Basic Stats

| Portfolio Value | $ 303,237,845 |

| Current Positions | 71 |

Latest Holdings, Performance, AUM (from 13F, 13D)

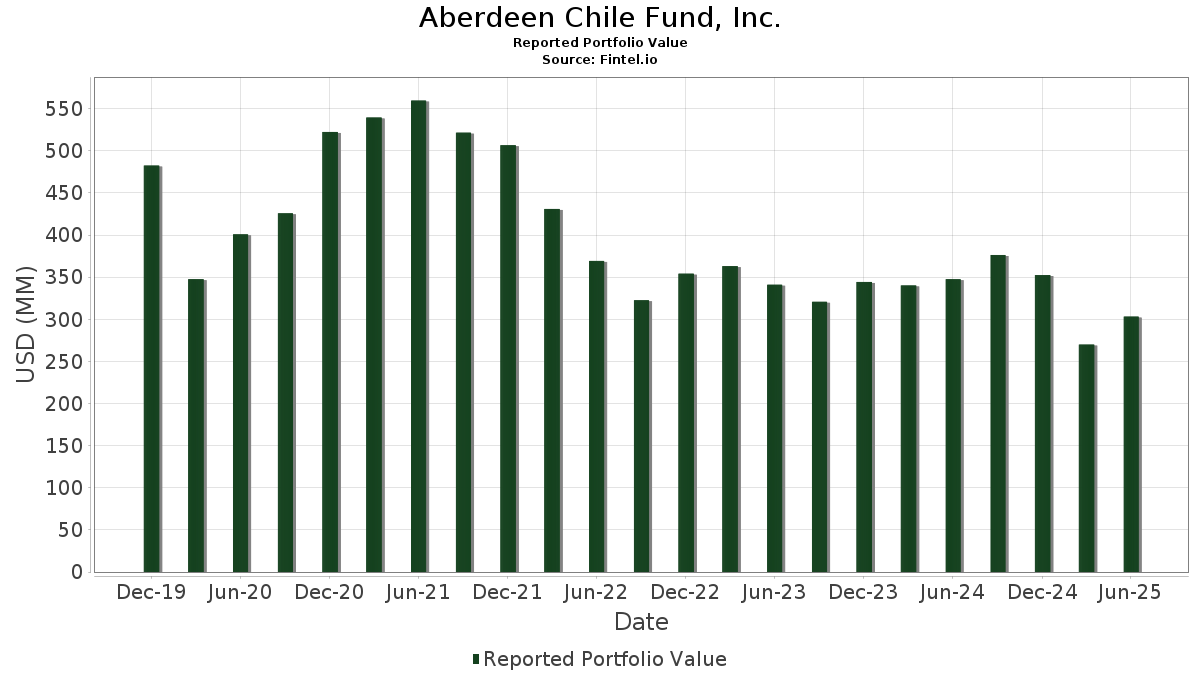

Aberdeen Chile Fund, Inc. has disclosed 71 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 303,237,845 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Aberdeen Chile Fund, Inc.’s top holdings are Taiwan Semiconductor Manufacturing Company Limited (TW:2330) , Samsung Electronics Co Ltd (KR:05935) , ICICI Bank Limited (IN:ICICIBANK) , SK hynix Inc. (KR:000660) , and HDFC Bank Ltd (IN:HDFCB) . Aberdeen Chile Fund, Inc.’s new positions include HD Hyundai Electric Co., Ltd. (KR:267260) , Zabka Group S.A. (PL:ZAB) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.31 | 47.94 | 17.8250 | 2.0931 | |

| 0.04 | 7.84 | 2.9138 | 1.1838 | |

| 0.04 | 3.43 | 1.2767 | 1.0892 | |

| 0.26 | 3.35 | 1.2451 | 1.0709 | |

| 0.01 | 2.78 | 1.0332 | 1.0332 | |

| 0.14 | 2.39 | 0.8872 | 0.8872 | |

| 0.33 | 1.97 | 0.7307 | 0.7307 | |

| 0.25 | 5.83 | 2.1664 | 0.6602 | |

| 0.42 | 6.42 | 2.3869 | 0.5978 | |

| 0.11 | 5.21 | 1.9381 | 0.5711 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 3.61 | 3.61 | 1.3436 | -2.4386 | |

