.2645 | |||||

| MALRY / Mineral Resources Limited - Depositary Receipt (Common Stock) | 1.14 | -26.85 | 2.7259 | -0.6889 | |||||

| USP87324BE10 / Peruvian Government International Bond | 1.11 | 0.91 | 2.6668 | 0.2443 | |||||

| USP3579ECG00 / Dominican Republic International Bond | 1.01 | -4.26 | 2.4184 | 0.1026 | |||||

| BRSTNCNTF1Q6 / Brazil Notas do Tesouro Nacional Serie F | 0.83 | -24.80 | 1.9887 | -0.4350 | |||||

| US040114HW38 / Argentine Republic Government International Bond | 0.82 | -3.07 | 1.9657 | 0.1082 | |||||

| US91282CJS17 / United States Treasury Note/Bond - When Issued | 0.74 | 85.93 | 1.7716 | 0.8974 | |||||

| XS1595714087 / KazMunayGas National Co JSC | 0.73 | -2.41 | 1.7424 | 0.1059 | |||||

| US71654QCC42 / Petroleos Mexicanos Bond | 0.71 | -2.60 | 1.7076 | 0.1018 | |||||

| US455780CN45 / Indonesia Government International Bond | 0.69 | -0.29 | 1.6478 | 0.1340 | |||||

| AU3CB0297653 / Commonwealth Bank of Australia | 0.69 | 3.32 | 1.6399 | 0.1861 | |||||

| AU3CB0296671 / Australia & New Zealand Banking Group Ltd | 0.68 | -21.11 | 1.6364 | -0.2663 | |||||

| BANBRA / Banco do Brasil SA/Cayman | 0.63 | 0.16 | 1.4996 | 0.1289 | |||||

| US168863DY16 / Chile Government International Bond | 0.62 | 1.65 | 1.4716 | 0.1449 | |||||

| US040114HU71 / Argentine Republic Government International Bond | 0.58 | -3.34 | 1.3868 | 0.0715 | |||||

| INE148I07GL3 / Indiabulls Housing Finance Ltd | 0.58 | 3.79 | 1.3774 | 0.1625 | |||||

| XS2318315921 / Asian Infrastructure Investment Bank/The | 0.55 | 1.3126 | 1.3126 | ||||||

| XS1775617464 / Egypt Government International Bond | 0.52 | -9.20 | 1.2515 | -0.0121 | |||||

| US900123DG28 / Turkey Government International Bond | 0.52 | -2.82 | 1.2360 | 0.0709 | |||||

| COL17CT03813 / Colombian TES | 0.50 | -4.62 | 1.1887 | 0.0482 | |||||

| XS2155352748 / Qatar Government International Bond | 0.49 | 0.00 | 1.1677 | 0.0959 | |||||

| 88WE / Angolan Government International Bond | 0.49 | -13.96 | 1.1653 | -0.0757 | |||||

| AU3CB0300358 / Westpac Banking Corp | 0.49 | 2.54 | 1.1609 | 0.1220 | |||||

| XS0079398250 / Eskom Holdings SOC Ltd | 0.48 | 0.21 | 1.1499 | 0.0985 | |||||

| USP16259AM84 / BBVA Bancomer SA/Texas | 0.44 | 1.14 | 1.0638 | 0.1006 | |||||

| Samarco Mineracao SA / DBT (USP8405QAA78) | 0.42 | -0.72 | 0.9973 | 0.0786 | |||||

| PL0000113783 / Republic of Poland Government Bond | 0.41 | 13.97 | 0.9780 | 0.1915 | |||||

| IDG000014101 / Indonesia Treasury Bond | 0.41 | -1.46 | 0.9732 | 0.0693 | |||||

| US105756BK57 / Brazilian Government International Bond | 0.38 | 0.79 | 0.9191 | 0.0827 | |||||

| US836205AY00 / Republic of South Africa Government International Bond | 0.38 | -2.56 | 0.9119 | 0.0547 | |||||

| XS0240295575 / Iraq International Bond | 0.38 | -1.56 | 0.9058 | 0.0639 | |||||

| XS1796266754 / Ivory Coast Government International Bond | 0.38 | 1.07 | 0.9032 | 0.0838 | |||||

| Organon & Co / Organon Foreign Debt Co-Issuer BV / DBT (US68622FAA93) | 0.38 | -5.99 | 0.9021 | 0.0212 | |||||

| USP9379RBC09 / Empresas Publicas de Medellin ESP | 0.38 | -0.53 | 0.9002 | 0.0705 | |||||

| MX0MGO0000R8 / Mexican Bonos | 0.38 | 10.62 | 0.8978 | 0.1545 | |||||

| US91339U2A15 / United Bank for Africa PLC | 0.37 | 0.00 | 0.8953 | 0.0742 | |||||

| US71568QAB32 / Perusahaan Perseroan Persero PT Perusahaan Listrik Negara | 0.35 | -0.57 | 0.8383 | 0.0646 | |||||

