Basic Stats

| Portfolio Value | $ 742,096,217 |

| Current Positions | 21 |

Latest Holdings, Performance, AUM (from 13F, 13D)

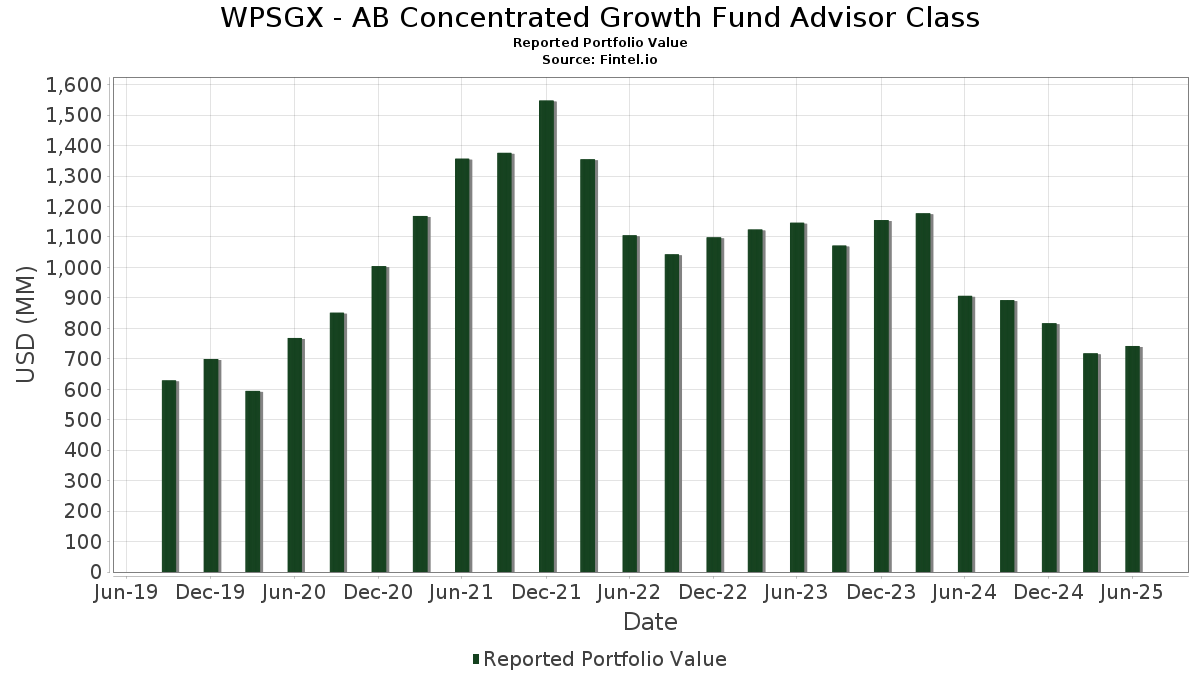

WPSGX - AB Concentrated Growth Fund Advisor Class has disclosed 21 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 742,096,217 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). WPSGX - AB Concentrated Growth Fund Advisor Class’s top holdings are Amazon.com, Inc. (US:AMZN) , Microsoft Corporation (US:MSFT) , Mastercard Incorporated (US:MA) , Amphenol Corporation (US:APH) , and Eaton Corporation plc (US:ETN) . WPSGX - AB Concentrated Growth Fund Advisor Class’s new positions include Motorola Solutions, Inc. (US:MSI) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.57 | 56.00 | 7.5481 | 2.3646 | |

| 0.03 | 14.71 | 1.9830 | 1.9830 | |

| 0.14 | 49.51 | 6.6741 | 1.7795 | |

| 0.34 | 73.58 | 9.9184 | 1.0252 | |

| 0.14 | 72.08 | 9.7158 | 0.8646 | |

| 0.13 | 21.29 | 2.8702 | 0.8345 | |

| 0.11 | 34.29 | 4.6223 | 0.2502 | |

| 0.09 | 25.44 | 3.4299 | 0.0932 | |

| 0.02 | 30.78 | 4.1490 | 0.0765 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -3.4546 | ||