| 0.00 | 0.00 | -0.8927 | ||

| 0.24 | 6.13 | 2.2801 | -0.8598 | |

| 1.23 | 4.30 | 1.5997 | -0.7605 | |

| 3.29 | 1.20 | 0.4454 | -0.6727 | |

| 0.05 | 2.37 | 0.8796 | -0.6585 | |

| 0.49 | 3.80 | 1.4135 | -0.5859 | |

| 1.48 | 6.69 | 2.4870 | -0.5447 | |

| 0.39 | 2.51 | 0.9344 | -0.4919 | |

| 1.03 | 2.87 | 1.0678 | -0.4171 |

13F and Fund Filings

This form was filed on 2025-08-28 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| 2330 / Taiwan Semiconductor Manufacturing Company Limited | 1.31 | 1.16 | 47.94 | 31.35 | 17.8250 | 2.0931 | |||

| 05935 / Samsung Electronics Co Ltd | 0.39 | 3.60 | 14.14 | 17.42 | 5.2578 | 0.0669 | |||

| ICICIBANK / ICICI Bank Limited | 0.59 | -2.52 | 10.03 | 5.07 | 3.7278 | -0.3851 | |||

| 000660 / SK hynix Inc. | 0.04 | 20.79 | 7.84 | 95.29 | 2.9138 | 1.1838 | |||

| HDFCB / HDFC Bank Ltd | 0.29 | 33.55 | 6.87 | 46.40 | 2.5550 | 0.5315 | |||

| FPT / FPT Corporation | 1.48 | 0.00 | 6.69 | -4.91 | 2.4870 | -0.5447 | |||

| 2360 / Chroma ATE Inc. | 0.42 | -10.74 | 6.42 | 54.67 | 2.3869 | 0.5978 | |||

| RJHI / COMMON STOCK SAR10. | 0.24 | -9.40 | 6.13 | -15.82 | 2.2801 | -0.8598 | |||

| ITC / ITC Limited | 1.24 | 0.00 | 6.00 | 1.47 | 2.2312 | -0.3177 | |||

| BHARTIARTL / Bharti Airtel Limited | 0.25 | 43.35 | 5.83 | 66.74 | 2.1664 | 0.6602 | |||

| A009540 / HD Korea Shipbuilding & Offshore Engineering Co., Ltd. | 0.02 | -43.31 | 5.58 | 11.17 | 2.0755 | -0.0888 | |||

| SBILIFE / SBI Life Insurance Company Limited | 0.25 | 5.67 | 5.25 | 25.10 | 1.9514 | 0.1432 | |||

| A055550 / Shinhan Financial Group Co., Ltd. | 0.11 | 16.02 | 5.21 | 64.36 | 1.9381 | 0.5711 | |||

| BKE1 / PT Bank Negara Indonesia (Persero) Tbk - Depositary Receipt (Common Stock) | 20.29 | 4.38 | 5.15 | 4.44 | 1.9150 | -0.2105 | |||

| ADIB / Abu Dhabi Islamic Bank PJSC | 0.87 | 0.00 | 5.12 | 34.08 | 1.9020 | 0.2574 | |||

| M&M / Mahindra & Mahindra Limited | 0.14 | 0.00 | 5.06 | 19.65 | 1.8817 | 0.0582 | |||

| ITSA4 / Itaúsa S.A. - Preferred Stock | 2.50 | 7.89 | 5.05 | 31.31 | 1.8760 | 0.2197 | |||

| TCS / Tata Consultancy Services Limited | 0.12 | 0.00 | 4.87 | -4.02 | 1.8121 | -0.3763 | |||

| KAP / National Atomic Company Kazatomprom JSC - Depositary Receipt (Common Stock) | 0.11 | 0.00 | 4.68 | 32.33 | 1.7414 | 0.2156 | |||