| HGB / Hungary Government Bond | 0.35 | 10.09 | 0.8362 | 0.1412 | |||||

| R2044 / South Africa - Sovereign or Government Agency Debt | 0.34 | -3.37 | 0.8243 | 0.0436 | |||||

| US836205AV60 / Republic of South Africa Government International Bond | 0.34 | -3.65 | 0.8223 | 0.0403 | |||||

| Saavi Energia Sarl / DBT (US78518PAA30) | 0.34 | 0.8197 | 0.8197 | ||||||

| US03846JX543 / Egypt Government International Bond | 0.34 | -5.56 | 0.8143 | 0.0243 | |||||

| El Salvador Government International Bond / DBT (US283875CG53) | 0.34 | -6.87 | 0.8131 | 0.0142 | |||||

| US25714PEW41 / Dominican Republic International Bond | 0.34 | 1.20 | 0.8097 | 0.0756 | |||||

| YKBNK / Yapi ve Kredi Bankasi A.S. | 0.33 | -1.47 | 0.7990 | 0.0539 | |||||

| TRT150927T11 / Turkey Government Bond | 0.33 | -18.11 | 0.7899 | -0.0946 | |||||

| CH0384125065 / PFAND SCHWZ HYPO | 0.33 | -2.09 | 0.7858 | 0.0501 | |||||

| XS2340149439 / Georgian Railway JSC | 0.32 | 1.28 | 0.7597 | 0.0719 | |||||

| XS1781710626 / Kenya Government International Bond | 0.32 | -47.24 | 0.7535 | -0.5571 | |||||

| USG91237AB60 / Tullow Oil PLC | 0.31 | -13.50 | 0.7527 | -0.0434 | |||||

| 50OW / Uruguay Government International Bond | 0.31 | 5.08 | 0.7430 | 0.0947 | |||||

| US80386WAD74 / Sasol Financing USA LLC | 0.31 | -8.04 | 0.7406 | 0.0018 | |||||

| US65412JAB98 / Nigeria Government International Bond | 0.31 | -9.14 | 0.7372 | -0.0066 | |||||

| US42727GAA67 / Heritage Petroleum Co Ltd | 0.29 | -2.65 | 0.7038 | 0.0409 | |||||

| US37311PAB67 / Georgia Government International Bond | 0.29 | 1.38 | 0.7019 | 0.0663 | |||||

| US92943TAA16 / WE Soda Investments Holding PLC | 0.28 | -0.71 | 0.6727 | 0.0514 | |||||

| US775109BS95 / Rogers Communications, Inc. | 0.27 | -0.74 | 0.6405 | 0.0499 | |||||

| MYBMX1100044 / Malaysia Government Bond | 0.26 | 4.35 | 0.6331 | 0.0780 | |||||

| XS2189919637 / International Container Terminal Services Inc | 0.26 | 1.19 | 0.6136 | 0.0578 | |||||

| MYBMZ2000016 / Malaysia Government Bond | 0.26 | 4.94 | 0.6116 | 0.0777 | |||||

| US92856HAB06 / Vivo Energy Investments BV | 0.25 | 1.65 | 0.5924 | 0.0584 | |||||

| US716564AB55 / Petroleos del Peru SA | 0.25 | -3.16 | 0.5866 | 0.0307 | |||||

| US Foods Inc / DBT (US90290MAJ09) | 0.24 | 0.42 | 0.5740 | 0.0518 | |||||

| US237266AJ06 / Darling Ingredients Inc | 0.24 | 0.42 | 0.5676 | 0.0484 | |||||

| MYBMY1900052 / Malaysia Government Bond | 0.23 | 5.50 | 0.5510 | 0.0722 | |||||

| IL0011971442 / Energean Israel Finance Ltd | 0.23 | -2.95 | 0.5509 | 0.0309 | |||||

| Helios Software Holdings Inc / ION Corporate Solutions Finance Sarl / DBT (XS2808409390) | 0.23 | 6.64 | 0.5405 | 0.0765 | |||||

| US1248EPCP61 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.22 | 3.26 | 0.5319 | 0.0591 | |||||

| XS2348767323 / BOI Finance BV | 0.22 | 7.96 | 0.5207 | 0.0783 | |||||

| USY59500AA95 / Medco Laurel Tree Pte Ltd | 0.22 | -2.70 | 0.5180 | 0.0301 | |||||

| US377320AA45 / Glatfelter Corp | 0.22 | -4.00 | 0.5179 | 0.0228 | |||||

| US91822Q2C08 / Republic of Uzbekistan Bond | 0.22 | 1.89 | 0.5176 | 0.0524 | |||||

| US603374AH26 / Minerva Luxembourg SA | 0.21 | 1.43 | 0.5103 | 0.0484 | |||||

| US46522TAC27 / ISTANBUL METROPOLITAN MUNICIPALITY 10.5% 12/06/2028 144A | 0.21 | -1.85 | 0.5084 | 0.0345 | |||||

| US05675M2D52 / Bahrain Government International Bond | 0.21 | -0.47 | 0.5053 | 0.0398 | |||||