| 0.40 | 28.19 | 3.7994 | -0.9480 | |

| 0.20 | 30.58 | 4.1226 | -0.8071 | |

| 0.06 | 23.59 | 3.1793 | -0.6792 | |

| 0.08 | 18.69 | 2.5195 | -0.5965 | |

| 0.12 | 66.75 | 8.9974 | -0.5588 | |

| 0.09 | 28.95 | 3.9028 | -0.4490 | |

| 0.16 | 20.04 | 2.7008 | -0.4116 | |

| 0.07 | 38.99 | 5.2552 | -0.3962 | |

| 0.21 | 32.60 | 4.3943 | -0.3635 |

13F and Fund Filings

This form was filed on 2025-08-26 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AMZN / Amazon.com, Inc. | 0.34 | 0.00 | 73.58 | 15.31 | 9.9184 | 1.0252 | |||

| MSFT / Microsoft Corporation | 0.14 | -14.35 | 72.08 | 13.49 | 9.7158 | 0.8646 | |||

| MA / Mastercard Incorporated | 0.12 | -5.05 | 66.75 | -2.65 | 8.9974 | -0.5588 | |||

| APH / Amphenol Corporation | 0.57 | 0.00 | 56.00 | 50.56 | 7.5481 | 2.3646 | |||

| ETN / Eaton Corporation plc | 0.14 | 7.35 | 49.51 | 40.98 | 6.6741 | 1.7795 | |||

| ROP / Roper Technologies, Inc. | 0.07 | 0.00 | 38.99 | -3.86 | 5.2552 | -0.3962 | |||

| SCHW / The Charles Schwab Corporation | 0.39 | -12.73 | 35.63 | 1.72 | 4.8032 | -0.0789 | |||

| CDNS / Cadence Design Systems, Inc. | 0.11 | -9.78 | 34.29 | 9.31 | 4.6223 | 0.2502 | |||

| ADP / Automatic Data Processing, Inc. | 0.11 | -3.21 | 33.26 | -2.30 | 4.4831 | -0.2612 | |||

| IQV / IQVIA Holdings Inc. | 0.21 | 6.83 | 32.60 | -4.51 | 4.3943 | -0.3635 | |||

| FICO / Fair Isaac Corporation | 0.02 | 6.27 | 30.78 | 5.34 | 4.1490 | 0.0765 | |||

| ZTS / Zoetis Inc. | 0.20 | -8.71 | 30.58 | -13.54 | 4.1226 | -0.8071 | |||

| AJG / Arthur J. Gallagher & Co. | 0.09 | 0.00 | 28.95 | -7.28 | 3.9028 | -0.4490 | |||

| COO / The Cooper Companies, Inc. | 0.40 | -1.92 | 28.19 | -17.26 | 3.7994 | -0.9480 | |||

| ECL / Ecolab Inc. | 0.09 | 0.00 | 25.44 | 6.28 | 3.4299 | 0.0932 | |||

| IT / Gartner, Inc. | 0.06 | -11.54 | 23.59 | -14.81 | 3.1793 | -0.6792 | |||

| NVDA / NVIDIA Corporation | 0.13 | 0.00 | 21.29 | 45.78 | 2.8702 | 0.8345 | |||

| TJX / The TJX Companies, Inc. | 0.16 | -11.51 | 20.04 | -10.28 | 2.7008 | -0.4116 | |||

| AMT / American Tower Corporation | 0.08 | -17.69 | 18.69 | -16.40 | 2.5195 | -0.5965 | |||

| MSI / Motorola Solutions, Inc. | 0.03 | 14.71 | 1.9830 | 1.9830 | |||||

| US0186167484 / AB Fixed Income Shares, Inc. - Government Money Market Portfolio | 7.16 | -20.43 | 7.16 | -20.42 | 0.9653 | -0.2889 | |||

| STZ / Constellation Brands, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -3.4546 |