| M1Z / Nu Holdings Ltd. | 0.32 | 12.07 | 4.41 | 50.17 | 1.6405 | 0.3739 | |||

| 532898 / Power Grid Corporation of India Limited | 1.23 | -23.72 | 4.30 | -21.42 | 1.5997 | -0.7605 | |||

| 500850 / The Indian Hotels Company Limited | 0.47 | 26.17 | 4.16 | 22.38 | 1.5477 | 0.0818 | |||

| OMAB / Grupo Aeroportuario del Centro Norte, S.A.B. de C.V. - Depositary Receipt (Common Stock) | 0.04 | 0.00 | 4.15 | 34.18 | 1.5443 | 0.2100 | |||

| MELI / MercadoLibre, Inc. | 0.00 | -6.99 | 4.10 | 24.58 | 1.5247 | 0.1061 | |||

| KR7028260008 / Samsung C&T Corp | 0.03 | 0.00 | 4.09 | 49.22 | 1.5208 | 0.3392 | |||

| TLKM / Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk | 23.51 | 32.03 | 4.02 | 55.55 | 1.4951 | 0.3807 | |||

| LT / Larsen & Toubro Limited | 0.09 | 0.00 | 3.89 | 5.42 | 1.4461 | -0.1442 | |||

| 511243 / Cholamandalam Investment and Finance Company Limited | 0.20 | 0.00 | 3.83 | 6.89 | 1.4247 | -0.1202 | |||

| PRIO3 / Prio S.A. | 0.49 | -26.75 | 3.80 | -18.05 | 1.4135 | -0.5859 | |||

| SCCO / Southern Copper Corporation | 0.04 | -5.80 | 3.79 | 1.96 | 1.4088 | -0.1929 | |||

| 4GE / Grupo México, S.A.B. de C.V. | 0.61 | 8.62 | 3.66 | 31.23 | 1.3625 | 0.1588 | |||

| ALDAR / Aldar Properties PJSC | 1.49 | 0.00 | 3.62 | 6.44 | 1.3467 | -0.1205 | |||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 3.61 | -58.82 | 3.61 | -58.83 | 1.3436 | -2.4386 | |||

| 2454 / MediaTek Inc. | 0.08 | 0.00 | 3.60 | -0.58 | 1.3382 | -0.2223 | |||

| 2308 / Delta Electronics, Inc. | 0.25 | -9.32 | 3.58 | 16.05 | 1.3311 | 0.0011 | |||

| 2345 / Accton Technology Corporation | 0.14 | 0.00 | 3.52 | 41.07 | 1.3103 | 0.2335 | |||

| INPST / InPost S.A. | 0.21 | 0.00 | 3.49 | 13.41 | 1.2988 | -0.0290 | |||

| GPL / Godrej Properties Ltd | 0.13 | 0.00 | 3.44 | 10.60 | 1.2802 | -0.0618 | |||

| KSPI / Joint Stock Company Kaspi.kz - Depositary Receipt (Common Stock) | 0.04 | 763.58 | 3.43 | 691.01 | 1.2767 | 1.0892 | |||

| ETE / Ekotechnika AG | 0.26 | 567.80 | 3.35 | 728.71 | 1.2451 | 1.0709 | |||

| RENT3 / Localiza Rent a Car S.A. | 0.40 | -10.92 | 2.97 | 12.88 | 1.1048 | -0.0300 | |||

| 028050 / Samsung E&A Co., Ltd. | 0.18 | -10.22 | 2.95 | 8.34 | 1.0961 | -0.0770 | |||

| TRP / Torrent Pharmaceuticals Ltd | 0.07 | 0.00 | 2.92 | 5.91 | 1.0860 | -0.1025 | |||

| RADL3 / Raia Drogasil S.A. | 1.03 | 0.00 | 2.87 | -16.66 | 1.0678 | -0.4171 | |||

| AEE01134E227 / Emirates Central Cooling Systems Corp. | 6.25 | 0.00 | 2.82 | 2.47 | 1.0499 | -0.1378 | |||

| 267260 / HD Hyundai Electric Co., Ltd. | 0.01 | 2.78 | 1.0332 | 1.0332 | |||||

| UTCEM / UltraTech Cement Ltd | 0.02 | 0.00 | 2.64 | 5.35 | 0.9818 | -0.0986 | |||