| US92332YAD31 / Venture Global LNG Inc | 0.21 | -7.46 | 0.5051 | 0.0032 | |||||

| Iliad Holding SASU / DBT (US449691AF14) | 0.21 | -1.87 | 0.5046 | 0.0338 | |||||

| WBCPM / Westpac Banking Corporation - Preferred Stock | 0.21 | 2.44 | 0.5043 | 0.0538 | |||||

| US44891CBL63 / Hyundai Capital America | 0.21 | 0.00 | 0.5001 | 0.0410 | |||||

| US00434G2B53 / Access Bank PLC | 0.21 | -2.36 | 0.4960 | 0.0307 | |||||

| 93QC / ECOBANK TRANSNATIONAL INC 9.5% 04/18/2024 144A | 0.21 | -1.90 | 0.4946 | 0.0327 | |||||

| XS1843433472 / Ukraine Railways Via Rail Capital Markets PLC | 0.21 | 5.67 | 0.4917 | 0.0661 | |||||

| US060335AB23 / Banijay Entertainment SASU | 0.20 | -1.45 | 0.4902 | 0.0344 | |||||

| US78669QAA85 / Sagicor Financial Co Ltd | 0.20 | 0.00 | 0.4901 | 0.0413 | |||||

| US87927VAR96 / Telecom Italia Capital 7.2% Senior Notes 7/18/36 | 0.20 | 2.00 | 0.4897 | 0.0499 | |||||

| IL0060406795 / Bank Leumi Le-Israel BM | 0.20 | 0.00 | 0.4893 | 0.0407 | |||||

| National Bank of Uzbekistan / DBT (XS2853544398) | 0.20 | 0.00 | 0.4881 | 0.0397 | |||||

| Yinson Boronia Production BV / DBT (US98584XAA37) | 0.20 | -1.46 | 0.4860 | 0.0333 | |||||

| US335934AU96 / First Quantum Minerals Ltd. | 0.20 | -1.46 | 0.4848 | 0.0351 | |||||

| US536333AB32 / Liquid Telecommunications Financing Plc | 0.20 | -47.93 | 0.4828 | -0.3652 | |||||

| XS1713469911 / MHP Lux SA | 0.20 | -3.37 | 0.4823 | 0.0259 | |||||

| Navoi Mining & Metallurgical Combinat / DBT (US63890CAB00) | 0.20 | 1.52 | 0.4819 | 0.0468 | |||||

| US89378TAD54 / Transnet SOC Ltd | 0.20 | -0.99 | 0.4814 | 0.0350 | |||||

| TSKB / Türkiye Sinai Kalkinma Bankasi A.S. | 0.20 | -3.38 | 0.4788 | 0.0237 | |||||

| US58518N2B76 / MEGlobal Canada ULC | 0.20 | 0.00 | 0.4783 | 0.0404 | |||||

| Genting New York LLC / GENNY Capital Inc / DBT (US37255JAB89) | 0.20 | -2.93 | 0.4780 | 0.0273 | |||||

| XS1317967492 / Huarong Finance II Co Ltd | 0.20 | 0.00 | 0.4771 | 0.0395 | |||||

| Connect Finco SARL / Connect US Finco LLC / DBT (US20752TAB08) | 0.20 | 4.74 | 0.4766 | 0.0580 | |||||

| XS2184856859 / China Huadian Overseas Development 2018 Ltd | 0.20 | 0.51 | 0.4752 | 0.0433 | |||||

| Honduras Government International Bond / DBT (US438180AK75) | 0.20 | 2.59 | 0.4743 | 0.0510 | |||||

| Telecommunications co Telekom Srbija AD Belgrade / DBT (US87945BAA89) | 0.20 | 0.00 | 0.4742 | 0.0392 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.20 | 0.4726 | 0.4726 | ||||||

| US14985VAE11 / CCM Merger Inc | 0.20 | 0.51 | 0.4717 | 0.0400 | |||||

| US00842XAA72 / Affinity Gaming | 0.20 | -15.58 | 0.4682 | -0.0399 | |||||

| TBC Bank JSC / DBT (US48128XAD57) | 0.20 | -2.01 | 0.4676 | 0.0311 | |||||

| QUIPOR / International Airport Finance SA | 0.19 | -2.02 | 0.4642 | 0.0282 | |||||

| XS2214238441 / Ecuador Government International Bond | 0.19 | -69.06 | 0.4640 | -0.8471 | |||||

| Greenko Wind Projects Mauritius Ltd / DBT (US39531JAB08) | 0.19 | 0.4631 | 0.4631 | ||||||

| IHS / IHS Holding Limited | 0.19 | -2.04 | 0.4609 | 0.0304 | |||||

| USF8500RAB80 / Societe Generale SA | 0.19 | -0.52 | 0.4607 | 0.0375 | |||||

| US914908BD90 / Univision Communications Inc. 2022 First Lien Term Loan B | 0.19 | 20.13 | 0.4585 | 0.1084 | |||||

| US00109YAA38 / AES Andres BV | 0.19 | -0.52 | 0.4578 | 0.0368 | |||||

| US71429MAC91 / Perrigo Finance Unlimited Co | 0.19 | 1.06 | 0.4552 | 0.0418 | |||||

| Port Of Spain Waterfront Development / DBT (US73500YAA55) | 0.19 | 0.4497 | 0.4497 | ||||||

| MYBMS1900047 / Malaysia Government Bond | 0.19 | 4.47 | 0.4488 | 0.0548 | |||||

| US49229QAC87 / Kernel Holding SA | 0.18 | -3.66 | 0.4415 | 0.0226 | |||||

| Benin Government International Bond / DBT (US08205QAC24) | 0.18 | -5.70 | 0.4372 | 0.0141 | |||||

| XS1268475727 / Synlab Unsecured Bondco PLC | 0.18 | -2.19 | 0.4297 | 0.0264 | |||||

| WBAD / Walgreens Boots Alliance, Inc. - Depositary Receipt (Common Stock) | 0.18 | 19.59 | 0.4255 | 0.0997 | |||||

| XS2290957732 / Bahrain Government International Bond | 0.17 | -2.82 | 0.4119 | 0.0223 | |||||

| US760942AS16 / Uruguay Government International Bond | 0.17 | 1.18 | 0.4113 | 0.0388 | |||||

| US05565ALQ49 / BNP Paribas SA | 0.17 | -1.72 | 0.4090 | 0.0269 | |||||

| US428102AE79 / Hess Midstream Operations LP | 0.17 | 0.00 | 0.4086 | 0.0354 | |||||

| US88023UAJ07 / Tempur Sealy International Inc | 0.17 | -20.57 | 0.3989 | -0.0613 | |||||

| US48126PAA03 / KazMunayGas National Co JSC | 0.17 | 0.00 | 0.3963 | 0.0327 | |||||

| US1248EPCQ45 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.17 | 1.85 | 0.3961 | 0.0391 | |||||

| US56085RAA86 / MAJORDRIVE HOLDINGS IV LLC 6.375% 06/01/2029 144A | 0.17 | -13.61 | 0.3959 | -0.0229 | |||||

| US45410LAA08 / India Green Power Holdings | 0.16 | -7.87 | 0.3946 | 0.0042 | |||||

| US126307AZ02 / CSC Holdings, LLC | 0.16 | -4.12 | 0.3912 | 0.0174 | |||||

| US10552TAH05 / BRF SA | 0.16 | -0.62 | 0.3869 | 0.0298 | |||||

| XS2404741584 / Bellis Acquisition Co PLC | 0.16 | 5.26 | 0.3842 | 0.0504 | |||||

| IL0011677825 / Leviathan Bond Ltd | 0.16 | -0.63 | 0.3793 | 0.0302 | |||||

| Pinewood Finco PLC / DBT (XS2783792489) | 0.15 | 7.75 | 0.3678 | 0.0544 | |||||

| US12543DBM11 / CHS/Community Health Systems Inc | 0.15 | 0.67 | 0.3612 | 0.0304 | |||||

| Cogent Communications Group Inc / Cogent Communications Finance Inc / DBT (US19240WAA71) | 0.15 | -0.66 | 0.3599 | 0.0270 | |||||

| US640695AA01 / Neptune Bidco US Inc | 0.15 | -26.11 | 0.3598 | -0.0869 | |||||

| US38869AAA51 / Graphic Packaging International LLC | 0.15 | 69.32 | 0.3581 | 0.1635 | |||||

| US644274AH54 / New Enterprise Stone & Lime Co Inc | 0.15 | 23.14 | 0.3576 | 0.0922 | |||||

| US400666AA13 / Guara Norte Sarl | 0.15 | -0.68 | 0.3540 | 0.0284 | |||||

| Adient Global Holdings Ltd / DBT (US00687YAD76) | 0.15 | 137.70 | 0.3490 | 0.2135 | |||||

| USP1850NAB75 / Braskem Idesa SAPI | 0.14 | -8.92 | 0.3444 | -0.0005 | |||||

| US00401YAA82 / Academy Ltd | 0.14 | 0.00 | 0.3438 | 0.0286 | |||||

| XS2696111389 / GTCR W-2 Merger Sub LLC / GTCR W Dutch Finance Sub BV | 0.14 | 8.33 | 0.3426 | 0.0529 | |||||

| US29269RAA32 / Enerflex Ltd | 0.14 | -1.40 | 0.3376 | 0.0235 | |||||

| XS2660424008 / Iceland Bondco PLC | 0.14 | 8.46 | 0.3373 | 0.0521 | |||||

| Aethon United BR LP / Aethon United Finance Corp / DBT (US00810GAD60) | 0.14 | -2.10 | 0.3362 | 0.0214 | |||||

| Panther Escrow Issuer LLC / DBT (US69867RAA59) | 0.14 | 0.00 | 0.3308 | 0.0277 | |||||