| ARAMCO / Saudi Arabian Oil Co | 0.39 | -16.56 | 2.51 | -24.06 | 0.9344 | -0.4919 | |||

| CHOLAHLD / Cholamandalam Financial Holdings Ltd | 0.10 | 0.00 | 2.49 | 23.57 | 0.9261 | 0.0575 | |||

| ASML / ASML Holding N.V. | 0.00 | 0.00 | 2.44 | 21.09 | 0.9075 | 0.0387 | |||

| FMX / Fomento Económico Mexicano, S.A.B. de C.V. - Depositary Receipt (Common Stock) | 0.02 | 42.99 | 2.41 | 50.94 | 0.8949 | 0.2074 | |||

| LA6A / Sanlam Limited | 0.48 | 15.17 | 2.40 | 27.80 | 0.8939 | 0.0831 | |||

| Info Edge India Ltd / EC (INE663F01032) | 0.14 | 2.39 | 0.8872 | 0.8872 | |||||

| SA15DHKGHBH4 / SAUDI TADAWUL GROUP HOLDING CO | 0.05 | -23.42 | 2.37 | -33.72 | 0.8796 | -0.6585 | |||

| 1477 / Makalot Industrial Co., Ltd. | 0.28 | 0.00 | 2.25 | -12.80 | 0.8362 | -0.2758 | |||

| 207940 / Samsung Biologics Co.,Ltd. | 0.00 | 0.00 | 2.07 | 5.77 | 0.7697 | -0.0742 | |||

| HAVELLS / Havells India Limited | 0.11 | -21.34 | 2.05 | -19.75 | 0.7632 | -0.3392 | |||

| INE466L01038 / 360 ONE WAM Ltd | 0.15 | 0.00 | 2.03 | 24.86 | 0.7565 | 0.0541 | |||

| ZAB / Zabka Group S.A. | 0.33 | 1.97 | 0.7307 | 0.7307 | |||||

| SA15LGLI0N19 / Riyadh Cables Group Co. | 0.05 | 0.00 | 1.89 | 11.42 | 0.7039 | -0.0288 | |||

| CSCCF / Capstone Copper Corp. | 0.24 | -16.70 | 1.50 | -0.73 | 0.5566 | -0.0931 | |||

| 517569 / KEI Industries Limited | 0.03 | 0.00 | 1.46 | 32.22 | 0.5434 | 0.0668 | |||

| INE572A01036 / JB Chemicals & Pharmaceuticals Ltd | 0.07 | 0.00 | 1.40 | 3.77 | 0.5215 | -0.0612 | |||

| 5904 / POYA International Co., Ltd. | 0.07 | 0.00 | 1.29 | 19.02 | 0.4793 | 0.0123 | |||

| CCOLA / Coca-Cola Içecek Anonim Sirketi | 1.02 | 0.00 | 1.27 | -12.21 | 0.4708 | -0.1511 | |||

| TALABAT / Talabat Holding plc | 3.29 | -51.04 | 1.20 | -53.86 | 0.4454 | -0.6727 | |||

| D8V / Credicorp Ltd. | 0.00 | 0.00 | 1.06 | 20.18 | 0.3942 | 0.0136 | |||

| LEEJAM / Leejam Sports Co JSC | 0.03 | 0.00 | 1.05 | -13.89 | 0.3897 | -0.1350 | |||

| TELESOFT PARTNERS II QP / EC (000000000) | 2.40 | 0.02 | 0.0089 | 0.0089 | |||||

| BPA ISRAEL VENTURES LLC / EC (000000000) | 3.35 | 0.01 | 0.0047 | 0.0047 | |||||

| EMERGING MARKETS VENTURES LP / EC (000000000) | 11.72 | 0.01 | 0.0031 | 0.0031 | |||||

| SBER / Sberbank of Russia | 0.73 | 0.00 | 0.00 | 0.0000 | -0.0000 | ||||

| NVTK / PAO NOVATEK | 0.02 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| 2327 / Yageo Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.8927 |