| CMPR / Cimpress plc | 0.14 | -8.11 | 0.3274 | 0.0008 | |||||

| XS2397447025 / BCP V Modular Services Finance II PLC | 0.14 | 7.09 | 0.3268 | 0.0480 | |||||

| CD&R Firefly Bidco PLC / DBT (XS2798887746) | 0.14 | 6.30 | 0.3251 | 0.0449 | |||||

| CNR / Core Natural Resources, Inc. | 0.14 | -12.34 | 0.3234 | -0.0150 | |||||

| Fiesta Purchaser Inc / DBT (US31659AAB26) | 0.13 | 0.00 | 0.3176 | 0.0275 | |||||

| Sherwood Financing PLC / DBT (XS2953609687) | 0.13 | 7.32 | 0.3172 | 0.0461 | |||||

| US87422VAK44 / Talen Energy Supply, LLC | 0.13 | 0.00 | 0.3167 | 0.0268 | |||||

| XS1071551391 / Deutsche Bank AG | 0.13 | 5.69 | 0.3116 | 0.0410 | |||||

| Dcli Bidco LLC / DBT (US233104AA67) | 0.13 | -9.15 | 0.3097 | -0.0037 | |||||

| US195325DQ52 / Colombia Government International Bond | 0.13 | -4.44 | 0.3088 | 0.0127 | |||||

| US15089QAX25 / CORP. NOTE | 0.13 | 0.3060 | 0.3060 | ||||||

| Summer BidCo BV / DBT (XS2758100536) | 0.13 | 9.57 | 0.3031 | 0.0507 | |||||

| US629377CT71 / NRG Energy Inc | 0.13 | 0.80 | 0.3015 | 0.0257 | |||||

| XS2649707929 / HT Troplast GmbH | 0.13 | 4.17 | 0.3007 | 0.0363 | |||||

| XS2187651497 / Virgin Media Vendor Financing Notes III DAC | 0.13 | 8.70 | 0.2995 | 0.0456 | |||||

| XS2615006637 / Monitchem HoldCo 3 SA | 0.12 | 6.03 | 0.2943 | 0.0393 | |||||

| XS2231189924 / Vmed O2 UK Financing I PLC | 0.12 | 8.93 | 0.2930 | 0.0465 | |||||

| XS2606019540 / IHO Verwaltungs GmbH | 0.12 | 7.96 | 0.2924 | 0.0445 | |||||

| US92840VAH50 / VISTRA OPERATIONS CO LLC 4.375% 05/01/2029 144A | 0.12 | 1.68 | 0.2898 | 0.0276 | |||||

| USY20721AL30 / Indonesia Government International Bond | 0.12 | 0.00 | 0.2877 | 0.0241 | |||||

| ENS / EnerSys | 0.12 | 0.85 | 0.2857 | 0.0260 | |||||

| Ephios Subco 3 Sarl / DBT (XS2734938678) | 0.12 | 6.25 | 0.2856 | 0.0391 | |||||

| Project Grand UK PLC / DBT (XS2848793688) | 0.12 | 8.18 | 0.2853 | 0.0424 | |||||

| BRTSG8EN8 / Staples, Inc., Term Loan | 0.12 | -11.94 | 0.2839 | -0.0104 | |||||

| 1011778 BC ULC / New Red Finance Inc / DBT (US68245XAT63) | 0.12 | 0.00 | 0.2837 | 0.0239 | |||||

| RAY Financing LLC / DBT (XS2854278194) | 0.12 | 7.34 | 0.2806 | 0.0398 | |||||

| DE000A254QC5 / WEPA Hygieneprodukte GmbH | 0.12 | 9.35 | 0.2804 | 0.0438 | |||||

| Flora Food Management BV / DBT (XS2849520908) | 0.12 | 9.43 | 0.2795 | 0.0452 | |||||

| CT Investment GmbH / DBT (XS2792575537) | 0.12 | 8.41 | 0.2787 | 0.0430 | |||||

| XS2624554163 / OI European Group BV | 0.12 | 9.43 | 0.2778 | 0.0438 | |||||

| BESI / BE Semiconductor Industries N.V. | 0.11 | 7.55 | 0.2746 | 0.0400 | |||||

| TrueNoord Capital DAC / DBT (US89785GAA67) | 0.11 | 0.2736 | 0.2736 | ||||||

| Nova Alexandre III SAS / DBT (XS2800795374) | 0.11 | 10.68 | 0.2735 | 0.0468 | |||||

| US92328MAE30 / Venture Global Calcasieu Pass LLC | 0.11 | -1.72 | 0.2727 | 0.0182 | |||||

| PrestigeBidCo GmbH / DBT (XS2848951856) | 0.11 | 7.62 | 0.2721 | 0.0413 | |||||

| XS2399700959 / Albion Financing 1 SARL / Aggreko Holdings Inc | 0.11 | 8.65 | 0.2717 | 0.0425 | |||||

| XS2498543102 / 888 Acquisitions Ltd | 0.11 | 8.65 | 0.2707 | 0.0412 | |||||

| XS2199597530 / Vertical Midco GmbH | 0.11 | 8.74 | 0.2702 | 0.0430 | |||||

| XS2052290512 / Matterhorn Telecom SA | 0.11 | 8.74 | 0.2700 | 0.0431 | |||||

| Assemblin Caverion Group AB / DBT (XS2842976362) | 0.11 | 7.69 | 0.2683 | 0.0392 | |||||

| Gruenenthal GmbH / DBT (XS2951378780) | 0.11 | 6.73 | 0.2655 | 0.0373 | |||||

| XS2410367747 / Telefonica Europe BV | 0.11 | 10.00 | 0.2645 | 0.0439 | |||||

| US05765WAA18 / TIBCO Software Inc | 0.11 | 0.00 | 0.2645 | 0.0229 | |||||

| US86722AAD54 / SunCoke Energy Inc | 0.11 | -40.22 | 0.2637 | -0.1406 | |||||

| XS2623257503 / Motion Finco Sarl | 0.11 | 1.87 | 0.2630 | 0.0272 | |||||

| Permian Resources Operating LLC / DBT (US71424VAB62) | 0.11 | -2.70 | 0.2596 | 0.0157 | |||||

| US62886HBE09 / NCL Corp Ltd | 0.11 | -0.93 | 0.2571 | 0.0193 | |||||

| XS2326493728 / Novelis Sheet Ingot GmbH | 0.11 | 8.08 | 0.2571 | 0.0393 | |||||

| SYNT / Synthomer plc | 0.11 | -0.93 | 0.2560 | 0.0192 | |||||

| XS2393001891 / Grifols Escrow Issuer SA | 0.11 | 13.98 | 0.2540 | 0.0498 | |||||

| US279158AS81 / Ecopetrol SA | 0.11 | -2.78 | 0.2514 | 0.0141 | |||||

| OLN / Olin Corporation | 0.10 | 0.2496 | 0.2496 | ||||||

| XS2272845798 / VZ Vendor Financing II BV | 0.10 | 7.29 | 0.2464 | 0.0340 | |||||

| US89346DAH08 / TransAlta Corp | 0.10 | 0.99 | 0.2441 | 0.0211 | |||||

| US21925DAA72 / Cornerstone Building Brands, Inc. | 0.10 | 46.38 | 0.2423 | 0.0897 | |||||

| Miter Brands Acquisition Holdco Inc / MIWD Borrower LLC / DBT (US60672JAA79) | 0.10 | -0.99 | 0.2394 | 0.0175 | |||||

| US911684AD06 / Us Cellular 6.7% Senior Notes 12/15/33 | 0.10 | 1.04 | 0.2330 | 0.0220 | |||||

| Delek Logistics Partners LP / Delek Logistics Finance Corp / DBT (US24665FAD42) | 0.10 | -2.06 | 0.2283 | 0.0145 | |||||

| US45074JAA25 / ITT Holdings LLC | 0.09 | -3.09 | 0.2271 | 0.0140 | |||||

| US12008RAP29 / Builders FirstSource Inc | 0.09 | 0.00 | 0.2262 | 0.0186 | |||||

| US1248EPCD32 / CCO Holdings LLC / CCO Holdings Capital Corp. | 0.09 | 0.2258 | 0.2258 | ||||||

| US16115QAF72 / Chart Industries Inc | 0.09 | -1.06 | 0.2233 | 0.0172 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0.09 | 0.00 | 0.2207 | 0.0174 | |||||

| XS2390152986 / Altice France SA/France | 0.09 | 0.2187 | 0.2187 | ||||||

| US005095AA29 / Acushnet Co | 0.09 | 0.00 | 0.2178 | 0.0175 | |||||

| US92332YAA91 / Venture Global LNG, Inc. | 0.09 | -5.32 | 0.2138 | 0.0076 | |||||

| US516806AJ59 / Vital Energy Inc | 0.09 | -20.72 | 0.2128 | -0.0319 | |||||

| N1RG34 / NRG Energy, Inc. - Depositary Receipt (Common Stock) | 0.09 | 1.15 | 0.2125 | 0.0203 | |||||

| GGAM Finance Ltd / DBT (US36170JAD81) | 0.09 | 0.2125 | 0.2125 | ||||||

| Hilcorp Energy I LP / Hilcorp Finance Co / DBT (US431318BE31) | 0.09 | -44.16 | 0.2073 | -0.1310 | |||||

| US19416MAB54 / Colgate Energy Partners III LLC | 0.09 | -2.30 | 0.2055 | 0.0141 | |||||

| US13323NAA00 / Camelot Return Merger Sub Inc | 0.08 | -12.50 | 0.2033 | -0.0078 | |||||

| NBR / Nabors Industries Ltd. | 0.08 | -28.81 | 0.2028 | -0.0567 | |||||

| CD&R Smokey Buyer Inc / Radio Systems Corp / DBT (US12515KAA60) | 0.08 | -13.54 | 0.1991 | -0.0127 | |||||

| Rogers Communications Inc / DBT (US775109DG30) | 0.08 | 0.1976 | 0.1976 | ||||||

| US931427AQ19 / Walgreens Boots Alliance Inc | 0.08 | 1.25 | 0.1940 | 0.0169 | |||||

| SOIL / Saturn Oil & Gas Inc. | 0.08 | -11.11 | 0.1929 | -0.0062 | |||||

| US98310WAN83 / Wyndham Destinations Inc | 0.08 | 0.00 | 0.1924 | 0.0158 | |||||

| Venture Global LNG Inc / DBT (US92332YAF88) | 0.08 | -17.71 | 0.1912 | -0.0213 | |||||

| US185899AN14 / Cleveland-Cliffs Inc | 0.08 | -3.66 | 0.1912 | 0.0100 | |||||

| Ghana Government International Bond / DBT (US374422AM52) | 0.08 | -4.82 | 0.1902 | 0.0082 | |||||

| US12543DBD12 / CHS/Community Health Systems Inc | 0.08 | 1.28 | 0.1890 | 0.0170 | |||||

| Fiesta Purchaser Inc / DBT (US31659AAA43) | 0.08 | 1.35 | 0.1804 | 0.0172 | |||||

| US92840VAP76 / Vistra Operations Co. LLC | 0.08 | 1.35 | 0.1796 | 0.0152 | |||||

| MX95PE1X00J5 / Petroleos Mexicanos | 0.07 | 0.00 | 0.1712 | 0.0000 | |||||

| MX95PE1X00J5 / Petroleos Mexicanos | 0.07 | 10.94 | 0.1712 | 0.0290 | |||||

| US91327TAA97 / Uniti Group LP / Uniti Group Finance Inc / CSL Capital LLC | 0.07 | -4.11 | 0.1676 | 0.0059 | |||||

| Long: B17315572 IRS USD R V 00MSOFR SL_2717315572_RECEIVE CCPOIS / Short: B17315572 IRS USD P F 3.38270 SL_2717315572_PAY OIS / DIR (000000000) | 0.07 | 0.1639 | 0.1639 | ||||||

| XS1824238239 / Lebanon Government International Bond | 0.06 | 18.52 | 0.1550 | 0.0363 | |||||

| US92332YAB74 / Venture Global LNG, Inc. | 0.06 | -72.85 | 0.1453 | -0.2963 | |||||

| Six Flags Entertainment Corp /Six Flags Theme Parks Inc/ Canada's Wonderland Co / DBT (US83002YAA73) | 0.06 | -1.64 | 0.1448 | 0.0104 | |||||

| XS1824238072 / Lebanon Government International Bond | 0.06 | 18.00 | 0.1430 | 0.0334 | |||||

| US18912UAA07 / Cloud Software Group Inc | 0.06 | -1.67 | 0.1422 | 0.0097 | |||||

| SUN / Sunoco LP - Limited Partnership | 0.06 | 0.00 | 0.1389 | 0.0108 | |||||

| US83001WAC82 / Six Flags Theme Parks Inc | 0.06 | 0.00 | 0.1388 | 0.0115 | |||||

| US46284VAF85 / Iron Mountain Inc | 0.06 | 0.00 | 0.1382 | 0.0121 | |||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AB20) | 0.06 | 0.1351 | 0.1351 | ||||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AA47) | 0.06 | 0.1350 | 0.1350 | ||||||

| US382550BN08 / Goodyear Tire & Rubber Co/The | 0.06 | -58.21 | 0.1342 | -0.1603 | |||||

| US55617LAQ59 / Macy's Retail Holdings LLC | 0.06 | -3.51 | 0.1336 | 0.0071 | |||||

| PCG.PRX / PG&E Corporation - Preferred Security | 0.06 | 0.00 | 0.1324 | 0.0109 | |||||

| XS1720803326 / Lebanon Government International Bond | 0.05 | 0.1164 | 0.1164 | ||||||

| US35906ABF49 / Frontier Communications Corp | 0.05 | 0.00 | 0.1136 | 0.0095 | |||||

| IDG000013707 / Indonesia Treasury Bond | 0.05 | -2.13 | 0.1124 | 0.0075 | |||||

| OMI / Owens & Minor, Inc. | 0.04 | 0.1062 | 0.1062 | ||||||

| US914906AY80 / Univision Communications, Inc. | 0.04 | -59.00 | 0.0999 | -0.1197 | |||||

| US69073TAU79 / Owens-Brockway Glass Container, Inc. | 0.04 | 2.50 | 0.0998 | 0.0100 | |||||

| CLF / Cleveland-Cliffs Inc. | 0.04 | -4.88 | 0.0944 | 0.0025 | |||||

| SUN / Sunoco LP - Limited Partnership | 0.04 | 0.00 | 0.0885 | 0.0070 | |||||

| US55337PAA03 / MIWD Holdco II LLC / MIWD Finance Corp | 0.04 | -83.86 | 0.0884 | -0.3566 | |||||

| US18060TAC99 / Clarios Global LP / Clarios US Finance Co | 0.04 | 0.00 | 0.0875 | 0.0070 | |||||

| Hess Midstream Operations LP / DBT (US428102AG28) | 0.04 | 0.00 | 0.0874 | 0.0069 | |||||

| US55617LAP76 / Macy's Retail Holdings LLC | 0.03 | -2.94 | 0.0794 | 0.0042 | |||||

| I1RM34 / Iron Mountain Incorporated - Depositary Receipt (Common Stock) | 0.03 | -3.33 | 0.0716 | 0.0057 | |||||

| Caesars Entertainment Inc / DBT (US12769GAC42) | 0.03 | 0.00 | 0.0697 | 0.0054 | |||||

| CLF / Cleveland-Cliffs Inc. | 0.03 | -3.57 | 0.0652 | 0.0020 | |||||

| US12543DBN93 / CHS/Community Health Systems Inc | 0.03 | 0.00 | 0.0642 | 0.0055 | |||||

| US46284VAG68 / Iron Mountain Inc | 0.02 | 0.00 | 0.0538 | 0.0047 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 0.0522 | 0.0043 | |||||

| IDG000013806 / Indonesia Treasury Bond | 0.02 | -4.76 | 0.0498 | 0.0038 | |||||

| Clarios Global LP / Clarios US Finance Co / DBT (US18060TAD72) | 0.02 | 0.00 | 0.0462 | 0.0039 | |||||

| Long: B71731557 IRS USD R V 00MSOFR SL_2717315570_RECEIVE CCPOIS / Short: B71731557 IRS USD P F 3.40020 SL_2717315570_PAY CCPOIS / DIR (000000000) | 0.02 | 0.0449 | 0.0449 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.01 | 0.0340 | 0.0340 | ||||||

| Ghana Government International Bond / DBT (US374422AN36) | 0.01 | 0.00 | 0.0315 | 0.0019 | |||||

| US72431PAA03 / NCI Building Systems Inc 8.00% 04/15/2026 144A | 0.01 | -7.69 | 0.0291 | -0.0015 | |||||

| Long: S22447140 IRS USD R F 3.46020 SL_2722447140_RECEIVE CCPOIS / Short: S22447140 IRS USD P V 00MSOFR SL_2722447140_PAY CCPOIS / DIR (000000000) | 0.01 | 0.0259 | 0.0259 | ||||||

| Long: S21661468 IRS USD R F 3.46020 2721661468_FIX CCPOIS / Short: S21661468 IRS USD P V 00MSOFR 2721661468_FLO CCPOIS / DIR (000000000) | 0.01 | 0.0227 | 0.0227 | ||||||

| Ghana Government International Bond / DBT (US374422AL79) | 0.01 | 0.00 | 0.0209 | 0.0020 | |||||

| XS2078247983 / Kaisa Group Holdings Ltd | 0.01 | -27.27 | 0.0203 | -0.0038 | |||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | 0.00 | 0.0112 | 0.0112 | ||||||

| US12769GAB68 / Caesars Entertainment, Inc. | 0.00 | 0.00 | 0.0098 | 0.0008 | |||||

| XS2059778212 / LHMC Finco 2 Sarl | 0.00 | 0.00 | 0.0080 | 0.0013 | |||||

| DELCO SERIES A 1 NOTES / DE (000000000) | 0.07 | 0.00 | 0.0000 | 0.0000 | |||||

| P7331H10 / OAS SA | 0.06 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| US84605LAB27 / Sovcombank Via SovCom Capital DAC | 0.00 | 0.0000 | 0.0000 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0.00 | -0.0010 | -0.0010 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0.00 | -0.0014 | -0.0014 | ||||||

| GB00H240B223 / LME Nickel Base Metal | -0.01 | -0.0213 | -0.0213 | ||||||

| DGZ / DB Gold Short ETN | -0.01 | -0.0230 | -0.0230 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.01 | -0.0355 | -0.0355 | ||||||

| Long: B20946371 IRS USD R V 00MSOFR SL_2720946371_RECEIVE CCPOIS / Short: B20946371 IRS USD P F 3.39600 SL_2720946371_PAY CCPOIS / DIR (000000000) | -0.01 | -0.0358 | -0.0358 | ||||||

| Long: B71731556 IRS USD R V 00MSOFR SL_2717315569_RECEIVE CCPOIS / Short: B71731556 IRS USD P F 3.46020 SL_2717315569_PAY CCPOIS / DIR (000000000) | -0.03 | -0.0648 | -0.0648 | ||||||

| DGZ / DB Gold Short ETN | -0.03 | -0.0772 | -0.0772 | ||||||

| GB00H240B223 / LME Nickel Base Metal | -0.05 | -0.1217 | -0.1217 | ||||||

| DGZ / DB Gold Short ETN | -0.06 | -0.1403 | -0.1403 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.10 | -0.2372 | -0.2372 |